Introduction

I just wrote an article titled “Betting Big On A Tiny Texan – Why I Just Bought LandBridge.” As I explained in that article, I bought LandBridge Company LLC (LB) for a number of reasons, including its massive land ownership and characteristics that make it a great investment in times of elevated inflation.

Horizon Kinetics is one of the biggest investors, as it just included the stock in its Inflation Beneficiaries ETF (INFL). I’m not bringing this up to promote their ETF but because I have become a huge fan of Horizon Kinetics, especially after I found out that we have other interests in common, including stock exchanges, gold streamers, and energy companies.

I’m also mentioning it because the Inflation Beneficiaries ETF includes a company that is very different from high-margin players like LandBridge.

That company is Archer-Daniels-Midland Company (NYSE:ADM), a company I called a “promising opportunity for sustained growth and income” in my latest article, published on March 31.

Generally speaking, ADM is “boring” and not necessarily in a good way.

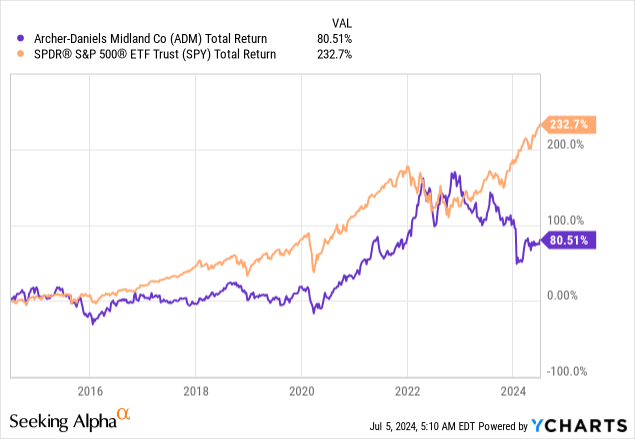

Although it had a good run until 2022, when lower inflation started to pressure the company, it returned just 81% over the past ten years, lagging the S&P 500’s (SP500) 233% return by a huge margin.

The good news is that after a prolonged decline, including an SEC investigation, the stock seems to be bottoming.

Even better, I believe ADM is one of the most underappreciated value stocks, trading at a steep discount with an increasingly favorable growth outlook.

Hence, in this article, I’ll update my thesis and explain why I remain bullish on this agriculture giant.

A Low-Margin Inflation Play With A Dividend

To give you a quick recap, Archer-Daniels-Midland is a critical part of the global food supply chain. Although it does not produce crops, it connects farmers to buyers and has a wide range of facilities that turn crops into value-added products.

Going into this year, it had roughly 700 facilities that serviced more than 200 nations. It also has roughly 440 crop procurement locations and 67 innovation centers.

Archer-Daniels-Midland

As we can see below, the company’s core operations span across the entire agricultural supply chain. This includes everything from originating and merchandising to storing and transporting agricultural raw materials like oilseeds and a wide range of grains.

As I already briefly mentioned, ADM doesn’t own farms, but it partners with growers to provide services.

Archer-Daniels-Midland

One big drawback of this business and its position at the beginning of the food supply chain is low margins. While it is very difficult to replicate the massive footprint and business relationships ADM has, it’s a business with a lot of competition.

This comes with low margins. Using the chart below, we see two things.

- The company has low margins. Even after the post-pandemic surge, operating margins are less than 4.5%. Before the pandemic, the company had multiple years of sub-3.0% operating margins.

- The company’s margins are cyclical. Hence, I added the price of corn as a proxy for agricultural commodities. Although I wish the corn history would go back further, we see that the company’s margin history is not a “random” development.

Speaking of these developments, in times of inflation, companies like ADM can thrive due to their essential role in the food supply chain.

As prices rise, the demand for basic commodities remains stable or even increases.

Meanwhile, the company’s diversified business activities across different geographies and product lines allow it to adjust and capitalize on the surge in prices.

Archer-Daniels-Midland

Moreover, the involvement in commodities trading gives ADM an edge, as commodity prices typically rise with inflation, potentially increasing the company’s profitability.

The chart below confirms this, as it compares the ADM stock price (including dividends) to the year-over-year rate of all-item inflation in the United States. The higher the rate of inflation, the higher the odds of a steep stock price surge.

TradingView (U.S. Inflation, ADM)

Before we dive into recent developments that tell us more about the company’s growth and profitability, ADM is also known for its dividend.

The company, which was founded in 1902, has paid a dividend for 92 consecutive years. Of these 92 years, 51 years saw positive dividend growth.

Currently yielding 3.2%, ADM has a five-year CAR of 6.8% and a payout ratio of slightly less than 30%, which is favorable for dividend growth.

It also started to increasingly focus on buybacks, as the second wave of buybacks after 2022 pushed the total buyback percentage to 25% since 2012.

For 2024, ADM aims to complete $2 billion in buybacks, roughly 6.5% of its current market cap.

Although buybacks do not directly end up in shareholders’ pockets, they improve the per-share value of a business.

As ADM is a cash cow with an implied free cash flow yield of more than 9% based on free cash flow expectations for 2024 and 2025, there is a lot of room to buy back stock, grow the dividend, and invest in growth.

There’s Deep Value In ADM

ADM is increasingly profitable.

In the first quarter, the company achieved a trailing four-quarter average adjusted return on invested capital (“ROIC”) of 11.2%. This is roughly 320 basis points above its annual weighted average cost of capital (“WACC”).

Archer-Daniels-Midland

To further improve its business, the strategic focus for this year includes three key priorities:

- Managing through the economic cycle.

- Driving the recovery in its Nutrition segment.

- Enhancing the return of cash to shareholders.

According to ADM, its proactive measures to navigate challenging market conditions, such as the buildup of grain and oilseed supply, support its resilience and adaptability.

Archer-Daniels-Midland

Regarding cost efficiencies, the company has a “drive for excellence” program. Through this program, it has identified roughly 1,200 validated proposals that are aimed at cost savings and operational improvements.

This includes the implementation of an automated chatbot in Thailand to streamline logistics transportation, reduce errors, and improve overall performance.

In Spain, adjustments in extraction timing have increased capacity at the Valencia facility by over 35%.

While none of this may sound like a big deal to some, please bear in mind that ADM is a giant with low margins and $55 billion in assets, including $12 billion in net property, plant, and equipment.

Even small improvements to this massive and capital/labor-intensive business can yield major bottom-line improvements.

In general, the company aims to achieve $500 million in cost savings over the next two years, which would be 14% of its trailing-twelve-months operating expenses. That’s a huge deal.

The company is also using strategic M&A in areas like the flavors market. This allows it to adjust to customer demands and accelerate both growth and profitability.

As we can see below, since 2014 (and before that), the company has engaged in a wide range of M&A projects to enhance its footprint in various markets to move closer to the customer and improve its capabilities.

Archer-Daniels-Midland

Valuation-wise, the good news continues.

Valuation

ADM’s stock price is in a downtrend for two reasons:

- Cyclical economic growth and inflation have come down.

- It became part of an investigation into its nutrition business. I discussed this in my prior article. Back then, it was nearly complete.

Although I would not blame anyone for staying away from a company that has been part of an SEC investigation, I believe these risks have now become limited, which bodes well for its valuation.

Using the FactSet data in the chart below, analysts expect the company’s EPS to bottom at $5.48 in 2024, potentially followed by a slow recovery to $5.72 in 2026.

FAST Graphs

These subdued expectations make sense, as analysts are, generally speaking, not betting on a growth rebound in cyclical industries.

However, even under these circumstances, ADM is cheap, as it trades at a blended P/E ratio of just 10.0x. That’s 4.1 points below its long-term average.

While it will take a rebound in agricultural commodity prices and a bottom in cyclical growth expectations (i.e., from the ISM Manufacturing Index), I believe ADM has a fair price of at least $80, 27% above the current price.

This is roughly in line with the target I gave in my prior article.

In general, I believe ADM has the potential to beat the S&P 500 on a prolonged basis, especially if inflation remains sticky.

While it’s not a high-conviction idea because of its subdued margin profile, I believe ADM is on the right path to improve its profitability and unlock a lot of shareholder value.

Takeaway

While ADM might seem “boring” with its low margins and slow growth, it has significant hidden value.

Despite past challenges, including an SEC investigation, ADM’s strong position in the global food supply chain and strategic cost-saving initiatives are set to significantly enhance profitability.

With a solid dividend history and aggressive buybacks, ADM offers a compelling value proposition at its current price.

For those looking for steady, inflation-resilient investments, ADM is worth a closer look.

Pros & Cons

Pros:

- Strategic Positioning: ADM is a key player in the global food supply chain, connecting farmers to buyers and turning crops into value-added products.

- Inflation Resilience: The company thrives in inflationary times due to stable demand for basic commodities and its focus on commodities.

- Dividend: ADM has a 92-year history of dividends, currently yielding 3.2%, with a strong track record of dividend growth.

- Valuation: With a blended P/E ratio of just 10.0x, ADM is significantly undervalued compared to its long-term average.

- Cost Savings: ADM’s drive for excellence program aims to achieve $500 million in cost savings, which is a major part of total costs.

Cons:

- Low Margins: Operating in a low-margin industry, ADM’s profitability is often under pressure when demand is weak.

- Cyclical Nature: The company’s performance is tied to agricultural commodity prices and cyclical economic growth, which drives pricing.

- SEC Investigation: Recent investigations into its nutrition business add a layer of risks, though it seems the worst is over.

- Subdued Growth Expectations: Analysts predict a slow earnings recovery.

Read the full article here