Background

Halozyme Therapeutics (NASDAQ:HALO) is an innovative biopharmaceutical company that has developed a unique platform technology, ENHANZE, that allows for the subcutaneous delivery of biologics, which has the potential to revolutionize the way we deliver and administer life-saving drugs. With several major partners, including Roche (OTCQX:RHHBY), AbbVie (ABBV), and Bristol-Myers Squibb (BMY), the company has the potential to generate significant revenue from royalty payments and milestone payments.

Why ENHANZE technology is a real deal

Halozyme IR deck (Halozyme IR deck)

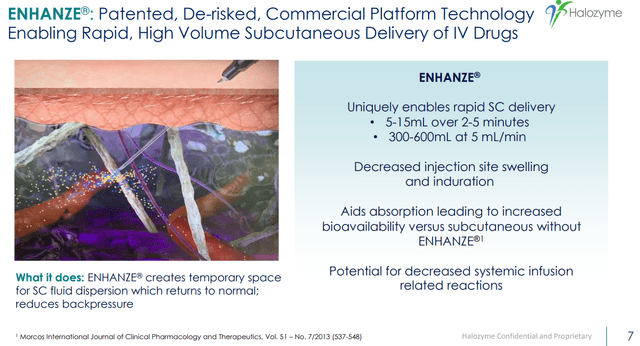

Halozyme’s drug delivery technology, called Enhanze, enables the subcutaneous delivery of biological drugs. Biologics are large, complex molecules produced using living cells and used to treat a range of diseases, including cancer, autoimmune disorders, and diabetes. However, most biologics are currently administered through intravenous (IV) infusion, which can be time-consuming and inconvenient for patients. Subcutaneous injection is an alternative route of drug administration that involves injecting the drug under the skin into the fatty layer between the skin and muscle. This route of administration has several advantages over IV infusions. Firstly, it is less invasive and can be self-administered by patients, reducing the need for hospital visits and making treatment more convenient. Secondly, it can lead to more consistent drug levels in the body, as the drug is released slowly from the injection site over time. Thirdly, it can reduce the risk of side effects associated with IV infusions, such as infections and blood clots.

Halozyme’s Enhanze technology works by temporarily breaking down the hyaluronan matrix in the subcutaneous space, which creates a larger and more permeable space for the drug to diffuse into. This allows for more rapid and efficient absorption of the drug, resulting in higher bioavailability and faster onset of action. Enhanze has been successfully used to enable subcutaneous delivery of a range of biologic drugs, including Roche’s Herceptin and Genentech’s Rituxan.

In addition to the benefits for patients, Enhanze can also provide significant commercial advantages for pharmaceutical companies. By enabling subcutaneous delivery, Enhanze can extend the life cycle of existing biological drugs and create new revenue streams. It can also improve patient adherence to treatment, which can increase drug efficacy and reduce healthcare costs associated with hospitalizations and complications.

IRA overhang may be overblown

The recent CMS guidance related to Medicare drug price negotiations under the Inflation Reduction Act (IRA) has caused some uncertainty among investors regarding the long-term value proposition of HALO’s technologies as it pertains to the Medicare portion of partner-product sales. However, we believe that this concern is overblown and that the impact on HALO should be minimal, particularly since the large majority of HALO’s drugs (and pipeline) fall under Part B, with the exception of HyQvia (which should be exempt anyway).

Zooming out, the long-term growth outlook remains appealing

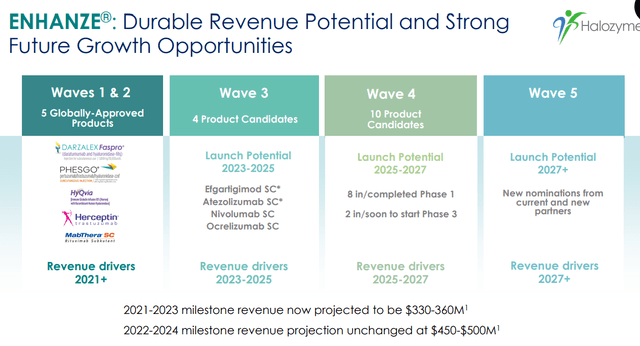

ENHANZE®: Durable Revenue Potential and Strong Future Growth Opportunities (Company source)

Despite this short-term concern, HALO has a substantial near-medium growth outlook. The company is expected to receive FDA approval for subcutaneous versions of efgartigimod and daratumumab in the coming months, which should be a positive catalyst for the stock. Although the FDA delayed the approval of SC efgartigimod, we believe it will get approved eventually in the short future based on the robust PK/PD equivalence data.

Positive long-term growth potential

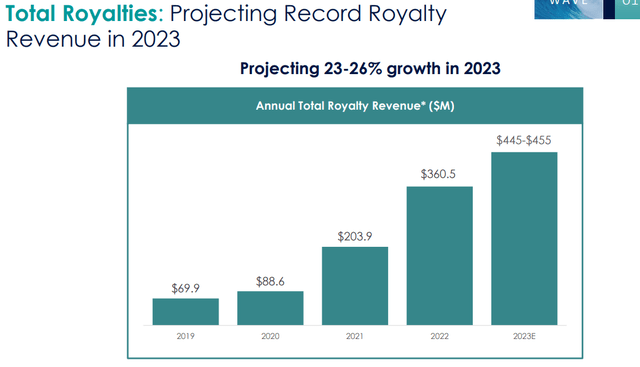

One of the key drivers of HALO’s long-term growth potential is the ENHANZE platform technology. The technology has already been licensed to several major partners, including Roche, AbbVie, and Bristol-Myers Squibb, and has generated significant revenue in the form of royalty payments and milestone payments. In addition, HALO has a strong pipeline of potential new ENHANZE products, which could generate additional revenue streams over the long term. Between 2019 and 2023, the royalty revenue grew from ~$70M to $450M, which is a greater than 600% increase. We expect the growth in royalty revenue to increase continuously through partnerships and reach ~1Bn by 2027 with wave 1-4 ENHANZE products.

Total Royalties: Projecting Record Royalty Revenue in 2023 (Company IR deck) ENHANZE®: A Royalty Growth Story (Halozyme IR deck)

Halozyme has a strong track record of developing successful partnerships. We believe the company’s strong pipeline of potential new products will continue attracting interest from major biopharmaceutical companies.

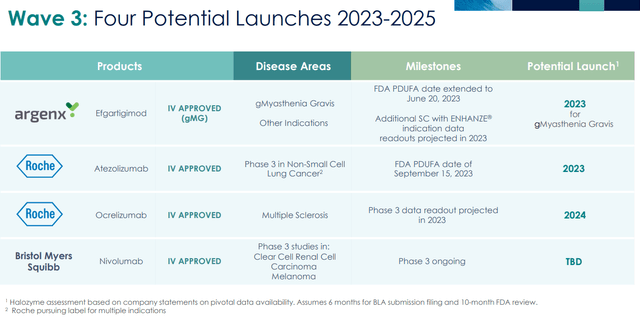

Four Potential Launches 2023-2025 (Company IR deck)

Risks

- Potential delays in the clinical trial timelines for Wave 3+ subcutaneous products, including BLA decisions from the FDA, slated for 2023, or an FDA filing for Tecentriq in 2023 post Ph3 results in 1Q23.

- Any unforeseen partnership or legal issues which could impact collaboration and milestone revenues or potential royalties, particularly related to the ENHANZE platform when first-generation API becomes generic in 2024 and 2027.

- Drug pricing headwinds: Lower-than-expected sales coming from the company’s partnered products, particularly due to the potential impact of CMS drug price negotiation.

- Increasing competition and potential erosion of long-term royalties, particularly as the US Enhanze patent expires in 2027 and more manufacturers could develop Enhanze formulations in-house for future candidates. Additionally, novel formulation technology competitors could emerge.

Conclusion

We initiate HALO stock with a buy rating. We believe that HALO is a compelling investment opportunity for long-term investors. While there may be some short-term uncertainty related to the CMS guidance and the potential for generic competition, we believe that the company’s strong near-medium growth prospects and its unique platform technology (IV to SC translation), and multiple potential new drug launches (efgartigimod and daratumumab) make it an attractive investment opportunity. Furthermore, the company’s strong track record of developing successful partnerships (Roche, AbbVie, and Bristol-Myers Squibb) and its potential to generate significant revenue from royalty payments and milestone payments make it a compelling investment opportunity for long-term investors looking for exposure to the biopharmaceutical sector with a lower degree of binary clinical risk.

Read the full article here