A Quick Take On Coursera

Coursera, Inc. (NYSE:COUR) went public in March 2021, raising around $519 million in gross proceeds in an IPO that was priced at $33.00 per share.

The firm operates an online learning platform for a variety of end-user markets worldwide.

I’m Neutral (Hold) for Coursera, Inc. in the short term, especially due to its high operating losses and softening revenue growth outlook.

Coursera Overview

Mountain View, California-based Coursera, Inc. was founded to develop an e-learning platform for consumers, academic institutions, businesses, and governments.

Management is headed by President and CEO, Jeffrey Maggioncalda, who has been with the firm since 2017 and was previously CEO of Financial Engines (FNGN).

The company’s primary offerings & capabilities include:

-

Large content catalog

-

Machine learning

-

Personalized education

-

Enterprise education

-

International

The company pursues consumer learners through its online presence and seeks industry, academic, and government clients through its direct sales and marketing efforts.

Market & Competition

According to a 2022 market research report by Beyond Market Insights, the global market for e-learning services was an estimated $236 billion in 2022 and is forecast to reach $649 billion by 2030.

This represents a forecast CAGR of 13.5% from 2023 to 2030.

The main drivers for this expected growth are continued technological innovation and growing Internet usage worldwide.

Also, the COVID-19 pandemic acted as a forcing function for many users to pursue their education in an online environment, likely increasing the industry’s growth prospects despite the waning of the pandemic. In 2022, the United States dominated the e-learning market in terms of market share, accounting for approximately $109 billion. E-learning is expected to grow in the U.S. by a CAGR of 11.0% through 2030, reaching an estimated $250 billion by the end of the decade.

Major competitive or other industry participants include:

-

2U, Inc. (TWOU)

-

edX

-

Eruditus Learning Solutions

-

FutureLearn

-

Udemy

-

upGrad Education

-

Degreed

-

A Cloud Guru

-

LinkedIn (MSFT)

-

Pluralsight (PS)

-

Udacity (UCITY)

-

Khan Academy

-

Alphabet (GOOG)

Coursera’s Recent Financial Trends

-

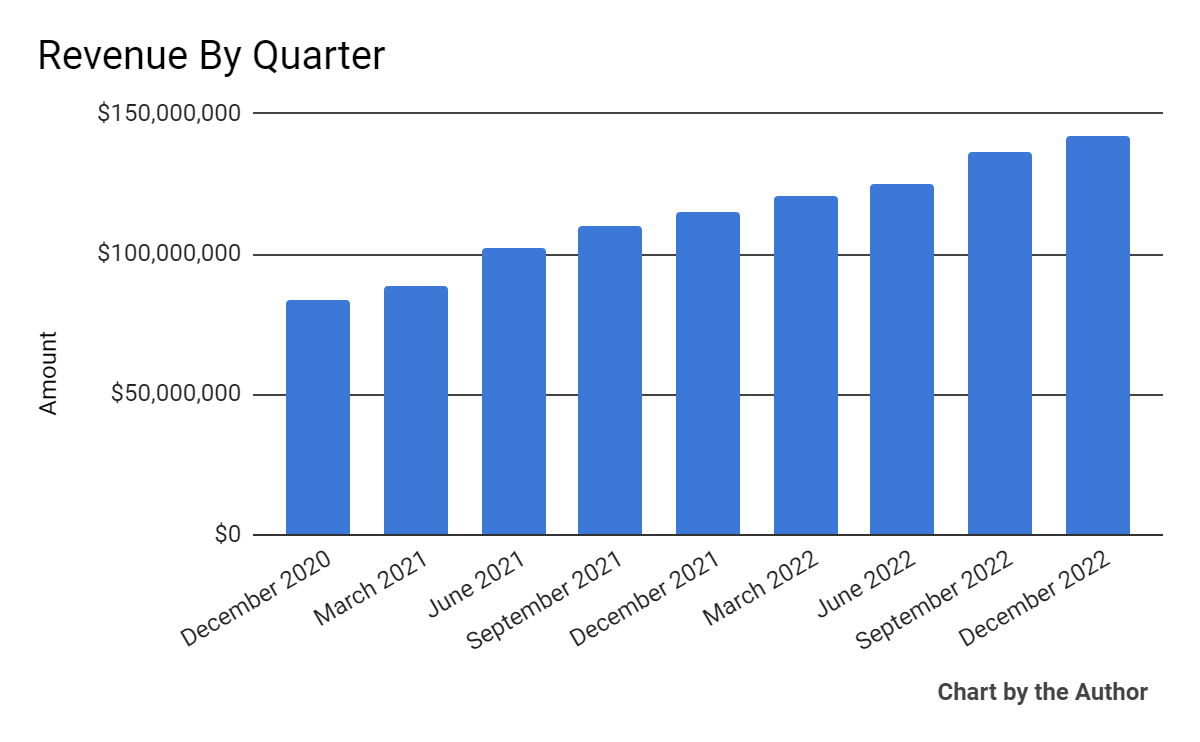

Total revenue by quarter has grown per the following chart, with Q4 2022 revenue representing 24% growth year-over-year:

Total Revenue (Seeking Alpha)

-

Gross profit margin by quarter has generally trended higher, as the chart shows below:

Gross Profit Margin (Seeking Alpha)

-

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated as follows, with Q4 representing a material drop year-over-year in SG&A:

Selling, G&A % Of Revenue (Seeking Alpha)

-

Operating income by quarter has remained heavily negative:

Operating Income (Seeking Alpha)

-

Earnings per share (Diluted) have also remained substantially negative, as shown below:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

In the past 12 months, COUR’s stock price has fallen 49% vs. that of 2U’s drop of 53.5%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

The company’s net retention rate for paid enterprise customers was 108%, but management saw increased churn from newer customer segments and reduced spending from some customer types.

For the balance sheet, the company ended 2022 with cash, equivalents and short-term securities of $780.5 million and no debt.

Over the trailing twelve months, free cash used was $39.7 million, of which capital expenditures accounted for only $1.6 million.

The company paid a whopping $110.8 million in stock-based compensation in the last four quarters, the highest as a public company, so it appears management is really ramping up this form of compensation, diluting equity shareholders in the process.

Valuation And Other Metrics For Coursera

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.6 |

|

Enterprise Value/EBITDA |

NM |

|

Price/Sales |

3.1 |

|

Revenue Growth Rate |

26.1% |

|

Net Income Margin |

-33.5% |

|

GAAP EBITDA % |

-29.8% |

|

Market Capitalization |

$1,630,000,000 |

|

Enterprise Value |

$859,270,000 |

|

Operating Cash Flow |

-$38,050,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.21 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be 2U, Inc.; shown below is a comparison of their primary valuation metrics:

|

Metric (TTM) |

2 U |

Coursera |

Variance |

|

Enterprise Value/Sales |

1.4 |

1.6 |

19.7% |

|

Enterprise Value/EBITDA |

29.4 |

NM |

–% |

|

Revenue Growth Rate |

1.8% |

26.1% |

1319.6% |

|

Net Income Margin |

-33.5% |

-33.5% |

0.1% |

|

Operating Cash Flow |

$10,930,000 |

-$38,050,000 |

–% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

COUR’s most recent GAAP Rule of 40 calculation was negative (3.7%) as of Q4 2022’s results, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

26.1% |

|

GAAP EBITDA % |

-29.8% |

|

Total |

-3.7% |

(Source – Seeking Alpha)

Future Prospects For Coursera

In its last earnings call (Source – Seeking Alpha), covering Q4 2022’s results, management highlighted the material uncertainty causing customers to constrain their spending in the short term.

Leadership believes that the impact of AI-based technologies will be increasingly felt in the education space and that we are at another “inflection point” in “unleashing a new wave of reskilling imperatives.”

Recently, the company has expanded its degree programs offered and is in the process of expanding its entry-level professional certificate offerings.

Looking ahead, management expects to achieve positive adjusted EBITDA by the fourth quarter of 2023. Note that adjusted figures do not include stock-based compensation, which, in Coursera’s case, is a large expense component.

The company’s financial position is quite strong, with large liquidity, no debt and small negative free cash flow over the trailing twelve-month period.

Regarding valuation, the market is valuing COUR at an EV/Sales multiple of around 1.6x.

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on March 30, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, COUR is currently valued by the market at a 75% discount to the broader Meritech Capital SaaS Index, at least as of March 30, 2023.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown, which could accelerate new customer discounting, produce slower sales cycles, and reduce its revenue growth trajectory.

In fact, management has echoed those possibilities for the rest of 2023. Add to that the apparent banking system credit pullback, which may negatively impact consumer credit availability, and the near-term future for Coursera looks challenging to me.

Accordingly, I’m Neutral (Hold) for Coursera, Inc. in the short term, especially due to its high operating losses and softening revenue growth outlook.

Read the full article here