I published my investment thesis on Gaotu Techedu (NYSE:GOTU) in September of 2023, assigning the stock a Strong Buy rating. The stock has rallied 187% in less than 6 months since. There have been two major developments since that article was published. The first is Gaotu’s strong quarterly financial results, which validated my thesis that Gaotu’s growth potential is very strong after business transformation. The second is the draft regulations released for public comments by China’s education ministry with regards to off-campus tutoring. However, I believe the stock price has mostly priced in the good news. Therefore, I am downgrading Gaotu to a “Hold” now.

Q4 2023 results

Gaotu reported Q4 2023 results on Feb 27, 2024. According to the company’s press release, highlights of the quarter include:

Net revenues were RMB761.0 million, increased by 20.9% from RMB629.6 million in the same period of 2022.

Gross billings were RMB1271.8 million, increased by 28.1% from RMB997.4 million in the same period of 2022.

Net operating cash inflow was RMB491.5 million, increased by 3.1% from RMB476.7 million in the same period of 2022.

As a recap, learning services accounted for more than 95% of Gaotu’s revenues. Within learning services, non-academic tutoring services and other traditional learning services accounted for roughly 75% of the segment revenue. It is very encouraging to see that during Q4 of 2023, revenue from non-academic tutoring services and other traditional learning services grew by more than 35% year-over-year.

Management explained during the earnings call that traditional learning services “achieved rapid growth in gross billings from new enrollments, while simultaneously reducing the unit acquisition costs.” This was due to “a more targeted and personalized curriculum by taking a tiered approach to design and developing holistic learning journeys” as well as Gaotu’s “carefully curated and cultivated the most influential and reputable instructors in the industry and established a highly competitive team of tutors”. In plain words, Gautu expanded its product offering and recruited more higher-quality tutors to better cater to students’ need.

Gross billings of Gaotu’s non-academic tutoring services increased by triple digits year-over-year. This impressive growth in gross billings is partly due to the industry consolidation, as Chinese parents have lost trust with small tutoring service providers as they often shut down abruptly without refunding the prepaid tuitions. For instance, as reported in this article, even well-known brands such as My Gym and Gymboree closed some training centers without notifying or refunding parents. This means more opportunity for public listed companies such as New Oriental Education & Technology Group (EDU) and Gaotu.

Gaotu’s net operating cash inflow for Q4 2023 was RMB 491.5 million. As of December 31, 2023, the company has total cash and cash equivalent of over RMB 4.24 billion. The strong balance sheet gives Gaotu a lot of flexibility in terms of business development as well as capital allocation. In November of 2023, the company upsized its share repurchase program from US$30 million to US$80 million. According to the press release,

“as of December 31, 2023, the Company had cumulatively repurchased approximately 4.9 million ADSs for approximately US$12.4 million under its existing share repurchase program.”

Along with the earnings release, Gaotu’s management announced its guidance for Q1 of 2024. Management guided that net revenue for Q1 2024 is expected to increase between 29.4% and 31.2% on a year-over-year basis. The growth momentum is very strong.

Overall, it was a very good quarter. My thesis for Gaotu is playing out exactly as I expected. Gaotu is on track to maintain its growth momentum over the next 2-3 years.

New draft regulation for off-campus training activities

Two years after the Chinese government’s crackdown on the after-school tutoring sector, which almost decimated the whole industry, the Chinese government has taken a big step in terms of relaxing its strict regulations regarding the after-school tutoring industry. On February 2,2024, China’s Ministry of Education released draft regulations for the country’s after-school tutoring industry. As reported by this Seeking Alpha news article,

“The notice states that the regulations are meant to standardize off-campus training activities, improve the quality of off-campus training, meet diverse cultural and educational needs and promote the healthy growth of teenagers.”

Importantly, the draft regulation has also explicitly excluded high school tutoring from the regulatory framework. This removes the uncertainty regarding the legitimacy of EDU and Gaotu’s high school tutoring business, as previous investors are concerned that the government may ban them from high school tutoring services too.

If the draft-regulation eventually becomes official, it will be great news for incumbent players for two reasons. First of all, it means the worst is over as far as regulation is concerned, as their business will be legitimate. Secondly, the draft-regulation encourages better quality tutoring, which will lead to more industry consolidation.

Financial projections and valuation

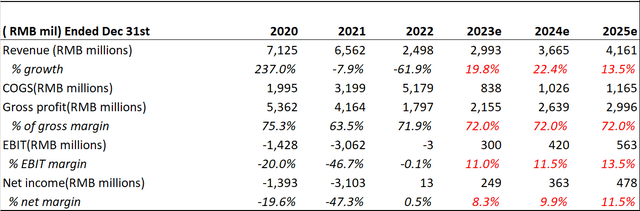

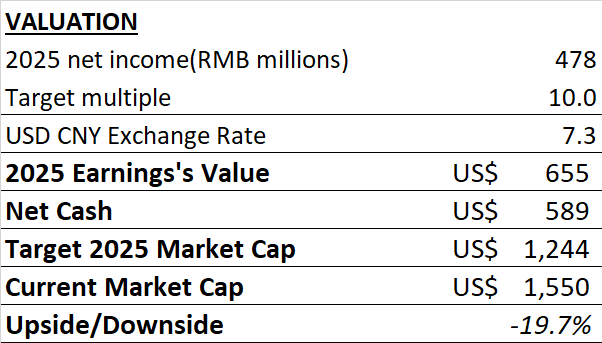

Gaotu’s Q4 2023 results are in line with my expectations. Therefore, I will keep my financial projections and that I used in my initial analysis. I’ve updated Gaotu’s valuation to account for the increase of net cash position.

author’s estimate

author’s estimate

At today’s valuation, Gaotu is no longer cheap, as the stock is trading above my 2025 fair value potential.

Risks to consider

While the draft regulation is an encouraging sign, it doesn’t mean the Chinese government won’t crack down the industry again in the future. I still think regulation remains the biggest risk in the industry in the long run. But in the short term, this risk has been very much mitigated.

In terms of Chinese ADR risk, Gaotu’s stock will continue to be extremely volatile as the U.S-China relationship remains very tense.

Conclusion

Gaotu’s Q4 2023 result confirmed my thesis that Gaotu is on track to achieve profitable growth in the next 2-3 years. The draft regulation by the Chinese government further removes the regulatory uncertainty regarding the after-school tutoring industry. However, investors seem to have priced in such optimism, pushing Gaotu’s stock price to a level well above my estimated 2025 fair value. Therefore, I am downgrading Gaotu to a “Hold” rating.

Read the full article here