The narrative of an impending recession, then at the same time there’s a narrative of “sticky” inflation

The more negative the reaction by financial pundits, and commentators the more accepted the notion of the big nearly thousand-point drop becomes. I am not here to say this is not possible, suppose it is. That doesn’t mean it is happening this month or even next month. Maybe the big selloff happens in September or October. That gives plenty of time for this rally to keep moving up. Moving as volatile as can be. Why am I promoting this notion of a rally building? Well for one thing the VIX is back under 19 and 20. This means that even though the pundits are predicting doom, investors, money managers, and institutions aren’t expecting anything of the sort. Otherwise, they’d be all hedged up.

I saw a lot of positives in the March employment numbers on Friday

The Labor Department reported Friday that payrolls grew by 236,000 for the month, compared to the estimated 238,000 and below the upwardly revised 326,000 in February.

The unemployment rate ticked lower to 3.5%, with the decrease coming as labor force participation increased to its highest level since before the Covid pandemic. Since the number of workers rose the percentage of unemployment goes lower. There were other data items that showed a cooling of the job market, like lower hourly earnings. Instead, commentators stressed that lower the unemployed percentage to 3.5%, to push the notion of a very tight job market. And expectations that the CPI will come in too hot as well.

What if the recent dive in interest rates isn’t foretelling a recession?

Much has been made by commentators that the 2-Year and the 10-Year rates have fallen precipitously. This is one of the pieces of evidence that the recession is around the corner. What if the bond market is looking ahead to 2024 and inflation falling back toward 2ish percent? Then the current levels in interest rates look a lot better. Perhaps, they are taking into account that the economy may be slowing down several months from now. That doesn’t mean that stocks will crash. The stock market is always looking to the future, and 9 to 11 months will get us into 2024, where inflation has calmed down mightily and the Fed gets off the economy’s back

Finally, why am I talking about a blow-off top?

It’s generally accepted that this is one of the most hated rallies in recent memory. We also talked about money being moved from savings to money markets funds. Most money markets are available at brokers. Playing armchair psychologists once money makes a leap from a bank to a brokerage account, it reduces a lot of inertia, to make another move into your stock portfolio. Another catalyst is the fall in interest rates which have been quite precipitous. Rates are no longer over 4%, so if the S&P 500 starts to move it makes sense to me that some of that loose cash will flow into brokerage accounts, and be invested in stocks.

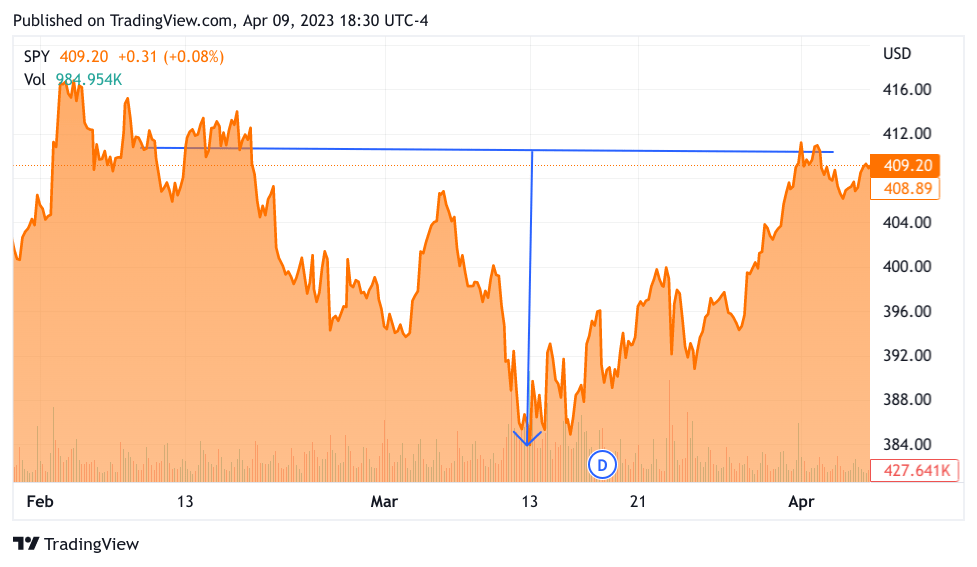

I think there is a very good set-up that as the rally grinds higher, negativity turns into positivity. Instead of recession talk, we could have soft landing talk, instead of more rate rises the Fed is done. Talk of sticky inflation right now, talk can turn to inflation receding and the 2% target coming into the first quarter of ‘24. Add to that, earnings that turn out better than feared, and you could have irrational exuberance, creating a rush into stocks. Let’s just see where the rally could go on the S&P 500 (SPY) ETF. I always make my market observations based on the S&P 500, though I expect the Nasdaq-100 to carry much of the water for a spike. Let’s employ what chartists call a measured move. Take the number of points that fell recently then add that to where the current recovery line is. Let’s stick with the SPY 6-month chart

TradingView

So the top is 410.4 and the bottom is 383.8 which is 26.6 points if you add that back to 410.4 it brings us to 437.0. So does the over-exuberant rally start from this level? A measured move usually maps out a “normal” rally. Perhaps once the S&P 500 breaks decisively above 4200 the rally could accelerate to a buyer’s panic, resulting in an unsustainable hyperbolic chart. Let’s keep in mind that this is the SPY, not the actual S&P 500 so the numbers are not one-to-one.

I’m not sure if any of you have noticed but rallies tend to change people’s soured opinion of the stock market to more of an optimistic view. That is why this could be such a strong rally, with the current negativity there is so much dry tinder. This rally can get plenty hot, and I fear too hot for its own good. Meanwhile, let’s enjoy the ride. I would start hedging further if the stocks push the S&P 500 over 4200. Do I really believe the measured move showing 4370 means that we really could hit that level? Perhaps, but if so that would make the rally pretty brittle. In order for a blow-off top to occur the rally need to appear to be almost straight up. Then on any negative news it collapses, and momentum builds as the index falls. When does this happen? I have no idea, meanwhile, watch the price action, that should let us know. I know that our community at Dual Mind Research will have a handle on when the market runs out of gas.

My Trades:

My first trade is some Calls on Alphabet (GOOGL) with the 105 strike out to June. I am now in the money but GOOGL could easily fall back to 105 this week going into the CPI reveal. If it does it will give me the opportunity to buy more calls. I believe GOOGL is a catch-up trade with Microsoft (MSFT). I have been comparing MSFT’s Chat GPT with GOOGL’s Bard, and I happen to like the Bard format. Apropos of nothing since I am sure Sundar Pichai doesn’t need my endorsement. GOOGL has tremendous capability in AI, building upon years of research. GCS in fact is the (or was?) the go-to cloud provider for AI/ML applications. I think their embrace of the “efficiency” mantra is led by Mark Zuckerberg’s example. I think GOOGL will be one of the few Tech Titans to grow profitability, perhaps not with much revenue growth now. Certainly when the economy returns to growth GOOGL will reap further rewards monetarily. Also perhaps more effective is building other revenue generators in the future. In the meantime, I don’t see why GOOGL couldn’t run up as much as Apple (AAPL) or MSFT.

My second trade is Exelixis (EXEL). Farallon is going public with getting three of their nominees to the board. EXEL has a sprawling research program, expanding from the west coast to a new research facility on the east coast. Their best drug generates $33 free cash per share, yet before the activist announcement, I believe it was trading at 17, now it is trading at 20. Farallon is either going to have EXEL curtail its research programs, either sell some candidates or drop them altogether. Perhaps instead of just announcing a $550M buyback actually buy back a bunch of shares. Or clean up the balance sheet and run an auction for EXEL. Or perhaps, push them to start a dividend to reward the beleaguered long-term shareholders. I do have it in my long-term investment account, so I am one of those sufferers. I am thankful there are activists out there. Not necessarily for a jump in EXEL but they provide pressure for companies to use shareholders’ money responsibly. I added to my long-term shares, with equity and long Calls in my trading account, My strike is 20, and the Exp Jan ‘24. That should give us plenty of time for this situation to be resolved.

My third trade is Charles Schwab, which is an investment, not a trade, and not a new name. I have just been adding to my positions both in Calls, and equity. I also wrote calls at 54 to protect the downside. I can’t believe my good luck as SCHW broke under 50. I have been adding more shares to my pile. I will likely add on some Calls at the 50 strike and out to June.

I sold out all my Boeing (BA) Calls as it ran toward 118, I didn’t top tick, I believe I sold out qt 115. I closed out all my UVXY Calls.

Frankly, I haven’t done much more than the activity above. I am trimming up positions just in case the CPI data reveal on Wednesday is not as well received as think it will be. If there is a strong sell-off I will the cash to add to my GOOGL calls, and hopefully, if Boeing falls to 105 I will start adding back Calls.

Read the full article here