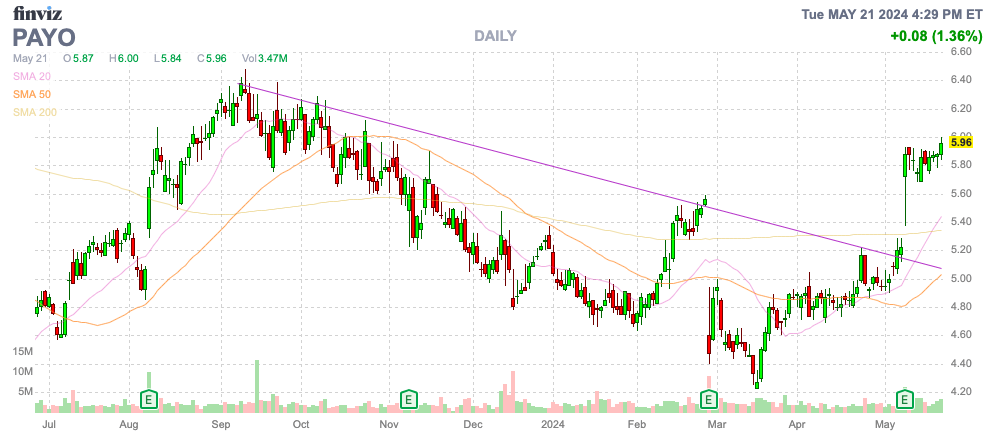

Payoneer Global Inc. (NASDAQ:PAYO) reported another quarter of strong growth, yet the stock continues to flutter below $6. The global payments company is starting to execute their business plan of focusing on key payments customers, and B2B payments volumes are soaring. My investment thesis remains ultra-bullish on the cheap stock trading at a major bargain to the growth rates.

Source: Finviz

Another Big Quarter Ignored

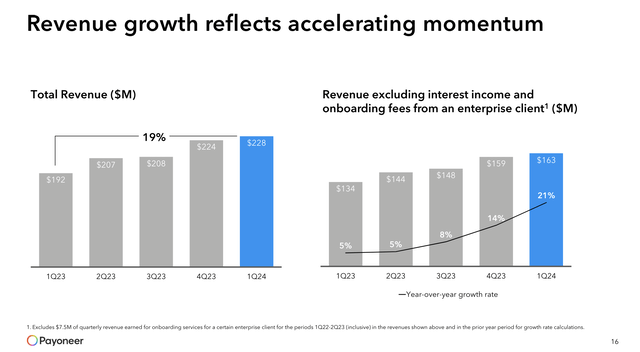

The global payments company reported a strong Q1 ’24, easily smashing consensus estimates as follows:

- Q1 GAAP EPS of $0.08 beats by $0.03.

- Revenue of $228.2 million (+18.8% YoY) beats by $17.0 million.

The key to the Payoneer growth story for 2024 was an expected hit to interest income to obscure ongoing momentum in the main payments business. The fintech grew Q1 ’24 revenues by 19% to reach $228 million, but the key ex-interest income revenue surged 21% to reach $163 million.

Source: Payoneer Global Q1’24 presentation

The global payments company has produced accelerating revenue growth by focusing on key ICP (ideal customer profiles) customers, boosting ARPU and expanding services via new payment products. The biggest boost has come from the global cross-border SMB market with 33% payments volume growth.

Payoneer generated $65 million in interest income during Q1, with customer funds growing 8% to $5.9 billion and the Fed not cutting interest rates. In essence, the negative interest income story isn’t even playing out, while the stock dipped to $5 based on fears of slower reported revenue growth ahead.

Payoneer produced an adjusted EBITDA of $65.2 million for a strong margin of 29.5%. The stock only has a market cap of $2.3 billion, while the fintech has grown quarterly revenues from $100 million when going public back in 2021 to revenues of $228 million now.

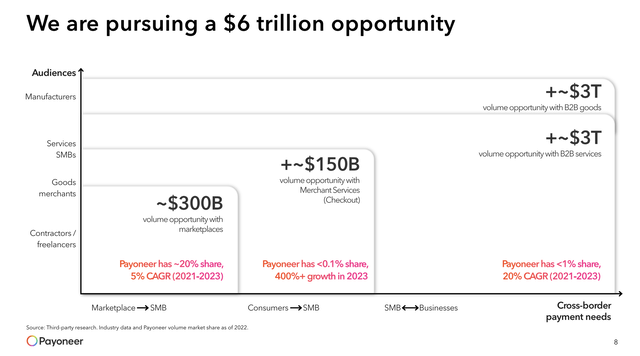

The company helps SMBs wanting to grow globally across complex borders in emerging markets. Payoneer helps these customers gain access to capital, get paid and pay bills.

Market research suggests that 80 million underserved SMBs exist around the globe, and Payoneer has recently decided to focus on key ICPs. The global payments opportunity is over $6 trillion with Payoneer currently garnering ~20% of the $300 billion contractor/freelance market and quickly moving into the $3+ trillion opportunity in B2B services where their market share is <1% with 20% CAGR.

Source: Payoneer Global Q1’24 presentation

Big Guidance

The company guided to 2024 revenues of $900 million with adjusted EBITDA at $205 million. The stock only has a market cap of $2.3 billion with a cash balance of $587 after repurchasing $51 million worth of shares during the last quarter at an average price of only $4.84.

The diluted share count actually dipped by nearly 10 million shares YoY to 379 million due to the share buyback in Q1. Payoneer lists a total of nearly 22 million shares repurchased since the start of the buyback, leaving 359 million outstanding common shares and another 20 million assigned to the dilutive impact of stock options, RSUs and private warrants.

The stock only trades at ~8x EV/EBITDA targets for 2024 due to the EV dipping to only $1.7 billion on the large cash balance. The consensus estimates only have revenues growing at around a 9% clip over the next 2 years due to some impacts from interest rates cutting interest income.

The guidance for 2024 revenues of ~$900 million, assumes $240 million in interest income. Payoneer earned interest income at an annualized rate of $260 million during Q1 with customer funds rising 8% YoY, suggesting a $7 million quarterly interest income headwind despite a lack of U.S. rate cuts as of May.

Payoneer likely has solid revenue upside with the potential for quarterly interest income to rise to $70 million this year on customer funds growth, while guidance suggests the quarterly average dips to $58 million. The company has long surpassed financial forecasts, and the current 2024 numbers allow for plenty of upsides in just interest income alone.

Takeaway

The key investor takeaway is that Payoneer Global Inc. constantly provides conservative guidance. The stock only trades at 8x EV/EBITDA targets and the stock market hasn’t paid a higher price for Payoneer in over 18 months now, but the stock appears set for a breakout above $6.

Investors should use the weakness to continue loading up on the global payments stock with ultimate targets for 15% to 20% growth rates, while Payoneer trades like a slow-growing, value stock priced for disaster.

Read the full article here