A Global Insurer the Bulls Have Been Chasing

In this week’s series of articles, I am continuing on the theme of mega-insurers with an analysis of Chubb Limited (NYSE:CB).

To best summarize what this firm does, here is what the company said about itself on its official website:

With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients.

Chubb has more than $225 billion in assets and reported $57.5 billion of gross premiums written in 2023. Chubb’s core operating insurance companies maintain financial strength ratings of AA from Standard & Poor’s and A++ from AM Best.

The last few times I covered Chubb, I gave it a buy rating both times. The outcome? Since my July 2023 buy rating the stock has gone up +49%, and since my followup buy rating in October 2023 the price is up 36% as of this article writing.

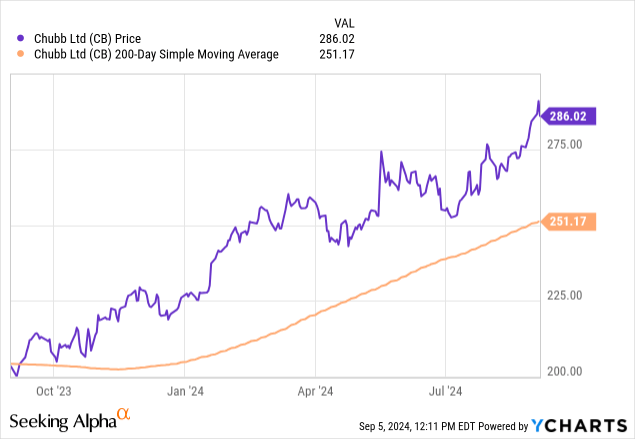

To paint a larger picture highlighting the market’s bullishness on this stock, SA data shows performance momentum on Chubb in the last year exceeding that of the S&P500, and as you can see in the yChart below it continues to trade well above its 200-day simple moving average, in fact 14% above it:

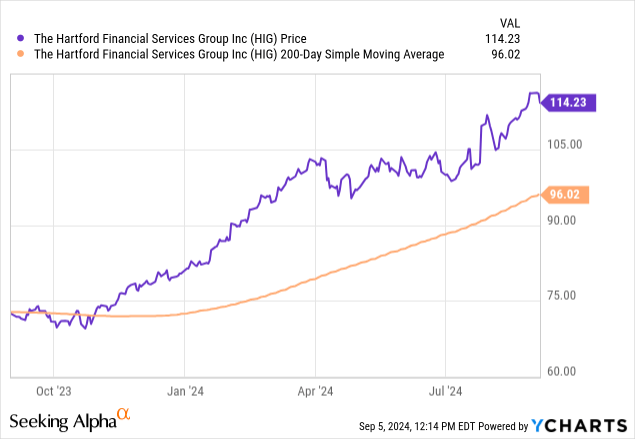

By comparison, some other insurance-sector peers have seen similar bullishness, as I discussed in my recent article on American Intl Group (AIG), and as we can see with another peer in this space, The Hartford Financial (HIG), which also has been above its 200-day SMA for most of 2024:

This data tells me that enough investors out there are confident in this sector again and have been betting on it.

However, that poses the question should I continue buying up this stock now in early September 2024 or not, expecting this tailwind to continue for another year at least? Also, is the bullishness the result of an overall market recovery or is there real fundamental strength to this firm?

According to last Friday’s article in CNBC, “the S&P 500 notched its fourth straight winning month. A surge in consumer staples, real estate and health care helped lift the broad market index in August.”

That leads into our next topic, taking a look at Chubb’s most recent growth and discussing potential future growth, to see if the firm’s fundamentals justify its bull run.

Strong Q2 Across Key Segments, Positioned for Future Revenue Strength

With the next earnings release not until October 22nd, the most recent data we can go by is the July release, when the firm beat analyst estimates.

To summarize its quarter ending June, from income statement data on SA, we see top-line revenue growth in 3 of its revenue segments: insurance premiums/annuities, interest/dividend income it makes on assets held, and sales of those assets.

We know that its insurance and annuities segment makes up about 89% of total revenue, so I think that performance in that space will have the biggest impact to this firm, and it will be driven by events such as growing insurance premiums and new policies written.

On the expense side, unlike firms like Prudential Financial (PRU) and AIG (AIG) which have much more significant life insurance businesses and thereby affected by winter quarters that see a spike in benefit payouts which impacts net income, something I mentioned in my article on AIG, Chubb does not appear to have such an issue since its worse quarter for benefit payouts was the one ending September 2023, according to its income statement. After all, although it does have a life insurance segment it is primarily a property/casualty insurer, as its own website stated, and that is its largest insurance line.

This means it will be impacted by catastrophe losses, which can be affected for example by weather events, and we can see a YoY spike in benefit payouts in Q2.

However, despite that, the good news for Chubb was that the quarter ending June saw a YoY earnings growth.

Looking ahead, other analysts’ consensus has been for an EPS of $21.54 for fiscal year ending December 2024, anticipating a YoY growth, with 4 upward revisions and 16 downward revisions so far.

In my opinion, continued earnings growth in a year from now could continue to drive the bulls to this stock, and future revenues will be helped by growth in insurance policies recently.

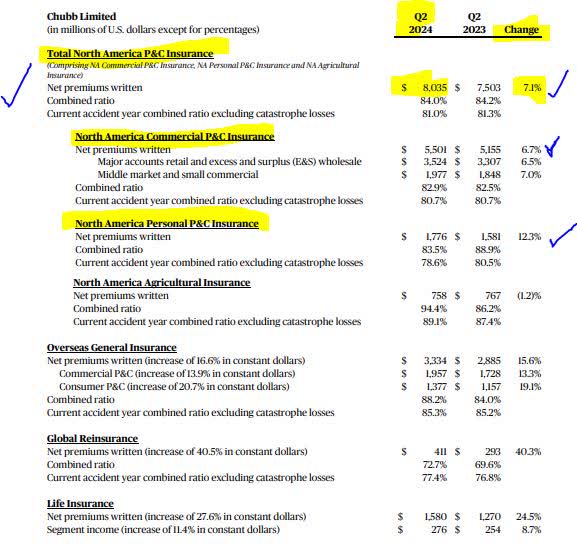

For example, Chubb’s Q2 earnings release spoke of such growth achieved, with its property and casualty (P&C) segments showing strength:

North America Personal P&C Insurance: Net premiums written increased 12.3% due to new business and renewal retention, as well as increases in both rate and exposure.

North America Commercial P&C Insurance: Net premiums written increased 6.7% with P&C lines up 8.7%.

Incidentally, its largest business seems to be its North America property and casualty business, as evidenced by the following table, so I think current and recent growth in this segment could lead to future stable revenue streams from policy premiums:

Chubb – business segments (company q2 results)

What I think this tells us is that it supports the case of future revenue streams in a year, assuming the majority of these policyholders do not jump ship of course in the next year and head to a different insurer.

In fact, CEO Evan Greenberg in his Q2 remarks struck a positive tone:

We are confident in our ability to continue growing our operating earnings at a superior rate through P&C revenue growth and underwriting margins, investment income, and life income.

A Dividend with Low Yield but Steady Growth in Payouts

So far we have demonstrated that this has been a profitable company that has grown earnings, but as many investors (myself included) are interested in getting some of that profit back to us via dividends, let’s take a moment to examine if this firm has a strong dividend case for investors to consider.

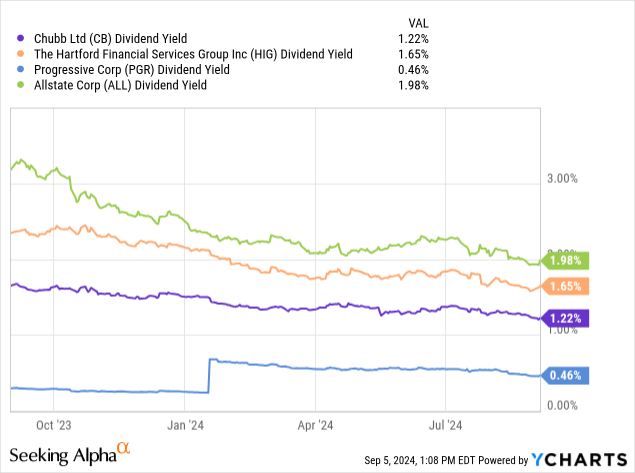

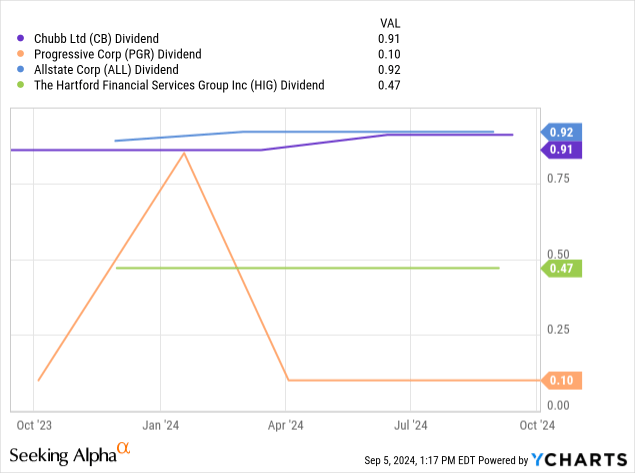

Here is what we know about its dividend yield vs 3 peers I chose in the insurance sector, which SA data shows as comparable to Chubb: Allstate (ALL), Progressive (PGR), and The Hartford Financial (HIG).

What this data tells me is that Chubb is comparable to its three peers in terms of dividend yield, with most of them being in the 1 to 2% yield range. This is hardly remarkable, I think, considering that investing in some CDs would result in a much higher yield.

According to a Sept. 5th article in Fortune magazine, “with interest rates at a record high, some of the best CDs offer rates that top 5%.”

For example, the article’s researchers were able to find a 3-month certificate of deposit from Morgan Stanley with a yield of 4.95%. Knowing that, I can’t boast that getting a 1.2% yield on Chubb stock is very competitive.

Besides yield, however, let’s look at the actual quarterly payout of Chubb dividends compared to peers.

In this peer comparison, it appears Chubb at a quarterly payout of $0.91/share is comparable to Allstate, while the other two are lagging behind. Chubb also was able to grow its dividend in each of the last 5 years, according to growth data from SA.

More importantly, is the dividend growth sustainable? I would say that it has a high likelihood of being so, and the evidence is supported by continued earnings growth, and expected future earnings growth. Although this does not guarantee the firm will continue hiking its payout, I believe it increases the sustainability of such a hike if it occurs.

Keep in mind also that a quarter with high property catastrophe losses means the company needs to divert more cash to benefit payouts. If the company has a lot of debt, it may want to hold on to more cash to pay down the debt. This leads into our next discussion which is risk.

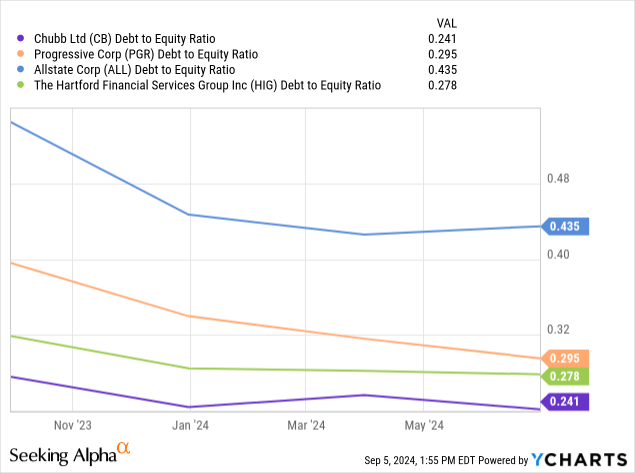

Debt to Equity Better than Peers

I think one valuable comparison to make is comparing Chubb’s debt-to-equity with that of peers, since I think excessive debt to equity in this context increases the risk level of investing in a firm in this sector, although it may be more common in firms where the entire sector is driven by debt-financing such as firms that take on a lot of debt to invest in manufacturing facilities for a product.

Although all 4 peers seem to have a relatively healthy debt to equity ratio below 0.50, and on a declining trend, Chubb appears to have the best ratio of all four.

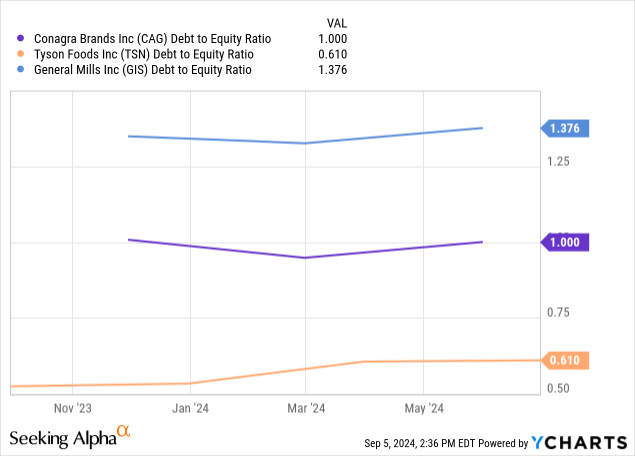

If I were to do the same type of comparison with firms that produce food products and have large manufacturing facilities, like Conagra (CAG), Tyson Foods (TSN), and General Mills (GIS), we can see that that peer group as a sector has on average much higher debt-to-equity ratios. So, this is why it’s best to compare among the same sector only.

Being overly indebted is not the only risk to think about for this sector, so next I want to touch on some more risks affecting an insurer like this specifically.

Risks to Watch: Rate Movements and Catastrophic Events

The company’s 2023 annual presentation had a great description talking about risk factors at this firm:

Invested assets are substantially held in liquid, investment grade fixed income securities of relatively short duration. Claims payments in any short-term period are highly unpredictable due to the random nature of loss events and the timing of claims awards or settlements. The value of investments held to pay future claims is subject to market forces such as the level of interest rates, stock market volatility, and credit events such as corporate defaults.

What I can learn from this is that Chubb is exposed to a large basket of fixed-income securities, which I know can be affected by interest rate decisions from the Fed as rising/falling rates affect the underlying bond values. It also tells me that as a property/casualty company it is exposed to having to pay catastrophe benefits, and those can often occur without prior warning.

For the moment what we do know is that according to rate tracker CME Fedwatch there is a 61% likelihood the Fed will begin lowering its target rate at the Sept. 18th meeting, and nearly a 50% likelihood for further lowering at the November meeting.

If September’s Fed meeting kicks off an extended period of lowering rates, I think it could impact Chubb’s interest income eventually, but at the same time may drive up the value of underlying bonds in their asset portfolio (since it is a standard known concept that interest rates and bond values have an inverse relationship).

Considering interest/dividend income is only about 11% of total revenue, as per the income statement, I don’t think there will be a huge impact to the firm overall, especially if interest rates start lowering at small increments over the next year. Growth in insurance premiums should more than make up for decreased interest income.

In terms of the other risk, catastrophe events that are unpredictable, we can consider if there are any trends indicating an overall uptick in such events due to more severe weather globally, and one major media portal has written about it this week actually.

According to a Sept. 3rd article in Reuters, specifically using Canada as an example:

Hotter summers in Canada that have sparked wildfires in tourist areas, intense hailstorms and thunderstorms with severe flooding in major cities, all likely linked to climate change, are leading to personnel shortages and potentially claims adjustment delays, according to insurance sector insiders.

Over the last 10 years, the number of Canadian claims tied to extreme weather events has risen to more than 1.3 million, up 93% from a decade ago, according to the IBC.

Although this is only one study, and reviewing every single weather trend on the planet goes beyond the scope of this article, what this data does point to is that a firm like Chubb could expect at least some risk of increased weather-driven catastrophe claims looking ahead if such trends do indeed prove widespread and long-term.

Besides weather, sometimes there are certain incidents like the March 2024 collapse of the Francis Scott Key bridge in Maryland which are also catastrophe events for an insurer.

According to an August article in Insurance Business magazine, Chubb had to pay out $350MM because of that incident.

Considering these risks, and the positives of this firm I already mentioned, let’s talk about where the market is valuing this stock right now and whether it is justified.

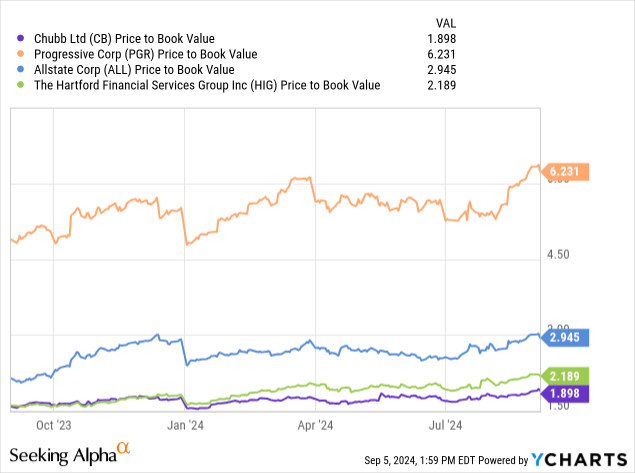

Slightly Undervalued Among Key Peers

Let’s look at valuation from a few different angles.

First, we will compare price to book (P/B) value of all 4 peers, using yCharts:

This data tells me that Chubb actually has the lowest P/B valuation in this peer group, at just 1.89 price to book multiple.

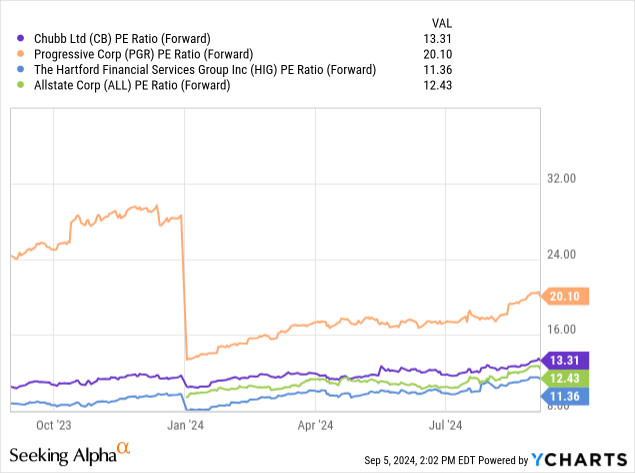

Next, we can compare the forward P/E ratios of the 4 firms:

In terms of forward price to earnings multiple, Chubb seems to fall in the middle of this peer group.

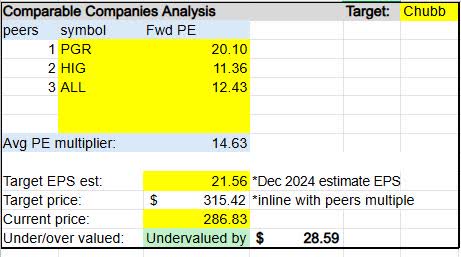

From this data, I created the following very simple comparable companies analysis:

Chubb – comps analysis – P/E (author work)

When applying the peer average forward P/E multiple of 14.63 to Chubb’s estimated December 2024 EPS of 21.56, a current price in line with the peer average would be $315.42.

As Chubb is trading today around $286.83 (as of the writing of this article), it appears to be undervalued by nearly $29/share.

Although it is not a huge undervaluation to peers, and may be somewhat unjustified given that Chubb has been a very profitable company with low debt-to-equity, I must question whether the 17% YoY spike in benefit payouts in Q2 has some investors concerned about Chubb’s risk level, despite otherwise strong fundamentals.

Clinical Impression: Neutral

To wrap up today’s discussion of Chubb, here is a quick review of what I covered:

I found the pros of this stock to be strong Q2 results with expected future growth driven by strong property/casualty businesses and net new premiums, a year of bullish market momentum, better debt-to-equity than peers, proven steady dividend growth over 5 years, and a very large global brand presence.

In addition, Chubb is slightly undervalued vs peers, and no mention in company presentations of direct exposure to risky commercial real estate assets in its portfolio but primarily fixed-income assets.

Some potential areas of concern for me would be a mediocre dividend yield under 2%, the future uncertainty of major catastrophe loss payouts in any given quarter which could be significant, and the impact to interest income that potential lower interest rates could have if they end up coming down over the next year, although not a major impact as over 89% of revenue at Chubb comes from non-interest revenue.

My clinical impression, therefore, is that after my prior 2 bullish ratings last year to be neutral on this stock at this time and call it a hold, as it is a nice $0.91/share sustainable quarterly dividend income to hold on to with potential to grow further.

In the next year, I think any given quarter could see a major catastrophe loss payout impacting earnings, although the firm has been able to withstand such impacts so far it seems.

As the stock is trading double digits above its SMA, while its fundamentals are good there is also 4 months of bullishness in the S&P which I mentioned at the start so I am waiting on the next market pullback and my buy target on Chubb would be the range it was trading at in during the early July price dip, as the chart below shows, which would have been a great time to pick up some shares and then ride the rebound.

Chubb – buy target (author)

Much like AIG, Chubb is one of those anchor stocks I would consider for a diversified dividend income portfolio, but not necessarily at its current buy price.

Read the full article here