Before the merger, our readers knew we were covering WestRock with a buy rating target and that Smurfit Kappa was one of our top picks. The combined entity just reported its first quarter together. That said, due to the timing of the completion of the combination between the two companies, the combined company of Smurfit WestRock (NYSE:SW, OTCPK:SMFKY) (OTCPK:SMFTF) will start reporting combined financials from Q3 2024. This is now a global leader in sustainable packaging (Fig 1).

Smurfit WestRock Combined Entity

Source: Smurfit WestRock Q2 results presentation – Fig 1

Latest Earnings

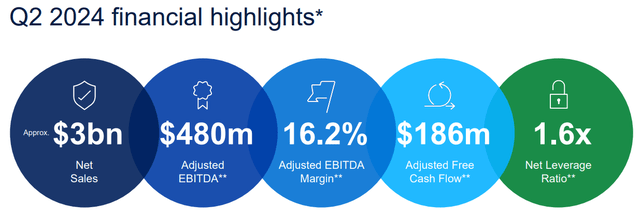

It is essential to report the latest numbers, but we have limited information. Indeed, the company reported the legacy numbers of Smurfit Kappa and only the Q2 WestRock EBITDA. No further WestRock detail was provided. Going to the number, WestRock’s EBITDA reached $669 million in the Q2 and was above 8% on a sequentially quarterly basis. This performance was below consensus, which estimated an EBITDA of $730 million before the de-listing. Related to Smurfit Kappa, the company’s turnover decreased by $107 million to $2.96 billion in Q2 2024. This result was mainly driven by lower EU average box prices and slightly offset by an increase in corrugated volumes. Going down to the P&L assessment, the EBITDA reached $480 million with an adj. margin of 16.2% (Fig 2). Smurfit Kappa EBITDA was more resilient than it was last quarter. Still, compared to the previous year, there was a decrease of $143 million, mainly due to wage inflation, higher distribution, and recovered fiber costs. On a positive note, the company’s interest expense decreased by $4 million, primarily due to reduced net cash interest costs.

Smurfit Kappa Standalone Entity

Fig 2

Why are we positive?

- Encouragingly, the CEO Tony Smurfit said on the analyst call that he believes the paper industry is at the cycle’s trough. Therefore, there is a positive expectation of price improvements to drive margin expansion going forward. Reporting its keywords, we highlight the following, “Q2 results were also achieved against a backdrop of significantly higher recovered fiber costs and lower corrugated box prices. We expect these increased costs will be recovered through increased box pricing with the customary time lag.” Volumes returned to growth in Q4 2023, and containerboard producers are looking for price increases, which could positively impact Smurfit Kappa’s 2025 EBITDA. In our view, the paper cycle is at the early stages of a recovery, with current product prices still below through the cycle levels. Here at the Lab, we see some further upside to key product volumes and prices from here;

- Thanks to disclosed synergies, there is space for value-accretive investments. As a reminder, WestRock’s mills are aged and expensive. Therefore, there are mill investments to consider. WestRock’s legacy business sells ~50% of its long paper position in the export space. Our team believes that with business integration, these sales will be carried over from Smurfit mills with ROIC towards the north of 20%;

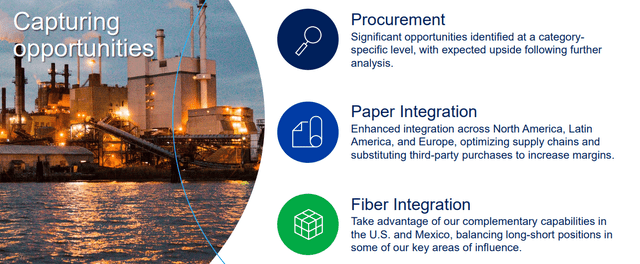

- Not all mergers are successful; however, the management team set cautious synergies’ guidance (disclosed synergies for a total amount of $400 million). And we believe there is an upside margin from here. In detail, the synergies identified are related to cost and not sales (Fig 3). Secondly, Smurfit Kappa has previous knowledge of some of the WestRock assets, and the management team has a solid track record in investing and integrating in Europe;

- More importantly, here at the Lab, we are at the bottom of the cycle, and the 7x EV/EBITDA acquisition price for WestRock assets was very attractive.

Upside Integration

Fig 3

Adjusting Estimates and Valuation

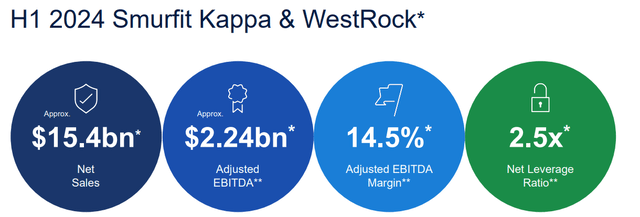

Smurfit WestRock’s 2024 CAPEX investment is still expected to be in the $2.2-2.5 billion range. This is divided by approximately $1 billion in the legacy Smurfit Kappa and $1.2-1.5 billion in the WestRock legacy business. Following the limited visibility of the H1 financials, we continue to forecast sales for $31.7 billion and an adj. EBITDA of $5.09 billion (Fig 4). It is too early to anticipate a 2025 forecast, but we initiate on Smurfit WestRock with an overweight recommendation. In our numbers, with the above technical guidance on CAPEX and a tax rate of 25%, the combined entity will reach a 2024 net income of approximately $1.5 billion. For this reason, we arrive at an EPS of $3.2. Smurfit WestRock is trading at a significant discount compared to peers. Before providing the peer’s P/E number, our investment call is based on the fact that we see significant scope to improve the business through 1) targeted mill improvement and 2) integration opportunities (beyond synergies).

Smurfit Westrock H1 combined

Fig 4

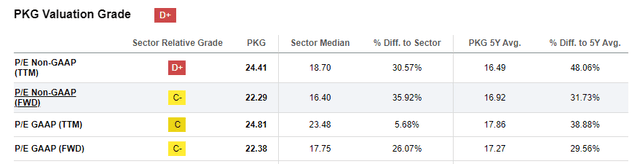

Despite this, the combined business trades at a P/E of 2024 of 14.2x. Without considering Packaging Corporation of America’s valuation (forward P/E of 22.29x), the paper sector trades at an average of 17x (Fig 5). This is an unwarranted discount to peers, and our team expects this valuation gap to close once the merger combination is better understood. Therefore, applying to Smurfit WestRock a P/E of 17x, we derived a target price of $54.4 per share with a 20% upside from the current stock price. Our target price will likely increase if we factor in the above-mentioned synergies. Therefore, there are upside risks in the current valuation.

Peers P/E table

Fig 5

Risks

Downside risks included in our target price are 1) combined deal synergies, 2) lower box demand, 3) volatile corrugated price with higher competition, 4) volatile raw materials costs, especially in the energy price, 5) paper capacity that might affect supply/demand balance, and 6) execution risks on the new integration with complexity in dealing in the North America region (Smurfit Kappa has an impressive M&A track record in the EU).

Conclusion

In our view, the paper cycle is in the early stages of a recovery, and there is a valuation gap compared to Smurfit WestRock’s peers. Even with low earnings visibility, the CEO analyst call reassures us. For this reason, we confirmed our buy rating status.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here