Introduction

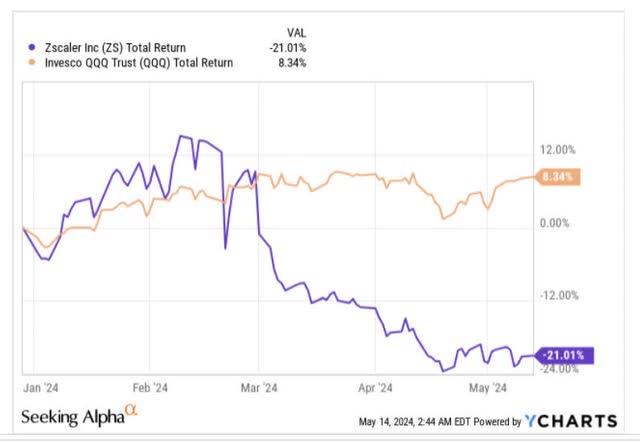

The stock of Zscaler (NASDAQ:ZS), a cybersecurity player noted for its fully integrated, multi-tenant cloud-native security solutions, hasn’t enjoyed a fruitful 2024 so far. On a YTD basis, when the tech-oriented Nasdaq has managed to notch positive gains of around 8%, ZS has crumbled by 21%.

YCharts

There could be an opportunity to right the wrongs, with ZS’s Q3-24 results (the company follows a July-ending fiscal year) coming out at the end of this month, on May 30, after the market close.

If you’re mulling over a potential position in Zscaler ahead of its key earnings event, here are a few things worth noting.

Earnings Considerations

Firstly, note that when it comes to beating consensus estimates, ZS has quite a stellar record; over the past 20 quarters, it has managed to beat both topline and bottom-line estimates on every single occasion! It’ll be interesting to see if ZS can keep it up for the 21st straight quarter, as expectations have been dialed up over the past three months, with the upcoming Q3 EPS ($0.65) only seeing positive revisions (33 in total), aggregating to an upward adjustment of nearly 11%.

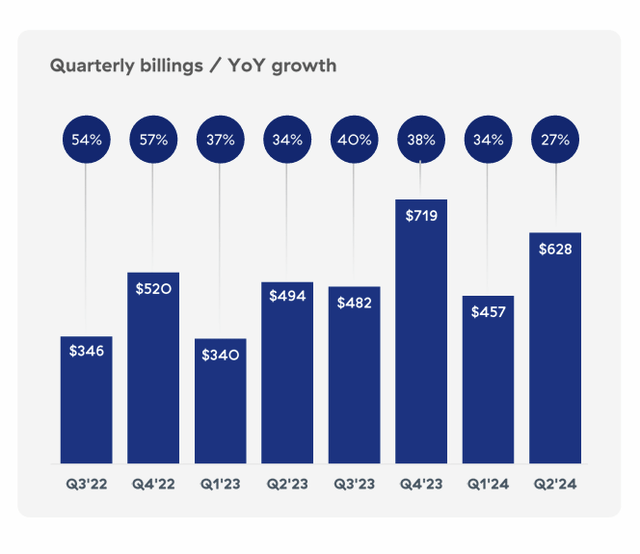

Seeking Alpha

Whilst ZS may end up doing well on the headline front once again, investors should note that Q3 is likely to be a slow quarter from a billings’ perspective on account of seasonal effects. Billings are basically expected to come off by 7% sequentially from the Q2 levels, but this will only be a temporary blip as the FY24 billings outlook was still maintained at 25-26% YoY. This basically implies over 50% sequential growth in billings for Q4. Having said that, it’s worth noting that the pace of billings growth per quarter has been slowing for three straight quarters, and in Q3 this trend will likely continue.

Q2 Presentation

In Q2, ZS also benefitted from strong new logo momentum, which accounted for half of the total new bookings, but we’d like to think in Q3, one could see this ease off, with a greater proportion of upselling accounting for new bookings.

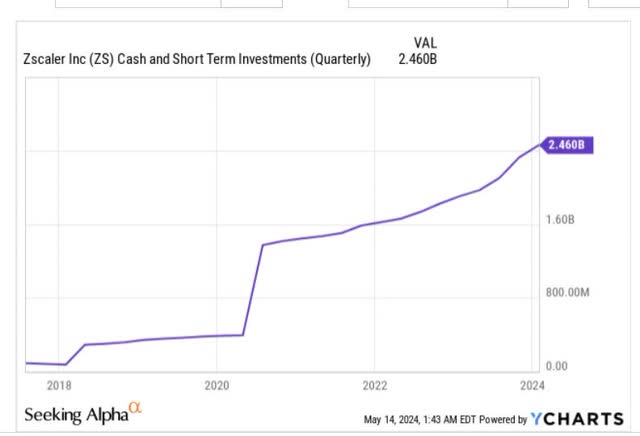

One of ZS’s sub-plots that doesn’t get spoken about a lot is its relatively sturdy FCF prowess, which has played a key part in ensuring that ZS maintains a net cash position (where cash and short-term investments exceed the total debt), even though the firm has over $1.23bn of debt on its books. Despite that, note that Zscaler’s cash and STI figure has grown impressively over the last five years, and is currently at levels of nearly $2.5bn.

What’s also key to note is ZS’s cash and STI balance accounts for the largest chunk of its asset base, at 63%, and such significant levels of liquidity also help bring some undertones of resilience to the ZS business model.

YCharts

Nonetheless, coming back to ZS’s FCF prowess, note that the company has been able to generate consistent FCF margins of 21% for three straight years (for every $1 of sales they make, they generate $0.21 of FCF). Note that in Q2, which is typically seasonally weak, from an FCF basis, the margin only came in at 19% (it still represented a record for Q2, and a 300bps YoY improvement); now in H2, it is quite commendable that ZS is on course to deliver improved YoY growth on the FCF margin front, even though there is likely to be more pressure from cloud and AI-related CAPEX investments. Despite these CAPEX commitments, management suggested that FCF margins would be in the lower 20s for the FY, likely making it the fourth successive year, where they’ve hit this landmark (not an easy feat at all, when you’re a growth company).

Part of the reason why ZS has been able to maintain such consistent FCF margins is because its cost of sales component is quite low with, gross margins too at consistently high thresholds of 80%. Note that in Q2, it came in at 80.8%, a 40bps YoY improvement. In Q3, some gross margin improvement could come on the back of an accounting tweak (the depreciable useful life of their cloud infrastructure has been stretched from 4 to 5 years), but some GM pressure is also to be expected as the company focuses on increasing the penetration of newer products such as Zscaler ZDX or Zscaler for Workloads which are inherently low margin. Yet despite all that, ZS is still on course to deliver Q3 GMs of 80%.

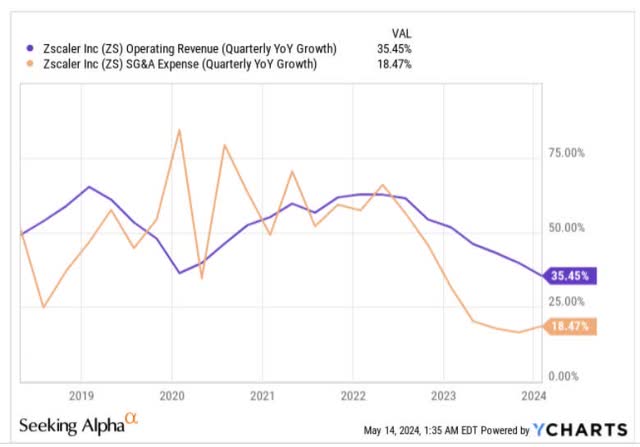

Operationally, there could be some sequential slowdown in Q3 as they ramp up hiring; management is guiding towards operational profits of around $99m, which would represent around a 4% sequential slowdown from what was seen in Q3, but don’t dismiss the probability of a strong beat here, as in Q2, the eventual operating profit number was 21% more than what management guided to (a range of $84-$86m). Otherwise, management deserves a pat on the back, cause since the second half of 2022, ZS’s SG&A base has been growing at a slower pace than the topline and most is roughly only coming in at half the pace of topline growth.

YCharts

Closing Thoughts – Is ZS A Good Buy Now?

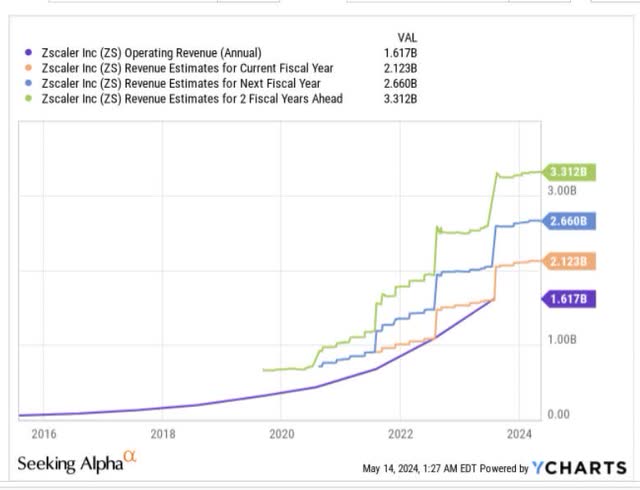

Over the last few years, Zscaler has built up strong credibility as a reliable agent of sturdy topline growth, but that narrative appears to be fading. For context, over the last three years, between FY20-FY23, ZS’s topline grew at an impressive CAGR of 55%, but consensus estimates through the next three years (FY23-FY26) now suggest that the pace of CAGR will halve to just 27%!

YCharts

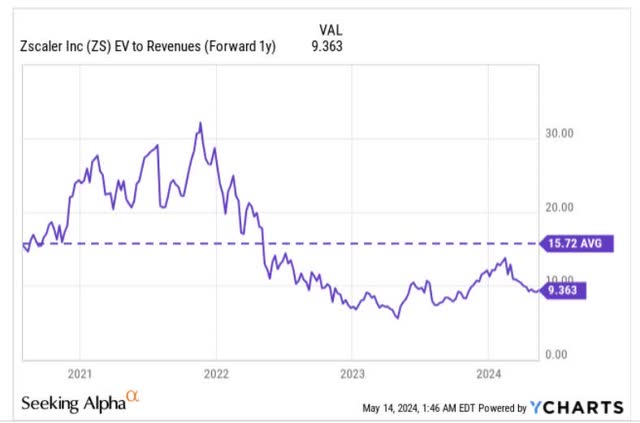

Some of ZS’s detractors may use the slowing forward topline growth as a stick to beat it with, and we too may have had a problem with this shift, if the stock was still priced at an inordinate premium relative to its historical average. That certainly isn’t the case now; rather, what we have now, is a stock that can be picked up at a compelling forward EV/Sales multiple of just 9.4x, which represents a sizeable discount of 40% to its rolling-5-year average.

YCharts

As the sales pie grows larger, it is always going to be difficult to live up to historical levels of growth, but at an EV/sales multiple of around 9x, please note that you’re still getting medium-term topline growth that is 3x that multiple, which we feel is still quite a compelling proposition!

We would also urge investors to focus on the improving texture of topline that one is likely to get going forward. In November, last year, ZS appointed a new CRO – Mike Rich, who has over 25 years of sales experience and played a key part in growing ServiceNow’s revenue profile by over 100x. Rich’s main remit, at least in the initial years, will be to help drive greater engagement and stickiness with large enterprises (currently over 40% of Fortune 500 companies serve as ZS’s clients), which in turn will serve as an ideal landscape to upsell and grow and eventually get to $5bn+ in ARR. A large-account-dominated sales profile will likely make ZS’s revenue profile less vulnerable to the vagaries of economic cycles.

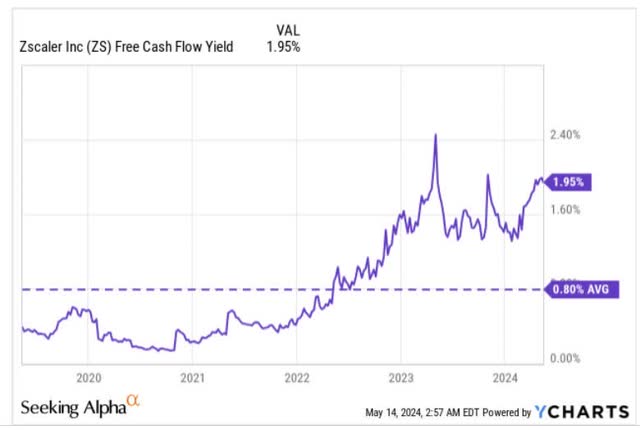

We’ve also previously touched upon ZS’s FCF prowess in the previous section, and you’d be interested to note that at the current share price, you’re getting to pocket quite a commendable FCF yield of 1.95%, which is around 2.4x better than what you’ve normally gotten over the past five years! Since ZS is expected to maintain an FCF margin (FCF as a function of revenue) of 20%+ yet again this year, we would expect the FCF yield to stay relatively robust going forward.

YCharts

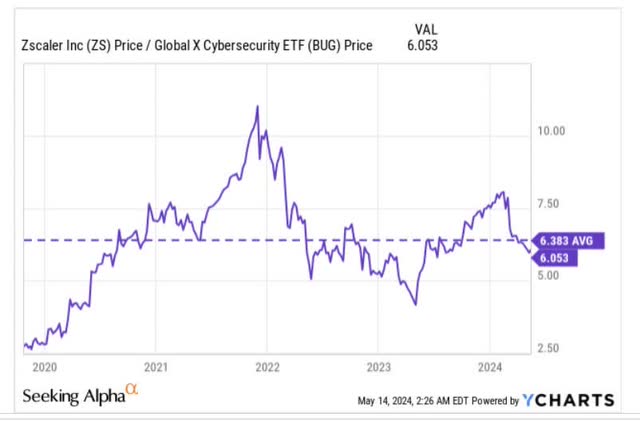

ZS’s stock may not necessarily fill the desires of rotational specialists looking at oversold opportunities within the broader cybersecurity space, but at least you could also still say that the stock no longer looks overbought either. Contrary to what was seen in Q1 of this year, we now have a scenario where the current relative strength ratio of ZS to its peers is around 5% lower than its long-term average.

YCharts

Finally, if we take a look at ZS’s standalone weekly chart we can see that from March 2023 and over the following 12 months, the stock had been coasting along within a certain ascending channel (marked by the two black lines). However, in February 2024, we saw the stock hit an intermediate top followed by some weakness, which eventually led it to break below its channel.

Investing

We’ve not yet spotted any bullish signs, but nonetheless, it has been encouraging to note the relative flattening out of the price action over the last few weeks. Note that this shift in the texture of ZS’s price movements comes as it has revisited an old price range, which had served as a congestion zone twice (first from May-October 2022, and then from May-November 2023). We wouldn’t be surprised to see this price terrain serve as a congestion zone yet again, and help the stock build a floor, before bullish conditions take over.

To conclude, we view ZS as a good BUY at current levels.

Read the full article here