As of 2024, the status of rare earth materials outside China remains a critical concern for global supply chains, particularly given China’s dominance over the majority of the production and processing of these materials. China has come to control 67% of mining, 91% of refining activity, 87% of oxide separation and 94% of magnet production. This dominance has prompted significant international efforts to diversify sources of rare earths.

Lots of Talk, Little Action

The Rep. Obernoite bill presented to the U.S. Congress has been referred to the House Committee on Natural Resources, so we need to wait.

These conflicting issues have been circulating for a long time with minimal resolve. Ten years ago I discussed China’s rare earth dominance in a Nov. 5, 2010, Seeking Alpha article entitled “How China’s Rare Earth Embargo Impacts High Tech Companies.” Thirteen years have elapsed since the article, and in light of expanded applications for REE, an impending China-U.S. trade war, and a very different REE industry outside China, I want to expand and update my analysis of the market.

China was able to dramatically impact REE prices because the country excavated more than 90 percent of rare earth elements produced in the world at that time in 2010. Then, it acquired nearly all of the ability for processing the rare earth ore into end products.

These processing capabilities include:

- Separating the rare earth ore into individual rare earth oxides;

- Refining the rare earth oxides into metals with different purity levels;

- Forming the metals into rare earth alloys; and

- Manufacturing the alloys into components, such as permanent magnets, used in defense and commercial applications.

In other words, even if there are alternative sources of rare earth minerals mined in the U.S, there are no sizable refineries for converting the rare earths from rock to separated elements.

- Now, roughly 60% of all mined rare-earth minerals are sourced from China. Three other major sources exist in Myanmar, Australia and Mountain Pass.

- China has come to control 91% of refining activity, 87% of oxide separation and 94% of magnet production.

Woes at Lynas Corporation

Lynas Corporation (OTCPK:LYSCF) operates a significant rare earth processing facility in Australia. Lynas has been actively expanding its operations and exploring opportunities to establish additional rare earth processing facilities, including in the United States, to provide a more diversified supply chain. Lynas owns the Mount Weld mine and processing facility in Australia and the Lynas Advanced Materials Plant in Malaysia for separating the concentrates into Nd/Pr oxides and other separated REs.

On the company’s April 24 fiscal Q3 2024 earnings call, Amanda Lacaze – CEO and Managing Director noted:

“Well, the market continues to be less than kind to us and to anybody else in rare earth, of course.

There’s a general consensus that the current price is below cost for many Chinese producers and that there’s also a general consensus that the Chinese economy is starting to pick up momentum again. So with these various sort of influences as everyone would have seen, we made a decision to hold some of the inventory rather than having it sitting as sort of in other people’s warehouses, appreciating as the price goes up, we thought it would be best if it sits at our warehouse and appreciates as the price goes up.”

The firm’s quarterly sales revenue fell to A$101.2 million ($65.64 million) in the three months to March 31, down from A$242.8 million a year earlier. It missed a Visible Alpha consensus estimate of A$146.3 million, according to Morgan Stanley. Lynas shares traded down 1.2%.

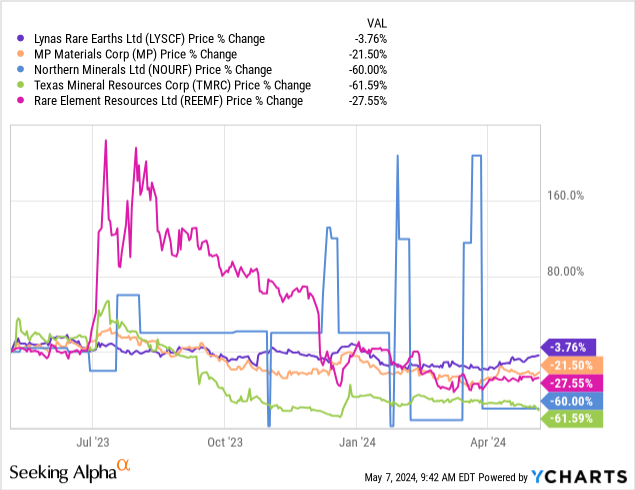

While it’s probable that sitting on inventory impacted Q3 earnings, the market has been “less than kind” to not only Lynas, but to the rest of the rare earth companies as shown in Chart 1.

YCharts

Chart 1

Chart 1 shows the 1-year stock price percentage changes for leading rare earth companies Lynas Corporation, MP Materials (MP), Northern Minerals Limited (OTCPK:NOURF), Texas Mineral Resources Corp. (OTCQB:TMRC), and Rare Element Resources Ltd. (OTCQB:REEMF).

All show negative growth, with LYSCF the best at -3.76% and TMRC the worst at -61.59%.

Leading Non-Chinese Companies

MP Materials (United States): MP Materials operates the Mountain Pass mine in California, which is a prominent rare earth production site in the United States. MP is in the process of adding on-site rare earth refining and separation capabilities and, producing neodymium-praseodymium (NdPr) oxide in addition to heavy rare earths and terbium (“Tb”) and dysprosium (Dy), which it refers to as Stage II. In what it calls Stage III, MP in parallel is building a NdFeB permanent magnet manufacturing facility in Fort Worth, Texas, with gradual production ramp expected in 2024 (for NdPr alloy) and NdFeB PMs by 2025 to support a long-term supply agreement with GM for use in several of GM’s EV motors. At full capacity, MP Materials expects the magnetics factory to produce 1,000 tons of rare-earth magnets a year, supporting the production of roughly half a million EV motors.

Northern Minerals Limited (Australia): Northern Minerals is an Australian mining company with the Browns Range project, which focuses on producing heavy rare earths, including dysprosium and terbium. Their aim is to diversify the global supply chain for these critical elements.

Texas Mineral Resources Corp. (United States): Texas Mineral Resources is exploring and developing rare earth resources in Texas. The company aims to establish a domestic rare earth supply chain and has partnered with USA Rare Earth LLC to commercialize these resources (see below).

Rare Element Resources Ltd. (United States): Rare Element Resources focuses on advancing the Bear Lodge Project in Wyoming, USA. A WEA grant is a cost reimbursement award for future expenditures related to construction of the company’s rare earth processing and separation demonstration plant to be located in Upton, Wyoming. The plant is also supported by the U.S. DOE through a previously announced $21.9 million financial award. The funding provided through the DOE and WEA programs is expected to cover more than half of the estimated project costs.

Ucore Rare Metals Inc. (OTCQX:UURAF) (Canada): Ucore Rare Metals is a Canadian company that intends to install RapidSX technology at its Alaska Strategic Metals Complex, a processing plant it plans in Ketchikan, a port town in Southeast Alaska. This facility, completed in 2024, would provide a domestic supply of rare earths.

China Dominates Complete Rare Earth Supply Chain

As I stated before, China has come to control 67% of mining, 91% of refining activity, 87% of oxide separation and 94% of magnet production, according to the U.S. Dept of Energy, as shown in Chart 2.

DOE

Chart 2

China, the world’s top processor of rare earths, banned the export of technology to make rare earth magnets in December 2023, adding it to a ban already in place on technology to extract and separate the critical materials.

China’s commerce ministry sought public opinion last December on the potential move to add the technology to prepare smarium-cobalt magnets, neodymium-iron-boron magnets and cerium magnets to its “Catalogue of Technologies Prohibited and Restricted from Export.”

Why is this important? From the magnets in Apple’s iPhones to the components in Tesla’s Model 3 electric vehicles, and even the advanced systems in Lockheed Martin’s F-35 fighter jets, the demand for refined rare earth elements is extensive.

This bottleneck in turning raw rare earth minerals into refined products underscores a critical vulnerability in the supply chain that impacts a wide array of industries across the global economy.

Introduced by Rep. Obernolte, Jay [R-CA-23] on 03/22/2024, Intergovernmental Critical Minerals Task Force Act found that:

- Current supply chains of critical minerals pose a great risk to the national security of the United States;

- Critical minerals are necessary for transportation, technology, renewable energy, military equipment and machinery, and other relevant sectors crucial for the homeland and national security of the United States;

- In 2022, the United States was 100% import reliant for 12 out of 50 critical minerals and more than 50% import reliant for an additional 31 critical mineral commodities classified as “critical” by the United States Geological Survey, and the People’s Republic of China was the top producing nation for 30 of those 50 critical minerals;

- As of July 2023, companies based in the People’s Republic of China that extract critical minerals around the world have received hundreds of charges of human rights violations; and

- On March 26, 2014, the World Trade Organization ruled that the export restraints by the People’s Republic of China on rare earth metals violated obligations under the protocol of accession to the World Trade Organization, which harmed manufacturers and workers in the United States.

Government Programs

Various governments outside China are a catalyst for reshoring of the rare earth industry through programs, involving government handouts, as shown in Table 1:

The Information Network

NdPr Magnet Demand Outpacing Supply

Neodymium (Nd) and Praseodymium (Pr), collectively known as NdPr, are critical rare earth elements primarily used in the production of permanent magnets, essential for a variety of technologies including electric vehicles (EVs), wind turbines, and high-performance electronics.

Demand for NdPr is surging, fueled by the electric vehicle industry, where these elements are vital for efficient, high-performance motors, and by the renewable energy sector, particularly in wind turbine generators. Additionally, NdPr is crucial in consumer electronics and advanced defense systems, where their magnetic properties are indispensable. Chart 3 shows the forecast for NdPr supply and demand, according to The Information Network’s report Rare Earths Elements in High-Tech Industries: Market Analysis and Forecasts Amid China’s Trade Embargo.

The NdPr market faces challenges such as supply risk due to geopolitical tensions and price volatility, which can impact project viability. Nevertheless, the market is on a growth trajectory, driven by the clean energy and tech sectors. This underscores the importance of strategic investments in supply chain diversification, technological advancements, and enhanced recycling techniques to secure a sustainable future for NdPr.

Near term I forecast a slowdown in EVs, which will impact rare earth magnets. I discussed this slowdown in an April 3, 2024 Seeking Alpha article entitled ON Facing Headwinds From A Slowing U.S. EV Market Amid Strong SiC Wafer Competition In China.

The Information Network

Chart 3

Green Technology applications (EVs, Wind Turbines) dominate the demand for REE Magnets, as shown in Chart 4, according to The Information Network’s report. These are extensively used in electric motors and generators found in numerous applications such as hybrid and electric vehicles, wind turbines, industrial machinery, and robotics. Their high magnetic strength and energy density enable efficient and compact designs.

The Information Network

Chart 4

Investor Takeaway

As of 2024, the status of rare earth materials outside China remains a critical concern for global supply chains.

The U.S. has intensified its efforts to revive and expand its rare earth capabilities primarily through the Mountain Pass mine in California, operated by MP Materials. This mine is one of the richest deposits of rare earths outside China. The U.S. Department of Defense has also funded projects to restart heavy rare earth production and improve separation capabilities to reduce reliance on Chinese imports.

Chart 5 shows for the 3-year period, Total Revenues are only positive for LYSCF and MP, but for both of these companies revenues peaked at the end of 2022 and have been dropping since.

YCharts

Chart 5

Chart 6 shows Neodymium Price. Although amplitude may be different between Nd and NdPr, the peak in price corresponds to the peak in revenues for LYSCF and MP. I contend that the reason for the increased revenues of these companies was a direct correlation with selling products at the increased price.

Trading Economics

Chart 6

In addition to a slowdown in EVs, particularly in the U.S. due to a poor infrastructure and higher prices of EVs, companies are attempting to reduce and eliminate the amount of REE magnets in EV motors.

Several technologies are being explored and developed to replace or reduce the dependence on rare earth elements (REEs) in magnets, particularly those containing neodymium (Nd) and dysprosium (Dy), which are crucial for high-performance applications. These alternatives are driven by the need to mitigate the risks associated with REE supply constraints and high prices. Here are some of the notable advancements:

- Nanocomposite Magnets: These magnets combine nanoscale particles of different magnetic materials to create a composite that exhibits strong magnetic properties without relying solely on rare earth elements. These can potentially offer a similar performance to rare earth magnets but with lower REE content.

- Iron-Nitrogen Compounds: Research into iron-nitrogen compounds aims to utilize the abundant and cheap iron in place of scarce rare earth elements. One promising development is the creation of iron nitride magnets, which theoretically could have a higher magnetic force than current rare earth magnets. However, practical application and mass production have been challenging.

- Rare Earth-Free Samarium-Cobalt (SmCo) Alloys: While SmCo magnets traditionally contain rare earth elements, newer formulations are exploring reduced rare earth content while attempting to maintain high magnetic performance.

- Advanced Ferrite Magnets: Ferrite magnets, which do not use rare earth elements, have been enhanced through better processing techniques and new formulations, improving their magnetic strength to make them a viable alternative for certain applications traditionally dominated by rare earth magnets.

- Manganese Bismuth (MnBi) Magnets: MnBi magnets are gaining interest due to their favorable magnetic properties and thermal stability. While not yet a direct substitute for high-performance applications, ongoing research is improving their performance metrics.

In addition, there are Recycling and Recovery programs. Technological improvements in the recycling of rare earth elements from electronic waste and end-of-life products are also contributing to reducing the need for newly mined rare earths, albeit this is more about sustainability than replacing the technology.

I rate Lynas a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here