We have written a lot about Vonovia SE (VNA / OTCPK:VNNVF / OTCPK:VONOY) at High Yield Landlord over the past months, and it is simple to explain.

Its share price just keeps dipping lower and lower!

I have bought so much of it that it has become my largest investment in Europe.

Vonovia is the largest landlord in Europe, owning 500,000+ apartment units, mainly in Germany, it has a strong BBB+ rated balance sheet, a great track record, steady rent growth prospects, and a management team that keeps buying more shares…

…and despite that, its share price continues to dip lower month after month.

Google Finance

The latest net asset value per share of the company is €57 per share, but the shares are priced at just €17, representing a huge 70% discount.

Such steep discounts are unusual for low-quality, small REITs, and they are even more unusual for blue-chip, large-cap investment-grade rated REITs like VNA. Comparable blue-chip REITs (VNQ) typically trade much closer to their NAV… To give you a few examples:

- Mid-America Apartment Communities (MAA)

- Public Storage (PSA)

- Equinix (EQIX)

- American Tower (AMT)

- American Homes 4 Rent (AMH)

… all trade within a 20% range of their NAVs. Not a 70% discount!

Apartment community owned by Vonovia:

Vonovia

This would imply that Vonovia is facing severe challenges, but the company just released its full-year results for 2022, and here are the highlights:

- Funds from Operations (“FFO”) per share rose by 17.3% and reached €2.56 per share.

- The synergies from the DW merger were even greater than expected.

- The vacancy is at an all-time low with occupancy at 98%.

- The average in-place rent rose by 3.3%

- Loan to value is down slightly from 45.4% to 45.1%.

- S&P and Moody’s reaffirmed VNA’s BBB+ credit rating.

I think that anyone would objectively say that the company is doing quite well based on these results. It certainly wouldn’t justify the recent crash in its share price.

The outlook for 2023 is also positive. Here’s what the management said:

“Our business model is intact. We still expect to see stable development in terms of both earnings and value development.”

So what’s the market so worried about?

It is mainly the debt maturities. There are some other small things that are impacting market sentiment (we discuss those as well below), but the big thing is the debt.

Interest rates have surged like rarely before and VNA has about $10 billion of debt maturities in the next 3 years alone.

The market fears that this will drive the company into significant difficulties, but here’s why we disagree:

- Strong balance sheet: The LTV is 45%, the debt is fixed-rate, and maturities are long and well-staggered with a 7.4-year average term. Therefore, VNA only has to deal with a limited amount of debt maturities each year. This balance sheet is strong when you consider the quality of the assets and the reliability of the cash flow and this is why the company has a strong BBB+ investment-grade balance sheet. The market is pricing VNA for failure, but the likelihood of a BBB+-rated company failing is extremely small. The credit rating was just recently reaffirmed.

- Stable property values: Valuations are stable in Germany, despite the surge in interest rates. The management just said that “there is no room for doubt: the impact is limited… It is important to understand that the German real estate market cannot be compared with the Anglo-Saxon markets. The real estate market in Germany is very stable.” This is due to numerous reasons: (1) rents are growing and the growth is even accelerating due to how they are regulated in Germany. A recession wouldn’t change that. The regulation makes German apartment communities a hybrid between real estate and inflation-protected bonds. (2) Valuations are already deeply below the replacement cost of the assets and we need more, not less housing. There is a severe undersupply of housing with an all-time low vacancy of 2% for VNA, and there is a lot of speculation that the government will eventually need to step in to provide additional incentives for landlords or allow rents to rise to market levels to get more housing. Landlords are long-term oriented and they know that a small change in policy could lead to an immediate surge in returns. (3) There are stringent lending standards, loans have long terms, and interest rates are fixed. (4) There are important tax advantages to holding property for longer. (5) The transaction costs are also particularly high with some states taking up to a 5% transfer tax when buying/selling a property. (6) German people, in general, have a clear affinity for real estate and a distrust for the stock market. This leads to lots of demand for real estate, even from buyers who aren’t using any debt. (7) Many institutions like insurance companies need to buy real estate due to regulations to meet their liability obligations. They need safe, inflation-protected cash flow, which is precisely what these assets are providing. Bond interest rates are up, but not nearly enough when you consider how high inflation has gotten. These overall conditions create an environment in which landlords tend not to sell their properties in the short term. Property values did not move much in 2022 and the management just noted that there is no doubt that valuations will remain more or less stable in the future.

- Ability to monetize assets: There is still demand for VNA’s assets in the private markets and VNA plans to sell some properties or equity interests to pay off maturities. There is still demand in Germany because many real estate investors such as insurance companies don’t use any or very little debt and so they aren’t as impacted by the recent surge in interest rates. Moreover, they understand the points that we made above about asset values. There are also lots of municipalities that want to buy and hold some properties and they are not as price/interest rate sensitive as private investment firms. Finally, VNA is also able to divide properties into condos and resell them individually with a 40-50% value uplift. In the fourth quarter of all year, VNA reduced the step up closer to 30% to move more product and it led to a doubling of condo sales when compared to the fourth quarter of 2021. Today, its portfolio is valued at €2,590 per square meter, which compares very favorably to the ~€3,600 price of existing (not new) condos in its markets. This provides significant margin of safety as it keeps selling assets. It could very significantly lower prices to sell more condos and it still wouldn’t have a major impact on its NAV per share.

- FCF surpasses debt maturities: Vonovia recently readjusted its dividend to retain a lot more cash flow. This combined with its asset dispositions should lead to ~€4 billion of free cash flow in 2023. On top of that, they have €1.3 billion of cash on hand. But it only has €3.4 billion of debt maturities in 2023 and another €3.1 billion in 2024. VNA’s plan is to pay off its unsecured debt maturities, which amount to €2.2 billion in 2023 and it will just refinance the secured debt maturity of €1.2 billion. This means that it expects to have nearly 2x more FCF than what it plans to pay off. This leaves significant margin of safety as it deleverages its balance sheet. It also means that it expects to only refinance ~$1 billion of debt annually in 2023 and 2024, which amounts to just ~1% of its balance sheet each year. Therefore, even if it has to pay a much higher interest rate, the impact won’t be significant. It will be less than the impact of rent increases, which affect 100% of the portfolio. This explains why VNA expects to have only slightly lower cash flow in 2023, despite selling some assets and refinancing some debt at a higher rate. The impact is not nearly as material as what the market is pricing into the stock.

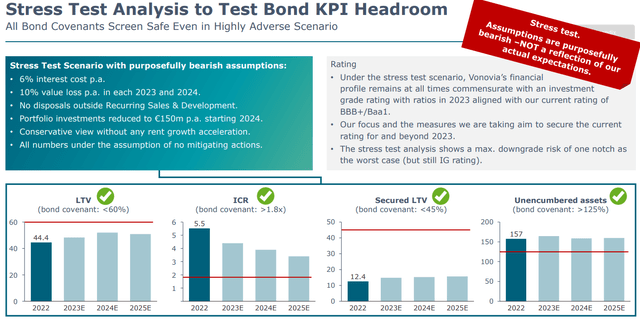

- Stress test: Finally, even if you have much more bearish assumptions, VNA should still be fine. At most, it would expect to be downgraded by just one notch to BBB, still a strong credit rating, and that’s under very negative assumptions that are unrealistic. Here is VNA’s analysis:

Vonovia

So this is why we continue to believe that VNA should be just fine.

Of course, there is an impact and VNA’s cash flow and NAV per share are likely to drop a bit more in the coming years as it sells assets and refinances a portion of its debt at higher rates. But there are important mitigating factors like the steady 3-4% annual growth in rents, and the selling of apartment communities with a value-uplift, and they are also growing their services business, providing property management services to other investors, monetizing the value of their immense platform.

Yet, the company is priced at less than a third of its NAV…

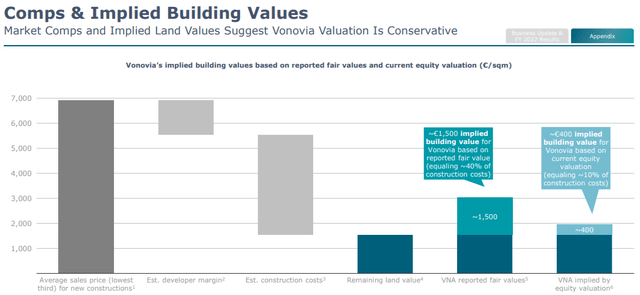

… And the NAV itself represents a huge discount to replacement costs and transactions for comparable assets.

Vonovia

So there is plenty of margin of safety built-in, even if the NAV and cash flow drop quite a bit. The NAV could drop by 30%, and there would still be over 100% upside to it from today’s share price…

…and let me remind you that this is a blue-chip company that has historically traded on average at a 10% premium to its NAV during most times.

What are other factors hurting the market sentiment?

Two smaller things:

#1 – Negative press:

A bribery scandal came out about a month ago. It led to a lot of negative press, but most investors appear to have overlooked that the allegations are not against VNA. The allegations are against a few employees who seem to have accepted some bribes to VNA’s detriment.

So VNA is the victim here. It is investigating the case and cooperating with legal authorities to get back what was taken from it.

In the grand scheme of things, this is not material as it impacts less than 1% of the maintenance and investment volumes in 2022.

However, it still led to a lot of negative press and confusion, which is never good for the stock over the short run. Fortunately, this should be quickly forgotten.

#2 – The dividend

A lot of VNA shareholders, including ourselves, have been asking for a dividend cut because it would allow the company to deleverage at a faster pace, reducing risks, all while increasing the long-term return potential as it would buy back more shares and increase the tax-efficiency of the investment (withholding taxes are high in Germany).

The management listened to these requests and temporarily reduces the dividend to just around a third of its cash flow. Here is what they said:

“Vonovia’s business model is intact. We are expecting to see robust developments on the earnings side. However, we need to find the right balance between two different expectations among our shareholders. One group of shareholders would like to see continuity in their dividends, while others are calling for special capital discipline. Both are equally important. It is the prerogative of our shareholders to decide on the dividend, and so we are convinced that our proposal is reasonable.”

They added that this is only temporary and that they will return to their policy of paying out approx. 70% of their FFO in the form of dividends in the future.

This is great news in my opinion, but it is leading to some selling in the near term as dividend-focused investors and ETFs/Funds sell the stock.

VNA’s CEO, Rolf Buch, shared a video discussing all of this on their website. You can watch it by clicking here.

Vonovia

The Long-Term Outlook Is Positive

VNA feels some pressure in today’s challenging environment, but not nearly as much as the market is pricing. I think that there is significant value and upside even if this environment persists for a long time to come because ultimately, we are paying a steep discount to replacement costs for essential housing infrastructure that’s enjoying growing cash flow.

But challenging times won’t last forever.

Eventually, the war in Ukraine will come to an end as Russia has already exhausted a huge portion of its military capabilities and isn’t making any major progress.

Eventually, inflation will also likely get back under control and interest rates will also return to lower levels as central banks switch to stimulating the economy.

I believe that this will ultimately lead to a significant repricing of VNA as the market sentiment adjusts to a more positive environment. This could lead to 100-200% upside from today’s extraordinarily low valuations, and a portion of these gains could be realized already earlier if and when VNA announces some major asset dispositions that allow it to pay off debt, mitigating the main concern of the market.

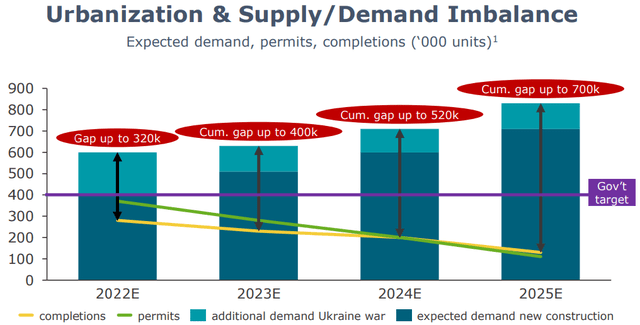

Besides, today’s difficult environment will also have some positive long-term implications for the company. The German market is already very severely undersupplied for housing, and things will only get worse due to the high inflation and high interest rates. There are virtually no new projects being started because it makes no financial sense, and yet, the government thinks that at minimum, we would need 400,000 new apartment completions annually. This is also happening right as the demand has surged from the large number of Ukrainian refugees arriving in Germany:

Vonovia

Again, unless something major changes, the demand/supply imbalance will get a lot worse than it already is and this will strengthen VNA’s fundamentals even further in the medium to long term. This should ultimately push the government to step in and offer extra incentives to landlords and/or loosen its regulation on rents to get more supply. It has been speculated that this could take the form of special loans with exceptionally low interest rates for landlords who accept to develop new properties.

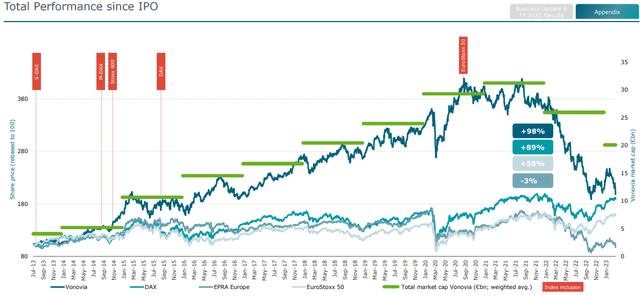

Finally, VNA has a fantastic track record of growing via M&A. They have repetitively acquired smaller peers at valuations that were very accretive to FFO and NAV per share and this is one of the main reasons behind VNA’s long-term outperformance:

Vonovia

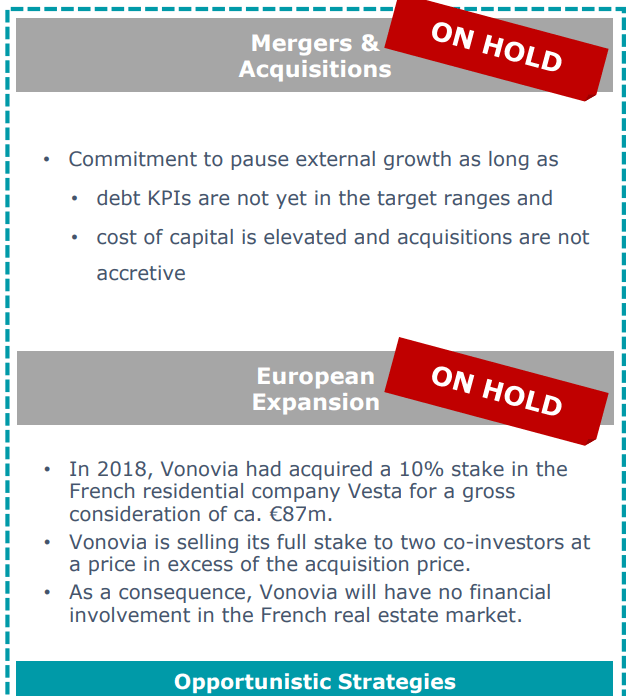

The M&A activity is on pause today, but it will eventually resume. VNA is still barely starting to expand into other European countries and it has a great opportunity here because cap rates are a lot higher in most other European countries, and many of its large European peers are facing greater financial challenges than VNA.

If VNA can regain the right cost of capital with its equity returning to near its NAV, it will be able to issue equity at a low cost to acquire peers at much higher cap rates in France and elsewhere.

Vonovia

So in short, we remain more bullish than ever, despite the continued decline in VNA’s share price, and so we continue to accumulate more shares.

It is rare to get to buy good real estate that’s well-managed in a cost-efficient way, with growing rents, and with reasonable leverage at less than 30 cents on the dollar.

The management agrees, as they have been buying millions worth of Vonovia SE shares with their own personal money.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here