It’s been about 3 ½ months since I took profits in CSX Corporation (NASDAQ:CSX) in an article with the very creative title “Taking Profits in CSX.” Since then, CSX stock is down about 2.7% against a gain of 6.75% for the S&P 500. I am intrigued by this 9.5% underperformance, because I like stocks that underperform, at least in the short term. I want to decide whether or not it makes sense to buy back in based on the latest financial results, and comparing those to the valuation.

It’s time again for the “thesis statement” paragraph. I provide one of these in each of the articles I write as a public service to you good people. I understand that some of you want to understand my thinking, but you may be less inclined to want to wade through an entire 1,700 word article written by me. I get that, and for that reason, I offer you these as a way to get in, get the thoughts, and get out before things get too tedious. You’re welcome for the thesis statement. Anyway, I’m of the view that the financial performance was relatively good in 2022, and I think the dividend is very well covered. I don’t like the fact that debt is much higher than it was, and I really don’t like that the company spent over $4.7 billion on overpriced buybacks at the same time debt exploded higher by about $1.681 billion. Although the shares are marginally cheaper than they were previously, they’re not cheap enough to get me interested at this point. For that reason, I’m going to continue to eschew these shares.

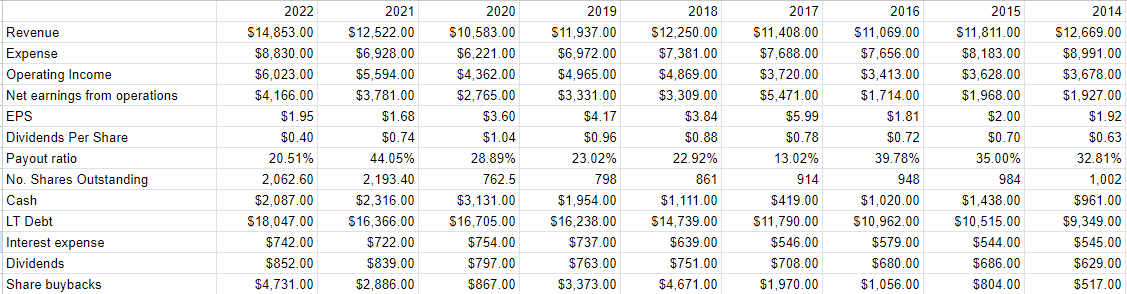

Financial Snapshot

In my previous article on this name, I was impressed by the financial results, and believed that the dividend was very well covered, given the low (21%) payout ratio. I didn’t like the fact that the capital structure had deteriorated, with long term debt up massively. Not much has changed in the intervening months. When compared to the full year 2021, revenue and net income in 2022 were up by 18.6% and 10.2% respectively. Also, in spite of the fact that long term debt is up a massive $1.681 billion over last year, interest expense was only about $20 million higher in 2022 than it was in 2021.

The Buyback

I want to focus on the buyback, because as the company was boosting debt by $1.681 billion, they were spending an additional $1.845 billion on buybacks. This represented a 63.4% uptick from the previous year. Before reviewing the buyback, though, I need to point out that it’s impossible to work out the exact price per share paid for stocks bought back by the company, because the timing of reporting each element of a buyback is different. Specifically, we know that on January 31 of last year, there were exactly 2,193,389,444 shares outstanding, and we know that as of January 31 of this year, there were 2,062,605,434 shares outstanding. This means that over this twelve month period, 130,784,010 shares were retired. The company spent approximately $4,731,000,000 on buybacks during the Calendar year, so precision isn’t possible unfortunately, because the “shares outstanding” figure is lagged by about a month behind the “price paid” figure.

That written, I’m comfortable “ballparking” it, and suggesting that the company spent somewhere around $36 per each share retired. I don’t judge whether or not this was a good or bad decision based on the current price. The purpose of this whole “Seeking Alpha” enterprise is to suggest that current price may not be accurate, so judging based on “higher or lower than current market price” would be foolish in my estimation. I determine whether or not it was a good decision by looking at the valuation at which management retired shares. We’ll take that issue up below.

Given all of the above, I’d be happy to buy the shares back at the right price.

CSX Financials (CSX Investor relations)

The Stock

The very few of you who may not be the most charitable souls in the world may want to take some time at this point to remind me that I’ve talked myself out of some great trades with the phrase “at the right price”, and that my insistence on paying attention to valuation is troublesome. I’ve been reading comments from you guys for years at this point, and I know that such flintiness represents a very tiny minority of you, but to those people I would respond thusly. I managed to avoid a 20% drop in the stock price of another railroad by eschewing the shares when they were too expensive. I had no way of predicting the catastrophe that happened in Palestine, obviously, but I’ve been alive long enough to know that things happen, and if you don’t account for the unpredictability of the world in your investments, you’re going to be flattened on occasion. It’s not fun being flattened, so I’d rather miss out on some gains than risk too much.

With that sermon done I need to remind you of the fact that I consider the business and the stock to be distinctly different things. This is because the business generates revenue and profits selling transportation services, while the stock is a speculative instrument that gets traded around based on long-term expectations about the business, fears of union contracts, the state of roadbed etc. Also, when we look at the business, we’re forced to look mostly at financial statements which are, by their nature, “backward-looking.” The stock, on the other hand, is a forecast about the distant future, so there’s an inevitable tension between the backward facing financials and forward facing forecasts.

Additionally, this stock, like all stocks, can be affected by changes in the overall market. The crowd may change its views about the desirability of “stocks” as an asset class, and that will impact individual stocks to some degree. Let me flesh this idea out a bit by using this investment as an example. I absolutely hate to remind you about this stock’s 9% relative underperformance since I sold it, but I’ll take one for the team and review the results again. A reasonable sounding, if counterfactual, argument could be made to suggest that CSX may have dropped even further in price if the market itself had not bounced back.

So, to sum up, the business sells transportation, while the stock bounces up and down based on the crowd’s ever-changing views about the future. The crowd is capricious, because the shares are much more volatile than anything that happens at the actual business. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. I like to buy stocks when the crowd is particularly down in the dumps about a given name, because those expectations are easier to beat.

Another way of writing “down in the dumps about a given stock” is “cheap.” I like to buy cheap stocks because they tend to have more upside potential than downside. This is because much of the bad news has been wrung out of price. As my regulars know, I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship of price to some measure of economic value, like sales, earnings, and the like. I like to see a stock trading at a discount to both its own history and the overall market. When last we met CSX, the shares were trading at a P/E of about 16.57, and sported a dividend yield of about 1.29%. They are now about 5% cheaper, and the dividend yield is 6 basis points higher per the following:

This is certainly “cheaper”, but as we see from the charts above, the shares have certainly been less expensive, so I don’t consider them to be “cheap” based on the above.

My regulars know that I think ratios can be instructive, but I also want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future. Applying this approach to CSX at the moment suggests the market is assuming that this company will grow earnings at a rate of ~5% in perpetuity. I consider this to be a fairly optimistic forecast. Given the above, I’ll not buy back in today.

Assessing the Buyback

As you may remember from the discussion above, the company spent approximately $36 per share to retire stock. That is the equivalent of buying back at a P/E of about 18.5 times. We see from the chart above that that valuation is near the top end of the range over the past decade. I think this was a relative waste of shareholder capital. If I were a shareholder, I would much rather have seen the company spend this $4.731 billion (!) paying down debt, or issuing a special dividend. At the same time, it’s interesting to consider how the shares would have performed in 2022 in the absence of this colossal bid under the shares.

Read the full article here