In my last article about Palantir Technologies Inc. (NYSE:PLTR), published before Q1 earnings on May 5th, I argued how the company represented an asymmetric bet on its Artificial Intelligence Platform (“AIP”). In this follow-up, I examine the details of the latest earnings and go over some new elements that I see as catalysts for Q2 – namely the Oracle partnership (not reflected in Q1 earnings yet, in my opinion) and the launch of Mixed-Reality OSDK.

All figures discussed in this article are taken from Palantir’s Q1 shareholders presentation and report, available on Palantir’s website.

Thesis: Palantir has shown excellent US commercial growth, the AIP asymmetric bet still holds

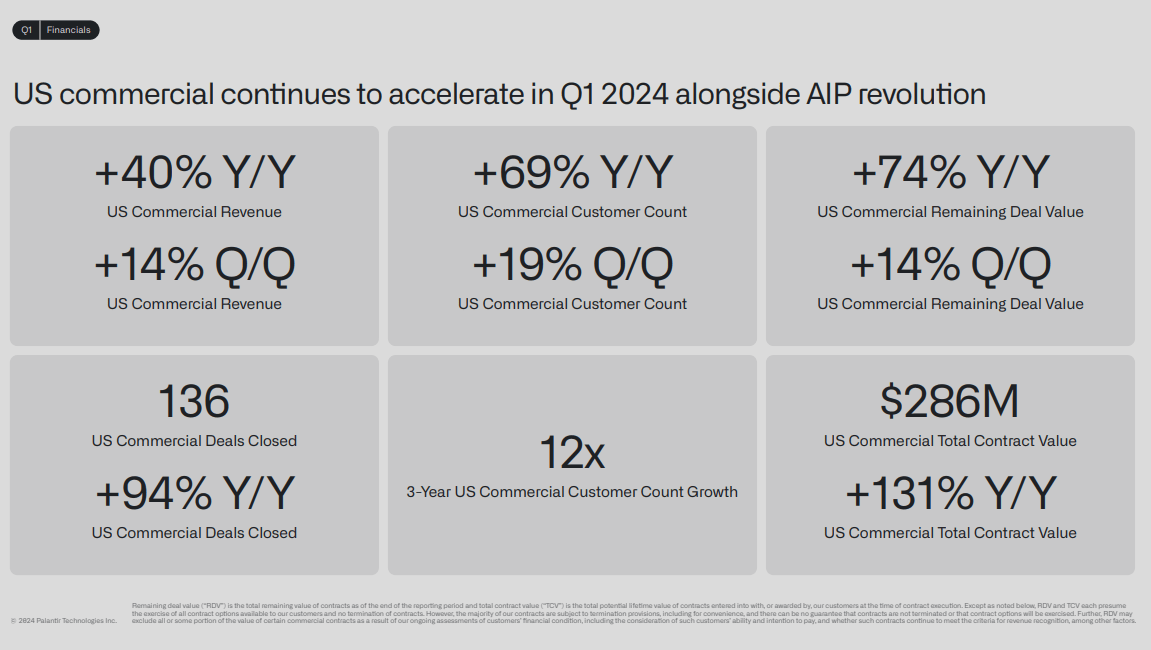

Palantir reported a +131% growth in US Commercial Total Contract Value (TCV) in Q1 2024, an improvement from +107% year-over-year growth in Q4 2023. TCV is the most critical metric, in my view because it serves as the best gauge for AIP’s scalability. This figure indicates the company is successful in scaling its AIP business by finding new customers and upselling existing ones.

The market reacted negatively to Q1 earnings due to a slowdown in US commercial revenue growth, which was 40% year-over-year compared to 70% in Q4. I believe this figure is less meaningful than TCV, as revenue is only recorded when customers pay Palantir. Payments can take months or even years, especially within the context of complex, multi-year B2B contracts. Additionally, Q1 is typically the slowest quarter of the year for most companies.

After Q1 results and additional catalysts (Oracle partnership and Mixed-Reality OSDK), to be covered in this article, I believe Palantir continues to be an asymmetric bet on AIP. However, I believe the market will find it challenging to value Palantir for the foreseeable future, or at the very least until the next earnings release.

Q1 Earnings deep dive: avoid the noise, TCV is growing ahead of Q4 figures

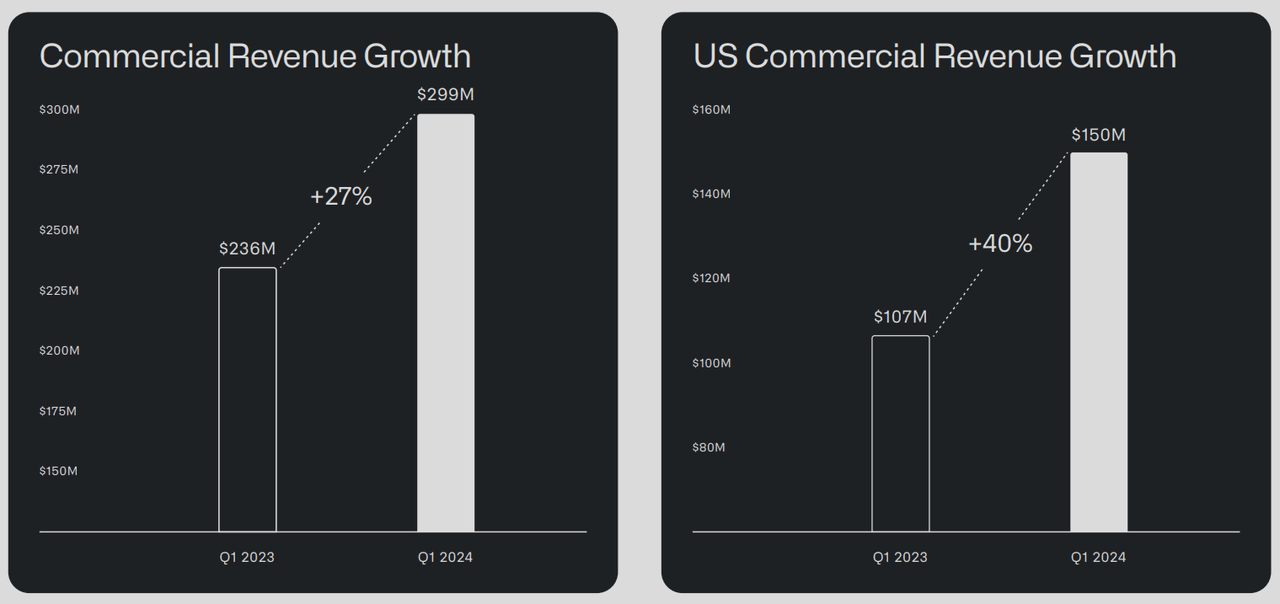

Palantir reported overall Q1 revenue growth of 21% year-over-year. Commercial Revenue grew at +27% year-over-year, and US commercial revenue grew at +40% year-over-year.

Palantir’s Commercial Revenue (Palantir’s Q1 earnings report)

These figures are hardly enough to justify Palantir’s current valuation as a high-growth Tech stock. However, I believe focusing on these company metrics is misleading in the context of an asymmetric bet on AIP.

Palantir’s AIP is a scalable platform that, in my opinion, resembles a Software-as-a-Service business. The company is prioritizing the expansion of AIP with commercial customers in the USA. This strategy makes sense because if AIP proves scalable in the U.S., the same model can be replicated in global markets.

Another way to think about this strategy is that AIP is essentially being “tested” for scalability with U.S. commercial customers, with less emphasis on other regions.

I believe the two key metrics that are proxies of AIP growth and scalability are:

-

US Commercial Total Contract Value (TCV), defined by Palantir as the “total potential lifetime value of contracts entered into with, or awarded by, our customers at the time of contract execution“.

-

US Commercial Remaining Deal Value (RDV), defined by Palantir as the “total remaining value of contracts as of the end of the reporting period“.

These two metrics show how AIP is performing with U.S. commercial customers and whether it’s proving to be a scalable platform. Both metrics are performing exceptionally well, with TCV growing +131% year-on-year and RDV increasing +74% year-on-year. This represents an acceleration from Q4 2023, when U.S. Commercial TCV was growing at +107% year-on-year.

Palantir’s commercial revenue, TCV and RDV (Palantir’s Q1 earnings report)

Is Palantir managing to scale AIP? Yes, it is.

I want to be clear, so as not to be accused of cherry-picking data; Palantir has a strong government business, which I see as a strategic advantage. Many of their legacy platforms also sell to commercial customers, so the company is not only about AIP.

However, my thesis (and Palantir’s valuation) relies on the growth of AIP, and Palantir maturing into a SaaS-like business as a result. In this context, what matters to understand whether the bet will pay off is the growth of AIP, not the rest of the business.

The critical question is whether Palantir is successfully scaling its AIP business. It appears the company is using US commercial customers to test the scalability of AIP. With a +131% growth in US commercial TCV, the answer seems to be a resounding YES.

If Palantir continues to demonstrate this level of growth (effectively more than doubling its business each year), I believe the asymmetric bet on AIP will likely pay off.

In evaluating Palantir’s AIP bet, all other financial metrics for Q1 are significantly less relevant in my view. Even considering US Commercial Revenue, which grew a respectable +40% year-on-year in Q1, can be misleading. Commercial revenues are only recorded after Palantir receives payment for invoices. In the realm of highly sophisticated software solutions, it can take time for the company to register that revenue and contracts can be signed for long periods of time. What’s truly important for assessing AIP’s scalability is whether the platform is successfully closing contracts with new prospects and existing customers. It is.

About Palantir’s “reduced” market guidance

Palantir increased forward market guidance for the remainder of 2024 during its Q1 earnings. However, its increased guidance fell short of analysts’ expectations.

I think the market is acting irrationally by placing too much emphasis on forward guidance, which is clearly affected by macroeconomic factors, as well as Palantir’s government business, which remains the company’s largest source of revenue.

For my thesis, the crucial factor is AIP and its growth. AIP was launched just 9 months ago, and it’s already impressive that it has managed to achieve over 100% growth in the US commercial business for two consecutive quarters. Given this context, I don’t believe that the reduced market guidance for 2024 is a major concern.

New catalysts for Q2

With the market so narrowly focused on a few financial metrics, it is easy to lose sight of the bigger picture for Palantir. I believe there are several significant catalysts that will drive this stock, and I will cover them in the next paragraphs. The picture that will emerge is that of a company that has a significant edge on AI in the B2B space and is proving excellence in commercial execution.

Oracle partnership and Q1 as a historically slow quarter

Oracle and Palantir revealed a collaboration designed to deliver secure cloud and AI solutions that will support businesses and governments globally.

This partnership was announced in early April 2024, before Q1 earnings. I think it is naive to assume that significant business results from this partnership could have already been registered in Q1. As much as Palantir can be focused on scaling its business, we are talking about less than 20 business days since the day the partnership was announced and Q1 closed.

I do expect this partnership to represent a potential catalyst going forward, with Palantir gaining access to Oracle’s existing customer base to propose its AIP solutions. I believe it will be reflected in Q2 results.

Another point to consider is that historically, Q1 is often the weakest quarter of the year for many businesses. The following quarters are likely to experience an acceleration in business activity, serving as an additional catalyst for growth.

Launch of Mixed-Reality OSDK, “Platform as a Service”

Palantir continues its focus on the defense industry and governmental business. The company reported 12% year-over-year growth in its US government revenue and 16% year-over-year in its overall government revenue for Q1.

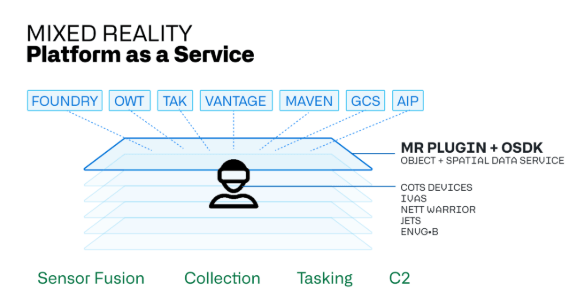

I see Palantir’s governmental business not only as a legacy revenue stream, but as a competitive advantage of this company. Palantir can develop state-of-the-art technology with its governmental business and then scale and extend it to private companies. An example of this capability is the launch of Mixed-Reality ODSK, something that was announced after the Q1 earnings release. In a nutshell, this is a mixed-reality gateway to data visualization that integrates into existing enterprise architectures. The below visualization, taken from Palantir’s product sheet, further explains the concept.

Palantir’s Mixed Reality OSDK presentation (Palantir’s product sheet)

Palantir is calling this solution “Platform as a Service“, indicating that this might eventually become a scalable solution that can make all of Palantir’s products available to customers in a mixed reality environment.

I believe this is a great example of the kind of innovation that can come up from Palantir’s government business and further accelerate the scalability of the overall business model for the company.

The market is behaving erratically, but my target is 5X from here

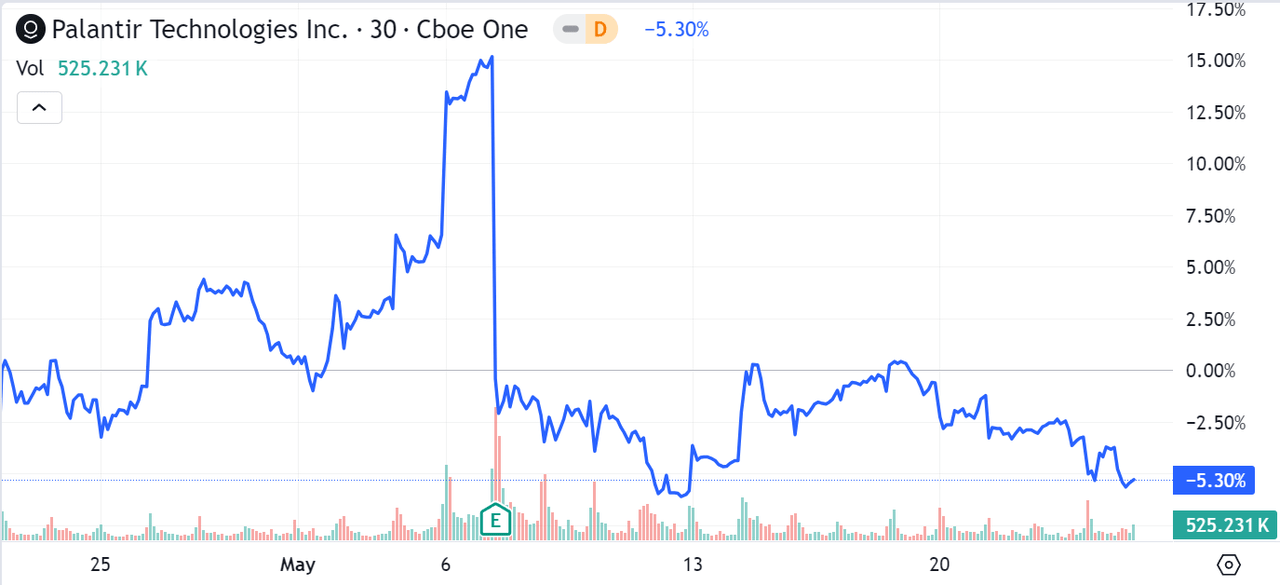

Mr. Market is famously irrational in the short term. I believe the behavior of Palantir’s stock before and after the Q1 earnings is a prime example of this short-term volatility and erratic market actions.

Palantir’s stock rallied more than 10% in the days immediately before the Q1 earnings release. In my opinion, this was based purely on speculation, given that no new information was released on this company in this time frame. Clearly, Mr. Market was expecting Palantir to deliver an outstanding quarter, beating all expectations.

Palantir’s stock performance, last 30 days (Seeking Alpha)

Palantir did deliver a good quarter in my opinion. However, the company still was subject to a selloff of the stock of about 16% at the time of writing. As a result, we are back to where we were before earnings.

I believe Q1 earnings validate my thesis that Palantir could become the Salesforce of AI, with at least a 5X upside from current prices

The market, in my view, has overreacted to some of the data that was reported in Q1. However, after deep diving into the financials, I believe that Palantir is managing to scale its AIP business in the US. That’s what really matters to gauge the scalability of the entire business model.

If Palantir keeps succeeding in scaling AIP, I see a notable similarity with Salesforce’s SaaS offerings. That’s why my target is for Palantir to eventually match Salesforce’s valuation. If Palantir reaches Salesforce’s current market cap of around $260 billion, shareholders could see a 5x return from current levels.

To reach a valuation like Salesforce’s, trading at a 28 P/E ratio, Palantir would need to increase revenue 14 times from revenue reported as of Q1 and increase profitability by around 40%.

Assuming Palantir continues to grow at the 40% rate it reported in Q1 for its US commercial business, it would take about seven years to reach Salesforce’s scale.

However, I believe this will happen sooner. Palantir’s Total Contract Value (TCV) is growing at over 100% year-over-year, and there are upcoming catalysts that, I think, will accelerate this growth even more. My personal target for PLTR is $100 by 2028.

Risks: this stock is not for the faint of heart

I believe Q1 results have demonstrated that AIP is a scalable product. However, Mr. Market may have been overly optimistic, expecting this scalability to be immediately evident in the company’s overall results. It appears we’ll have to wait for this impact, and I anticipate continued volatility in Palantir’s stock for the foreseeable future.

If you only invest in stocks with a good valuation or have a deep value approach to investing, Palantir is simply not for you. Purely from a rational standpoint, a stock valued at more than 60 P/E posting 21% revenue growth and barely any EPS growth year-on-year does not make sense.

The reason why the stock enjoys its current valuation has only to do with AIP and the bet that this stock could become the Salesforce of AI. It could take many quarters, or years, for Palantir’s results to reflect the growth expected by the market.

Palantir’s stock will therefore remain volatile, and of course, it still represents an asymmetric bet. This means that the bet can still not pay off, and you could lose your capital, even if I believe that Q1 earnings show the opposite trend.

Another risk related to Palantir represents its historical tendency for stock dilution. This is a point that I have mentioned in my previous article and remains valid.

Conclusion

Palantir’s Q1 results have shown, in my opinion, that AIP is a scalable product. However, the market was expecting the impact of AIP’s performance to be immediately visible in Palantir’s overall results, which hasn’t yet occurred.

Given that AIP was launched only about 9 months ago, I believe this expectation from the market was unreasonable. There are also many catalysts for Q2, including the partnership with Oracle and Palantir’s ever-growing government business, which can fuel innovation and help with scalability.

I remain bullish on Palantir, and it continues to be the third-largest single stock holding in my portfolio. Palantir is not suited for those averse to risk or investors focused on short-term gains who might be uncomfortable with volatility.

For investors willing to make an asymmetric bet, I recommend buying Palantir at its current price. My long-term outlook for Palantir, assuming the success of AIP continues, still targets a 5X return from current levels, aiming to match Salesforce’s valuation.

Read the full article here