Introduction

It’s time to go back to 2022.

Back then, I wrote my most recent article covering the copper giant Southern Copper Corporation (NYSE:SCCO) in an article titled “I’m A Copper Bull, Here’s Why Southern Copper Could Double.”

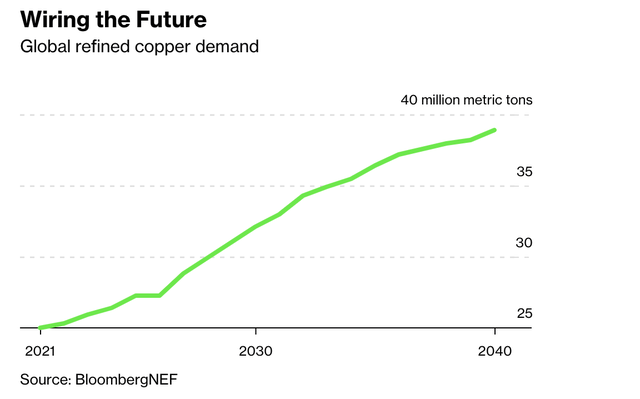

In that article, I discussed the strong secular tailwinds of copper, especially regarding its role in the energy transition, which could push annual copper demand to almost 40 million metric tons by 2040.

Bloomberg

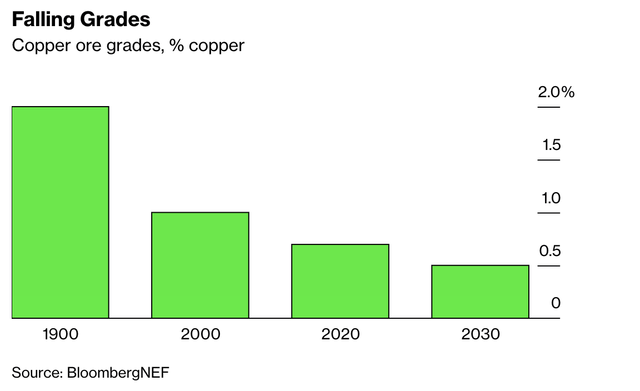

At the same time, the global copper supply is weakening, as shown by the steep decline in copper ore grades, which are expected to fall to 0.5% by 2030.

Bloomberg

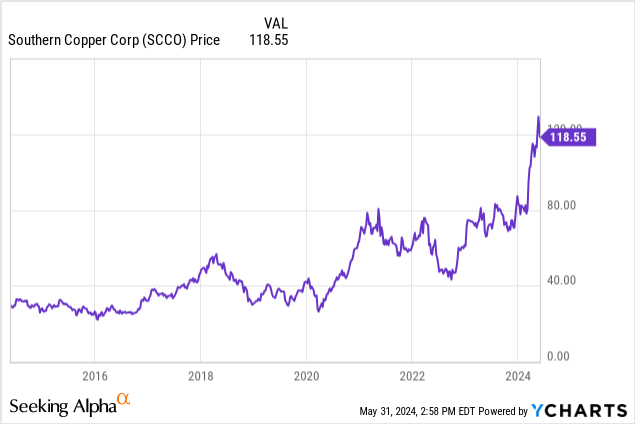

Since then, SCCO shares have risen by 162%, beating the impressive 37% surge of the S&P 500 (SP500) by a wide margin.

Even better, including dividends, the total return of New York-listed SCCO shares is 181%.

In this article, I’ll update my thesis using new developments, the company’s latest financials, and my view on the general risk/reward.

So, let’s get to it!

Copper Is Flying

In the second half of May, COMEX Copper Futures (HG1:COM) rose to $5.10 per pound, the highest copper price ever.

While prices have come down a bit since then, they are still at levels we have seen during the first two post-pandemic years.

TradingView (COMEX Copper)

As reported by The Wall Street Journal on May 20, copper is benefitting from a number of trends. I added emphasis to the quote below.

The price of the world’s favorite electricity conductor hit a fresh record Monday, on target for its seventh day in a row of gains. Big investors are clearly getting in on the action. Caxton Associates, a large macro hedge fund, pointed to a trio of mega trends that could have a lasting impact on demand for the electric metal, in a recent letter to investors.

Markets are just waking up to the long-term impact of artificial intelligence and nationalistic industrial policies, including defense spending, Caxton Chairman Andrew Law wrote. That is in addition to the already well-established trend of green-energy investment.

“A commonality across all three is the need for copper,” he said.

“The build-out of AI by companies and nation states will be akin to a modern-day arms race with competing, replicated investments across geographies,” Law added. – The Wall Street Journal

In other words, in addition to the green transition, the market is now expecting more tailwinds from artificial intelligence (infrastructure), defense spending, and economic re-shoring.

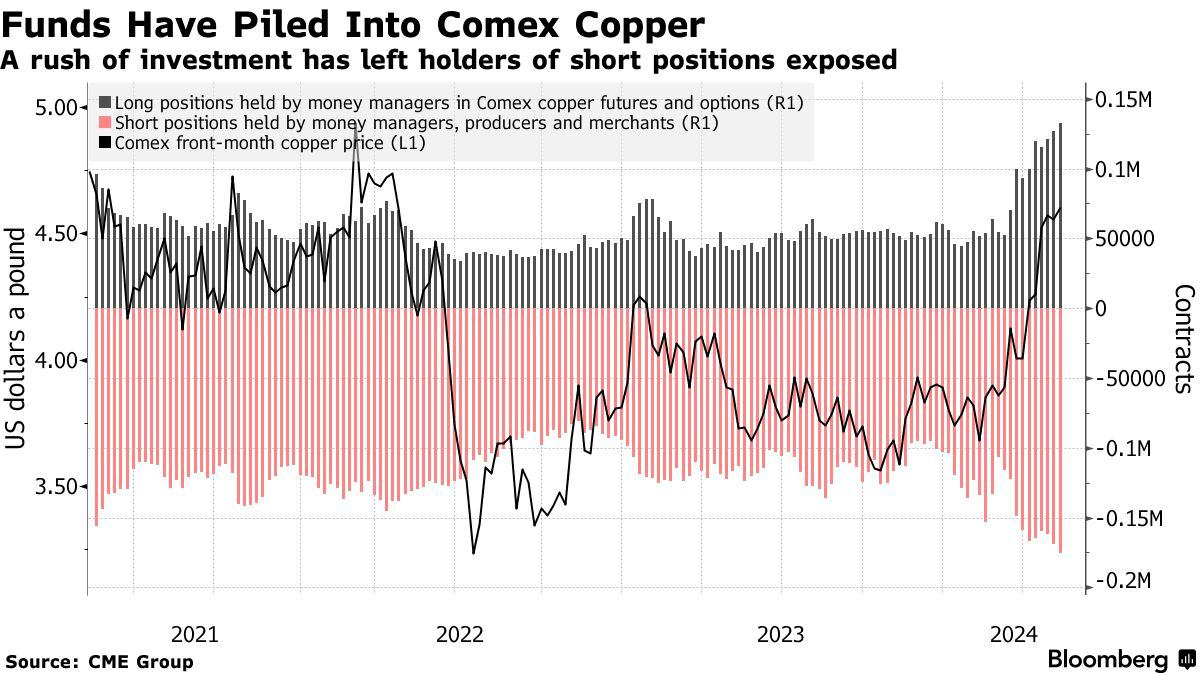

As a result, total long positions of investors rose almost 3x, as we can see in the chart below.

Bloomberg

What’s interesting is that Bloomberg’s commodity expert Javier Blas wrote an in-depth article on copper, including comments from sell-side researchers that see much more upside potential if we compare the May surge to past rallies.

Can copper surge to $12,000 a ton, maybe $13,000? Perhaps. In 2008, during the China-led commodity boom, the metal briefly traded above $8,000. In real terms, adjusted by inflation, it would need to rise to nearly $14,000 a ton in today’s money to match that peak. – Bloomberg

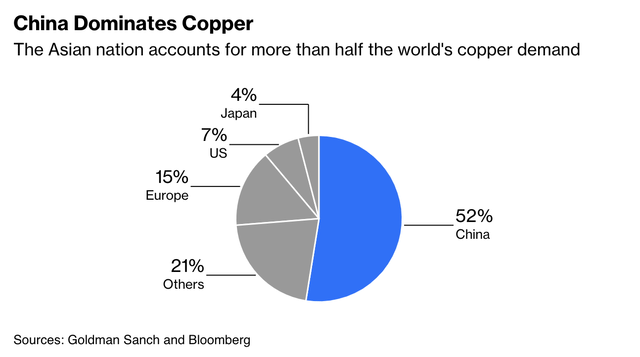

That said, he makes a fantastic call to be careful, as China accounts for roughly half of the world’s copper consumption.

Currently, this nation is dealing with a weak real estate sector, which has been one of the biggest drivers of global commodity demand since the early 2000s.

Bloomberg

Mr. Blas makes the case that China’s physical copper market remains weak, which makes it less likely that manufacturers are willing to pay premiums for copper.

He even makes the case that global copper demand expectations are useless (I’m paraphrasing here).

Essentially, he is making the case that these estimates are based on what the world would look like in a “Net Zero” environment.

The problem is that, based on current trends, we won’t see such an environment, which means copper demand expectations are likely too high.

CRU Group expects global demand to reach 35 million tons by 2050, well below the current expectations.

That said, the bull case is still intact. Even if demand growth is weaker than expected, it will still face bullish supply challenges.

To quote Mr. Blas:

[…] the easiest copper deposits have been tapped. Extra production will come from miners with lower ore grades, located in more difficult geographies, and probably with ore bodies buried deeper.

However, he still makes the case that people calling copper the “new oil” are wrong, as this would require the most bullish demand and supply expectations to turn into reality without support from new resources and technological advantages.

I agree with that.

The odds of that are very low.

While I’m still a long-term copper bull, I’m not chasing this rally.

So, what does this mean for Southern Copper?

A Closer Look Behind The SCCO Ticker

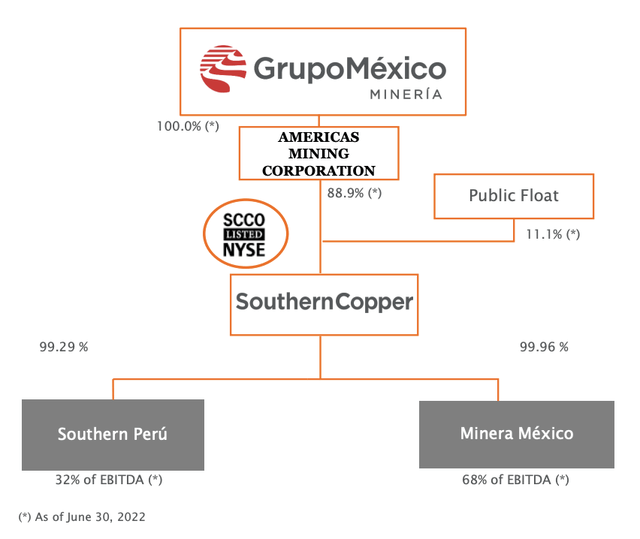

Southern Copper is one of the biggest copper miners in the world. It’s also majority-owned by the Mexican Grupo Mexico (OTCPK:GMBXF).

GrupoMéxico

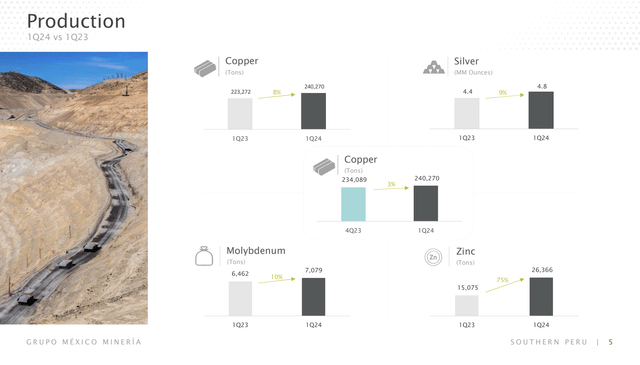

In addition to benefitting from strong pricing, the company is boosting production.

In the first quarter of this year, copper production increased by 7.6% quarter-over-quarter, bringing the total to 240,270 tons.

Southern Copper

According to the company, this growth was driven by significant improvements in Peru, with a 19% increase in production due to higher ore grades and enhanced mineral processing and recoveries.

Looking forward, the company’s forecast for 2024 sees a surge in copper production to 948,800 tons, which would translate to a 4.1% increase compared to 2023.

Furthermore, the Pilares project and the Buenavista zinc concentrator are expected to contribute 43,800 tons of copper. Last year, the company drove Pilares to full capacity and initiated a ramp-up of Buenavista zinc concentrate.

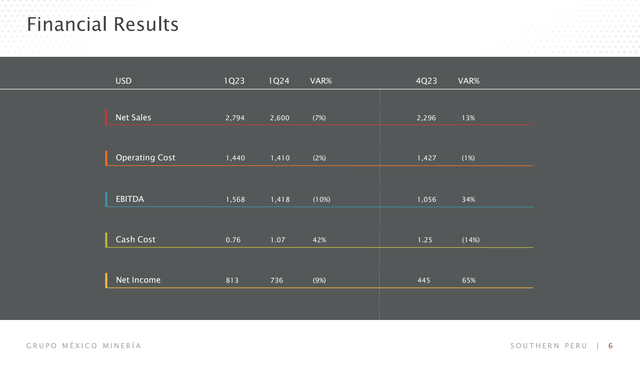

With that said, the company’s revenues did not rise – on the contrary.

In 1Q24, the company reported 7% lower net sales of $2.6 billion. This is mainly due to the surge in copper prices that started to break 1Q23 highs after the end of the first quarter. In other words, the recent rally isn’t included in these numbers.

Southern Copper

The good news is that solid margins kept the net income decline below 10%, which also helped the company to increase operating cash flow by 22% to roughly $660 million.

It also needs to be said that Southern Copper brings more to the table than copper.

Besides copper, the company produces significant amounts of molybdenum, silver, and zinc.

- Molybdenum, which represented 10.5% of sales value in 1Q24, saw a production increase of 9.5% compared to the prior-year quarter. This metal is used to create alloys, as it improves the strength and electrical conductivity. For example, many engines include molybdenum.

- Silver production also increased by 8.4% in 1Q24, with expectations to produce 20.5 million ounces in 2024, which would be an 11.4% increase over 2023.

- Zinc production saw a 75% quarter-on-quarter increase due to the company’s new Buenavista zinc concentrator.

Going forward, the company aims to further boost production in both Peru and Mexico.

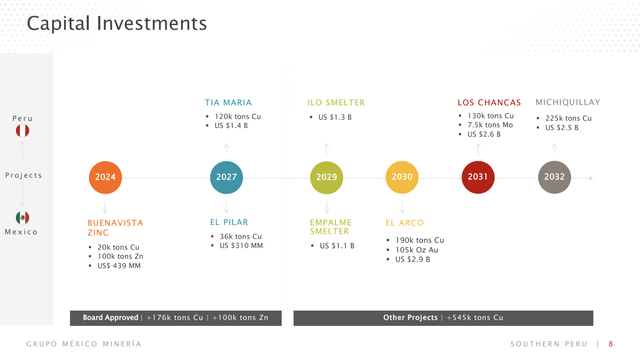

As we can see below, these projects include the Tia Maria, Los Chancas, Michiquillay, Buenavista Zinc, Pilares, El Pilar, and El Arco projects.

Southern Copper

In 1Q24 alone, the company invested $214 million in capital expenditures, which represents 29% of net income.

We expect, as we mentioned already, to produce 54,500 tons of zinc and 11,900 tons of copper this year, and for the next 5 years, we expect to have an average production of 90,200 tons of zinc and 20,000 tons of copper per year coming from this new Buenavista zinc concentrator. – SCCO 1Q24 Earnings Call.

Valuation

Putting a fair price target on a copper miner is tricky.

After all, revenue is highly dependent on the price of copper.

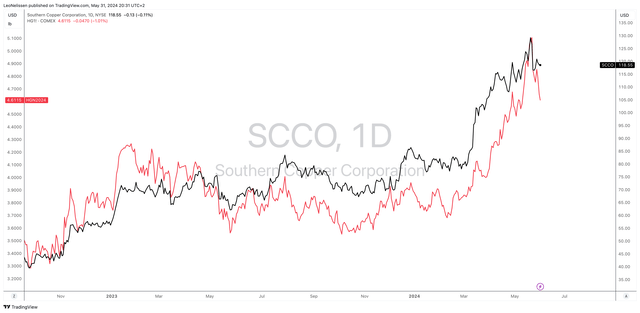

This is what the comparison between SCCO (black line) and COMEX copper looks like:

TradingView (SCCO, COMEX Copper)

After the recent surge, we need copper prices to remain high.

Why?

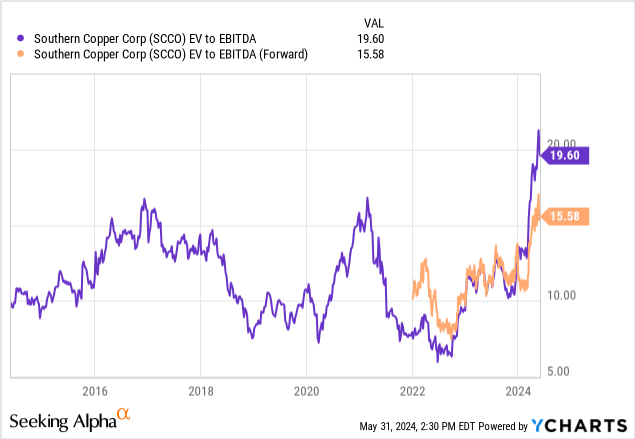

That’s because SCCO now trades at a forward EV/EBITDA multiple of 15.6x, which is close to the upper bound of its 10-year range.

Although I’m bullish on the long-term future of copper, I believe the massive surge over the past 2 years warrants some caution.

The latest copper rally was quite something and likely to be met by fears of a cyclical slowdown, which is why I’m going with a Hold rating in this article.

I would love to see SCCO shares come down to $100 before I upgrade it to Buy again.

Takeaway

Copper rallied due to strong demand expectations from green energy investments, artificial intelligence infrastructure, defense spending, and economic re-shoring.

These factors have accelerated investor interest, pushing prices to record highs.

However, the rally might be overdone. China’s weak real estate sector and lower-than-expected global copper demand could hurt the current upswing

Additionally, high copper prices rely on optimistic supply and demand projections that may not fully materialize unless the world goes all-in on the energy transition – and what are the odds of that?

Regarding SCCO, the company has benefitted from these trends, showing strong production growth and impressive returns.

Despite this, SCCO’s valuation is moderately lofty.

The recent copper price surge suggests a cautious outlook, with the potential for a cyclical slowdown.

Therefore, I’m maintaining a Hold rating on SCCO, waiting for a more attractive price close to $100 before considering a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here