Global Medical REIT Inc. (NYSE:GMRE) is a United States medical office building-focused healthcare real estate investment trust that offers a compelling value proposition to passive income investors seeking both income and growth.

Global Medical REIT, in my opinion, provides a growing dividend, portfolio expansion, and the strong possibility of robust funds from operations growth as the trust continues to expand its medical office building footprint through acquisitions.

Global Medical REIT is also undervalued in my opinion, as its stock trades at a low FFO multiple. As a result, an investment in Global Medical REIT provides yield, income, a margin of safety, and growth potential.

A Fast-Growing Real Estate Investment Trust With A Focus On Medical Office Buildings

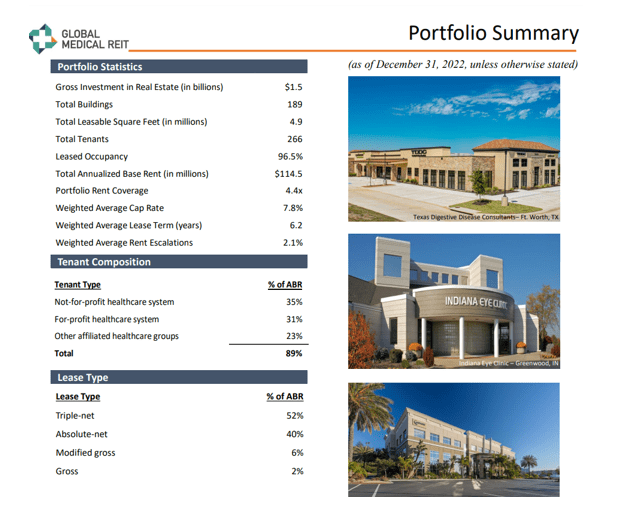

Global Medical REIT is a growing healthcare trust that primarily invests in medical office buildings. Global Medical REIT had $1.5 billion in real estate assets as of December 31, 2022. Medical office buildings, or MBOs, are a distinct asset class in the healthcare market that are typically leased to health systems and physicians who provide outpatient services to patients. As of the end of 2022, the REIT’s portfolio lease rate was 96.5%, with 189 different MBOs in 35 states.

Leases for Global Medical REITs are typically triple-net leases, which means the tenant is responsible for paying things like property taxes, insurance, and maintenance. Global Medical REIT can focus more on acquiring and scaling its business by shifting the burden of operating expenses to the tenant.

Portfolio Summary (Global Medical REIT)

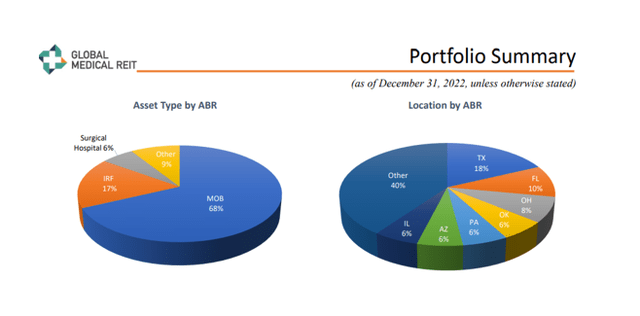

Global Medical REIT’s primary holdings are medical office buildings (68% of the portfolio), but it also has inpatient rehab facilities (17%), surgical hospitals (6%), and other healthcare assets (9%).

Asset Type (Global Medical REIT)

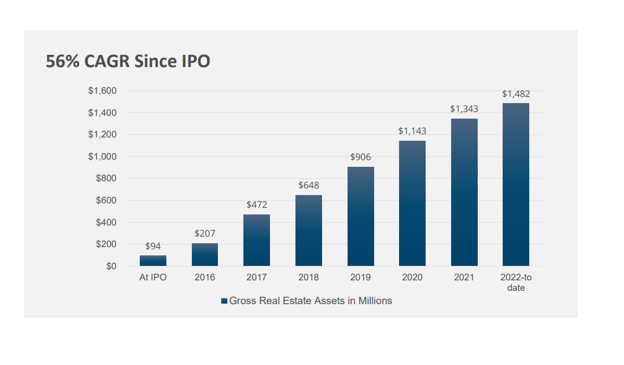

The trust is expanding primarily through acquisitions, resulting in a significant increase in the size of the REIT’s portfolio. The trust, which now owns $1.5 billion in real estate (gross value), is a healthcare REIT that investors should keep an eye on. Though the trust is still relatively small, with a market value of $600 million, management is eager to expand the trust’s portfolio in the future.

CAGR Since IPO (Global Medical REIT)

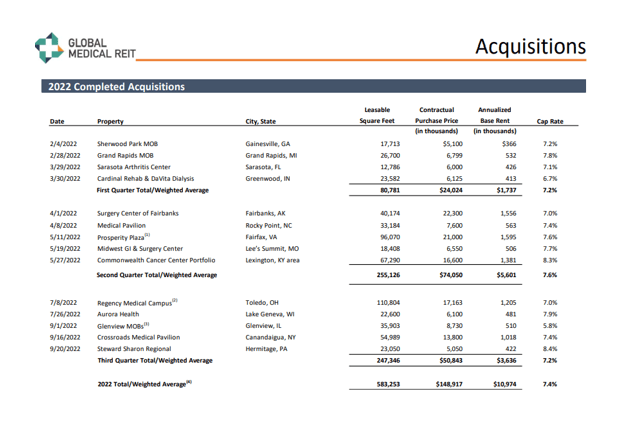

Global Medical REIT paid $149 million to add 583K square feet to its portfolio in 2022. In exchange, the trust increased its rent receipts by nearly $11 million.

Acquisitions (Global Medical REIT)

Dividend Coverage

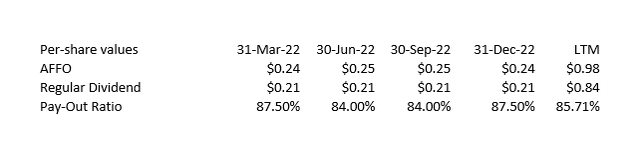

Global Medical REIT earned $0.98 per share in adjusted funds from operations in 2022 and paid out a total of $0.84 per share, resulting in a dividend pay-out ratio of approximately 86%, which is a good pay-out ratio for a trust, especially a fast-growing one like GMRE.

Omega Healthcare Investors Inc. (OHI), while not an MBO-focused healthcare trust, had a 2022 pay-out ratio of approximately 90%.

Dividend Coverage (Author Created Table Using Company Supplements)

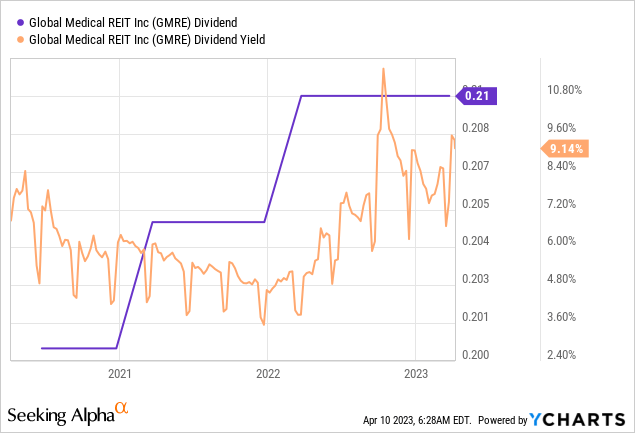

What matters here is that Global Medical REIT is increasing its dividend payout, which means that passive income investors can expect a higher stream of dividend income in the future. The current quarterly dividend payment is $0.21 per share, resulting in a dividend yield of 9.1% based on the stock price of $9.19.

Attractive AFFO Multiple

Global Medical REIT is expected to earn $1.00-1.05 per share in adjusted funds from operations in 2023, implying an AFFO multiple of 9.0x based on the current stock price of $9.19.

Another MOB-focused healthcare real estate investment trust, Healthcare Realty Trust Incorporated (HR), trades at a funds from operations multiple of 13x.

Global Medical REIT’s lower multiple is due to the trust’s smaller real estate portfolio and higher perceived risk, as GMRE has a shorter operating history than Healthcare Realty.

In my opinion, the valuation reflects a high margin of safety, and Global Medical REIT’s multiple could reasonably expand to 11-12x.

Investment Risks With Global Medical REIT

Global Medical REIT relies on a healthy annual transaction volume to some extent to grow its adjusted funds from operations. The market for medical office buildings sees approximately $20 billion in transaction volume each year, and if this volume dries up, Global Medical REIT will struggle to grow as quickly as it has in the past.

My Conclusion

Global Medical REIT, in my opinion, provides an appealing combination of portfolio growth and a high dividend yield of 9.1%. Furthermore, the trust is expanding rapidly as a result of its acquisition strategy, which could result in continued robust funds from operations growth.

Global Medical REIT also covers its dividend pay-out with adjusted funds from operations, and the dividend has been increasing, which adds to GMRE’s appeal as a passive income investment.

Because the stock is also reasonably valued based on AFFO, I believe GMRE should be added to your (and mine) investment portfolio.

Read the full article here