Gladstone Investment (NASDAQ:NASDAQ:GAIN) has been one of my favorite BDCs since late December last year, when I did a more thorough assessment of its fundamentals, determining that the risk and return profile was attractive enough to go long.

The motivation behind recommending a buy for GAIN came from the following aspects:

- One of the lowest leverage levels in the BDC sector.

- Notable exposure towards preferred shares, which not only generate stable cash flows, but also offer an enhanced upside potential in the scenario of falling interest rates.

- The focus on cash-flowing companies that have already established their operations in relatively defensive industries.

- Strict underwriting standards leading to a de-risked portfolio exposure and thus reduced probability of recognizing meaningful non-accruals.

A counter argument was the tiny portfolio of GAIN that inherently limits the overall option space where to participate in LBOs, M&As and other transactions, which typically require meaningful amounts of external financing. Similarly, the fact that GAIN had not utilised its leverage potential could theoretically imply a reduced upside potential in the scenario of upward trending markets.

However, considering my investment strategy of preferring defense over offense and primarily focusing on the sustainability of the underlying dividend, the aforementioned benefits were more than enough to offset potential drawbacks.

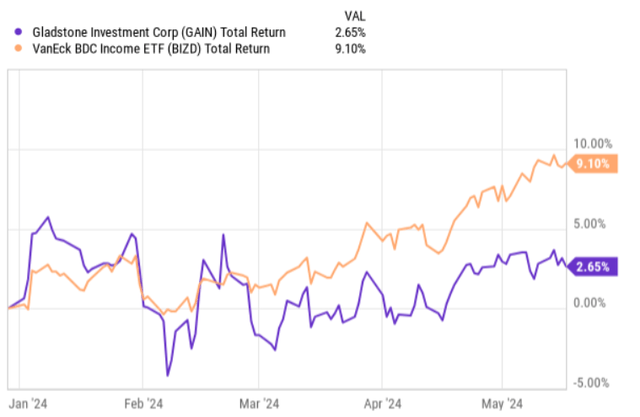

Since the publication of my bullish thesis, GAIN has delivered stable results but underperformed the BDC market, which has in general experienced tailwinds mostly stemming from the strengthening of a ‘higher for longer’ interest rate scenario. This goes in line with my assumption before recommending a buy on GAIN, which is that during a highly upwards trending BDC market it would most probably lag the index due to smaller leverage that reduces the overall beta component.

Ycharts

GAIN just published its Q4, 2024 earnings report, which reveals a fresh set of data points that are worth contextualising against my current bull thesis. Let’s review the earnings deck and determine whether the bull case remains intact.

Thesis review

The fourth quarter brought in a mixed bag of messages, which really if assessed deeper boils down to still a favourable momentum in the underlying business.

On the surface, the most unpleasant aspect from Q4 results was the notable drop in the net investment income figure, which came in at $5.3 million compared to $9.7 million in the prior quarter. Looking at the top-line, we notice that it actually improved by circa $0.5 million, but it was the expansion in the cost base that drove the bottom-line figure lower (i.e., the net investment income). Net expenses for the fourth quarter landed at $18.3 million, which is circa $5 million more than in the prior quarter. So, if we stopped here and contextualised this with the underlying dividend, we would easily conclude that the distributions are unsustainable and that GAIN will sooner or later revise the dividend downwards.

However, the main reason why the net expense component rose so much was related to a successful realisation of an equity investment that unlocked significant capital gains from the embedded book values that were recorded a relatively long time ago when GAIN injected its capital in companies’ equity.

So the increase in the cost base was primarily driven by accrued capital gains based incentive fees, which could be considered a one-off and also to some extent a positive thing since that stems from a successful exit.

As the table below indicates, the adjusted net investment figure, which excludes these fluctuations and focuses only on the interest bearing components, was at $0.24 per share. That is slightly lower than in the prior quarter, when GAIN achieved a result of $0.26 per share.

GAIN Q4, 2024 earnings report

This drop by $0.02 per share is attributable to the overall margin compression in the BDC segment and largely to the fact that GAIN managed to exit from an equity positions, thereby imposing headwinds on the top-line level. This is once again something temporary and even if GAIN was not able to get back the adjusted net investment income result, it would still be sufficient to cover the dividend.

Now, as a result of the exit, GAIN was able to increase its NAV by $0.42 per share after making the distributions. So, this divestiture alone brought in sufficient capital to cover the gap between adjusted net investment income and the dividend, while also leaving ample amounts of liquidity unutilised that could be used to bring down the debt or sponsor incremental investments.

On a forward basis I would, however, assume that GAIN will be able boost its core net investment income result as it does just that: either reduced debt further or begins to underwrite more notable amounts of new investments by using its fortress balance sheet (which has one of the lowest leverage profiles in the BDC space).

According to the commentary by Dave Dullum – President – in the recent earnings call, it also seems that GAIN will continue to slowly but surely tap into its equity portfolio to unlock the embedded value that should, ultimately, provide tailwinds for either the top-line or its balance sheet.

As our portfolio has matured, we’ve been at this since 2005, and the equity values have been, we clearly will be able to continue to constructively harvest these gains for the benefit of shareholders. As you all know, we are able to, because of our model, be in some of these companies for a long period of time and really, it’s to the benefit of shareholders that we’re not having to exit companies too rapidly unable to maintain them. We will continue to balance the timing of the exits while maintaining the level of our assets that produce the income that we need to support the monthly dividend levels that we currently are able to have and hopefully over time continue to grow them.

The bottom line

Optically, it might seem that the recent quarterly results indicate a deteriorating performance leading to an unsustainable level of the current dividend coverage.

Yet, peeling back the onion a bit, it becomes clear that it was just the successful realisation of a previously made equity investment that introduced accrued capital gains based incentive fees, which, in turn, lowered the net investment income result.

However, the fact that GAIN managed to divest one of its equity stakes has boosted its NAV base and strengthened the liquidity profile, allowing to not only cover the temporary gap in the dividend coverage, but also provide management with a more flexibility to either reduce its debt further or channel this capital into new interest bearing investments. Either of these should warrant a higher net investment income result.

Given the aforementioned dynamics and the clear value potential in Gladstone Investment equity portfolio, the stock is a buy.

Read the full article here