Summary

Fox Factory (NASDAQ:FOXF) is facing some troubling times after a particularly large acquisition, rising interest rates and falling margins have been plaguing the company. After diving deep into their financial history, I find that the current prices seem to be reasonably fair. However, some of the qualitative aspects of the case, coupled with my view on the macro environment, make me call this a SELL instead of a HOLD.

Company overview

Fox Factory designs and manufactures vehicle accessories. Their main focus is suspension products, but they have expanded to include other peripherals as well. They are mostly known among mountain bike enthusiasts, and the sport is both the company’s origin and main brands.

Podium gold fork, one of Fox Factory’s products. (Fox Factory website.)

In case you are a layman like me, forks are used at the front of the bike, attached to the wheel.

Fox Factory’s fork in use. (Fox Factory website.)

Their mountain bike products are known among users for their quality, high prices and eye-catching designs, being considered premium products. I recommend anyone interested in the company to type in their products’ name in Google and seek out mountain bike hobbyists’ websites to see discussions about it. Many times the discussion is whether Fox Factory’s products are worth their price or not.

Fox Factory has, over the years, diversified into other industries as well, mostly focused on suspensions and accessories. Besides mountain bikes, they sell products for trucks, UTVs (utility task vehicle), motorcycles and even snowmobiles. Their strategy has been to grow through several acquisitions. Here’s a summary of the most recent ones:

March 2020: SCA Performance Holdings, a leading OEM (original equipment manufacturer) for light trucks and sport utility vehicles.

May 2021: Manifest Joy LLC (“Outside Van”), a custom van conversion company.

December 2021: Shock Therapy LLC, a premier suspension tuning company in the off-road industry.

March 2023: CWH Blocker Corp and CWH Holdco, parent company of Custom Wheel House, a designer, marketer and distributor of high-performance wheels, tires and accessories (flagship brand called Method Race Wheels).

November 2023: Wheelhouse Holdings, parent company of Marucci Sports, a leading designer, manufacturer and marketer of highly engineered premium wood, aluminum and composite baseball bats.

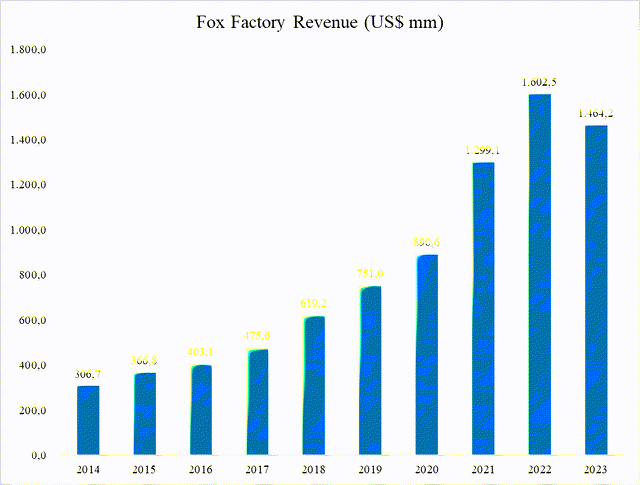

Over the years, such aggressive growth strategy has had results, and the company presented an impressive CAGR of 19% from 2014 to 2023.

Fox Factory Revenue (Company Filings, Author)

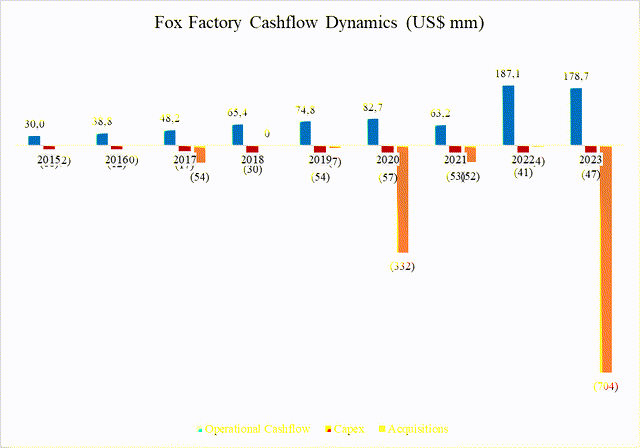

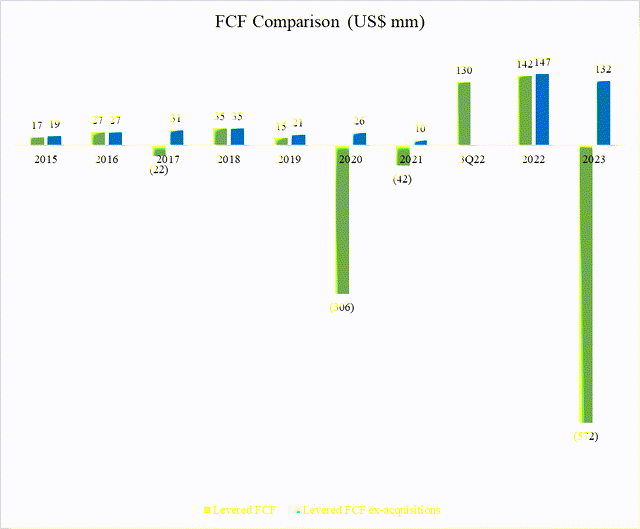

However, that growth path has a cost, and Fox Factory has spent a lot of cash for that expansion. Their levered FCF generated since 2015 has been a negative $706 mm if you include the acquisitions.

Fox Factory Cashflow Dynamics (US$ mm) (Company Filings, Author)

Were it not for the acquisitions, they would be FCF cashflow positive. But perhaps would not have grown as much, if at all.

Fox Factory FCF (Company Filings, Author)

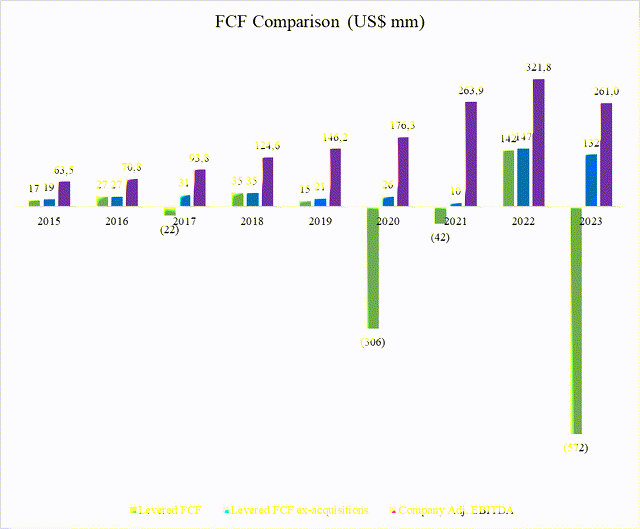

Such behavior is explained by executive’ incentives, as in the great Charlie Munger said: “show me the incentives and I’ll show you the outcome.” Here’s their executive compensation philosophy, taken from their Proxy Statement:

The Company performance metric we believe is most important to our stockholders is the same primary metric we used in determining performance-based cash incentive compensation in fiscal year 2023, adjusted EBITDA. We believe adjusted EBITDA directly correlates to stock price and is a good indicator of earnings and cash flow health. Additionally, for fiscal year 2023, in the Performance-Based RSU Award program (“PSUs”), we incorporated return on invested capital (“ROIC”) and free cash flow (“FCF”) which are equally weighted. We believe ROIC and FCF directly correlate to long-term company performance.

Their strategy has been successful in increasing Adj. EBITDA.:

Fox Factory FCF and Adj. EBITDA (Company Filings, Author)

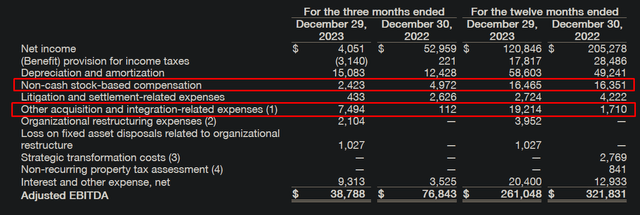

Their definition of Adj. EBITDA even adds back some of the acquisition expenses (and stock-based compensation):

Fox Factory Adj. EBITDA (2023 Press Release)

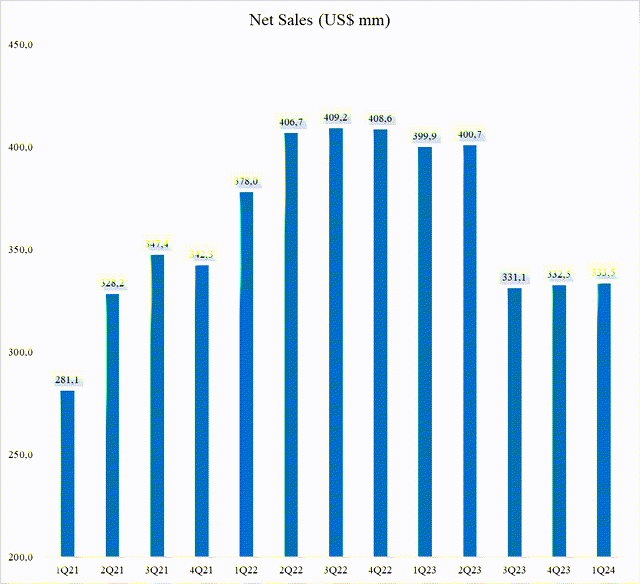

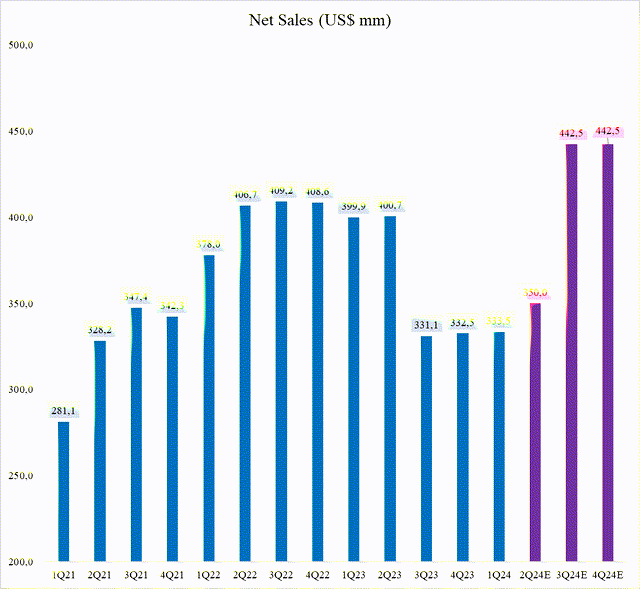

However, that was mostly done in times of low interest rates. As interest rates have risen, their growth suddenly halted.

Fox Factory Net Sales (Company Filings, Author)

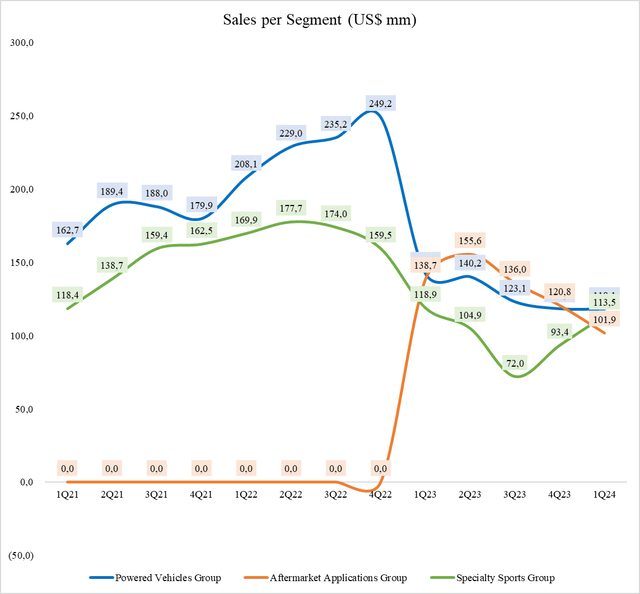

It’s difficult to pinpoint a precise segment to blame; the company mostly separates their businesses into three major segments. However, comparison is very limited because they are often changing it, as well as incorporating recent acquisitions into them. The After Applications Group segment was created in 1Q23, which is why it jumps from 0 to $138.7 mm in the chart below. It doesn’t really matter, as the slowdown seems to be impacting all of them.

Fox Factory Segment Sales (Company Filings, Author)

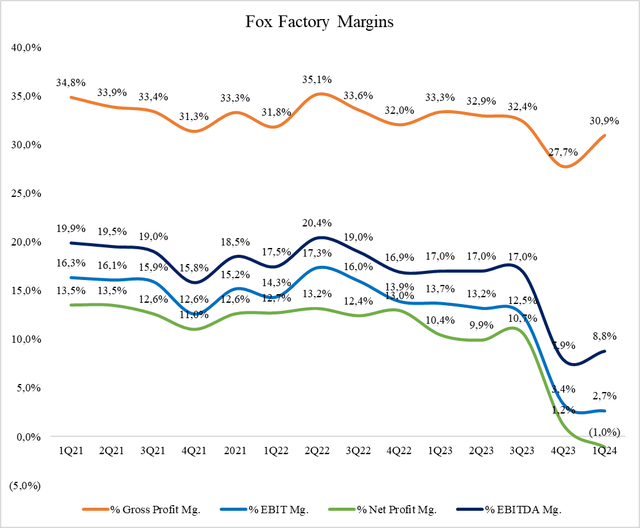

As with any manufacturing company, operational leverage is extremely important and lower sales directly impact margins.

Fox Factory Margins (Company Filings, Author)

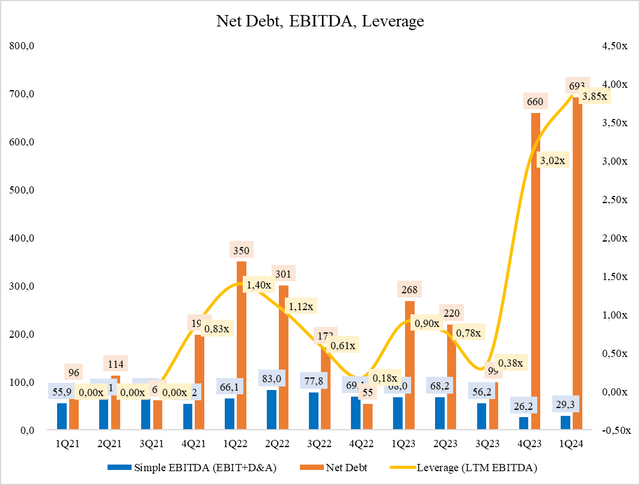

This slowdown is coming at a bad time, as the company has recently leveraged itself quite heavily to pay for their last acquisitions. By my calculations, they are currently leveraged 3.85x EBITDA.

Fox Factory leverage. Net Debt and EBITDA in US$ mm. (Company Filings, Author)

The cause for the slowdown is well known: interest rates. High interest rates slow their business down as discretionary consumer spending gets hit pretty hard. The company admits this in several sources.

From their 2023 10-K:

… rising interest rates, and other economic changes. In addition, many of our products are recreational in nature and are generally discretionary purchases by consumers. Consumers are usually more willing to make discretionary purchases during periods of favorable general economic conditions and high consumer confidence. Discretionary spending may also be affected by many other factors, including interest rates…

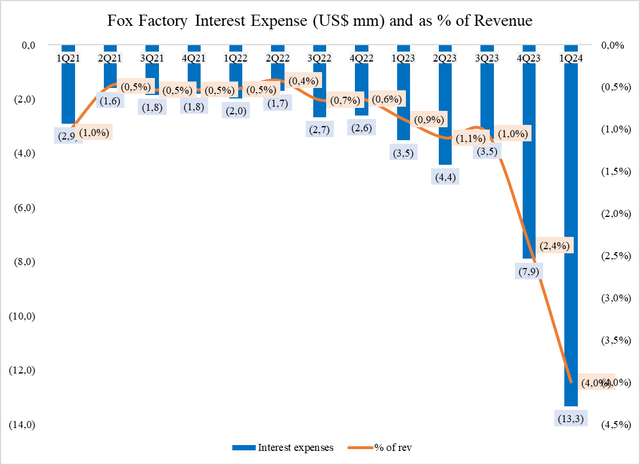

It also directly impacts the cost of their debt. Also from their 2023 10-K:

As of December 29, 2023, we had $750.0 million of interest-bearing indebtedness outstanding under the 2022 Credit Facility. Based on the $650.0 million of variable interest rate indebtedness that was outstanding under the 2022 Credit Facility as of December 29, 2023, after giving effect to our interest rate swap, a hypothetical 100 basis point increase or decrease in the interest rate would have resulted in an approximately $6.5 million increase or decrease in interest expense for the year ended December 29, 2023, respectively.

Fox Factory Interest Expenses (Company Filings, Author)

Management is currently optimistic about the second half of 2024. From their 1Q24 transcript:

We continue to expect the first half of 2024 to be down year-over-year, with the second quarter being sequentially stronger than the first quarter. Our expectation for the second quarter remains unchanged and is consistent with our plan. Dennis will speak more to our second quarter guidance in his remarks. Our full year guidance continues to be weighted to the back half and predicated on the following.

The basis for that is lower interest rates.

While those assumptions remain intact and show positive signs so far within Q2, our full year guidance also assumed easing macro pressures and an improved consumer outlook driven by the timing of interest rate relief.

In the 1Q24 press release, the company has explicitly given a number for the 2Q24 and 2024 revenue guidance. This is what it looks like:

Fox Factory Net Sales (Company Filings, Author)

They’ve given the 2Q24 target and FY2024, so I split the difference for it in the 3Q24 and 4Q24. As you can see, for the company to deliver on their guidance, they would need to have some third and fourth quarters that are record-levels of sales. The biggest problem, in my opinion, is that even if interest rates come down (which is unknown), it might take the consumer a while to feel the effects. And I suppose that I, personally, find any thesis based on the expectations of lower interest rates weak, since that is not guaranteed to happen this year, as much as some market participants might want to believe.

How much is already priced in? An exercise in valuation.

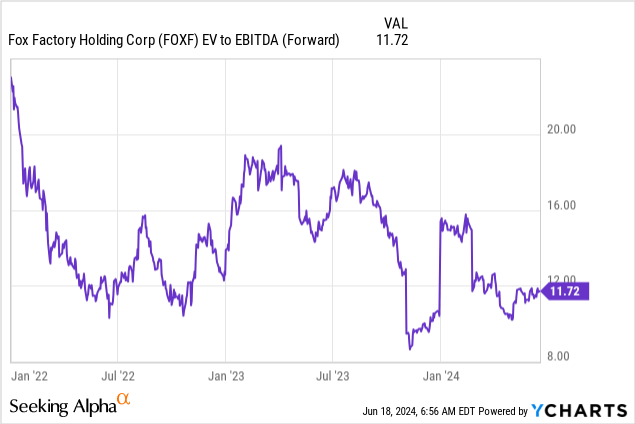

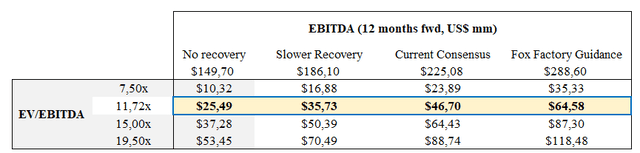

I will mostly use EV/EBITDA forward multiples to create a few scenarios for Fox Factory. The reason for that is that the company was unprofitable in the 1Q24 and therefore, in the worst scenarios, it might be unprofitable for 2024 and 2025, so a forward PE ratio would be useless.

Fox Factory was once a stock market darling with its high growth, so it traded at generous multiples back in 2021. As you can see in the chart above, since early 2022, the company has mostly bounced around 10x-20x fwd EV/EBITDA, with the peak around 19.5x and the bottom 7.5x. Currently, it’s trading at roughly 12x forward EBITDA.

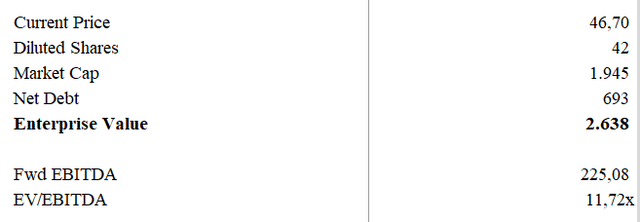

But what EBITDA is that? Well, at current $46.70 stock price, 42 mm diluted shares and $693 mm net debt, Fox Factory’s EV is around $2.6B. At 11.72x EV/EBITDA, we derive a consensus fwd EBITDA of $225 mm.

Fox Factory EV and Forward Consensus EBITDA (Company Filings, Author)

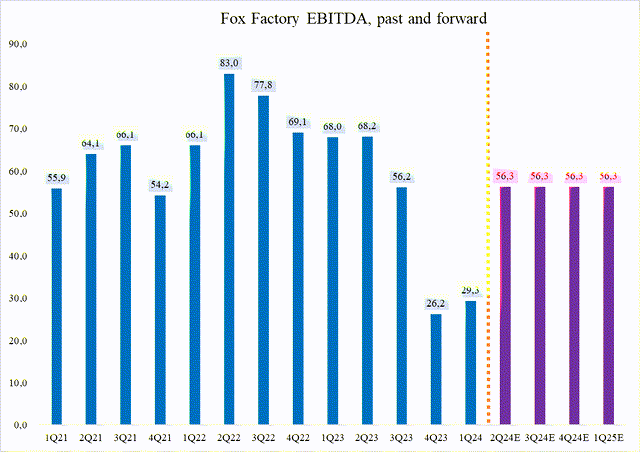

$225 mm EBITDA in 12 months means $56.25 mm per quarter. Here’s what it looks like, compared to their past performance.

Fox Factory EBITDA (US$ mm), past and forward. (Company Filings, Author)

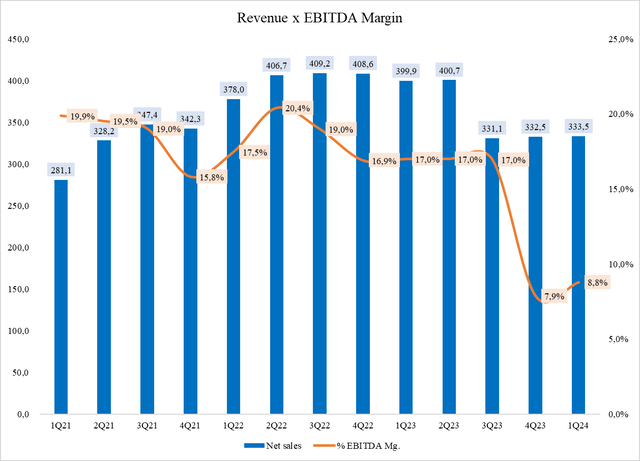

So the market is pricing in some recovery. However, it does seem slightly too optimistic to me. What if the recovery doesn’t come, or comes slower? I created a few valuation scenarios. But first, let’s look at EBITDA margins and its relationship with revenue.

Revenue (US$ mm) x EBITDA Margin (Company Filings, Author)

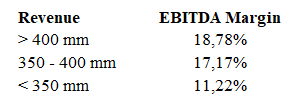

Based on the evidence above, I created three possibilities for Fox Factory’s margins, linked to their revenue.

Fox Factory’s Revenue (US$ mm) and EBITDA Margin (Author)

And, using that for the modelling, I created a table with four main different scenarios and their respective valuations.

Valuation Table (Author)

Personally, I believe somewhere in-between the Current Consensus and Slower Recovery scenario to be realistic. At current multiples, that gives us a price range between $35.73 – $46.70, which isn’t that far from the range the stock has been trading in the past couple of months.

Conclusion

I must admit that I’m torn between giving this a HOLD or a SELL. Numerically, I think the company is roughly fairly valued and that the market is giving it a discount already. However, a couple of things in the qualitative aspect don’t sit right with me, such as the many acquisitions (diworsefication, as some would call it), and perhaps most of all is my gut feeling that consumer discretionary will continue to suffer as interest rates take longer than expected to normalize. Their leverage is pretty high, and their loans do have some covenants, which might be a source for trouble if the recovery is slower than expected.

This is a difficult case to call, and while I’m going here with a SELL rating, perhaps this is one where I’m proven to be wrong. I would love to hear your comments and feedback on this one.

Read the full article here