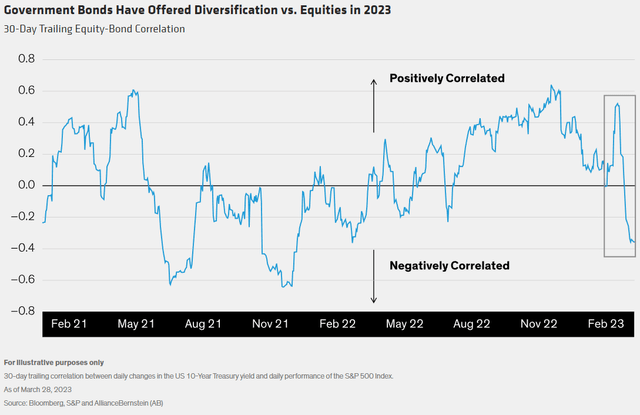

The lack of diversification benefits of government bonds in 2022 was painful for multi-asset investors. The sell-off in US Treasuries in particular was sharp, and we saw correlations versus stocks move well into positive territory.

But strong Treasury returns so far in 2023 have turned correlations negative. This has been a welcome dynamic for multi-asset investors, particularly those seeking income.

A key driver was the sudden failures of Silicon Valley Bank and Signature Bank (OTC:SBNY), which sent investors fleeing to the perceived higher quality and stability of government bonds.

US 10-year Treasuries were particularly popular, and their returns soared. From March 8 to 15 alone, the US Treasury Bond Index rose 3.3%, while the S&P 500 fell 2.5%.

Alongside this, we saw the market reprice fed funds futures sharply downward, as forecasts now expect a quicker arrival for Fed terminal interest rates – the point where policymakers stop hiking.

The result: Correlations between US government bonds and stocks fell sharply in March, reaching nearly –0.4% by month-end – levels last seen in early 2022 (Display).

Factoring the Correlation “Reset” into the Bigger Picture

We think this negative correlation shift creates a near-term opportunity for multi-asset investors – with duration a valuable diversifying tool in an environment where volatility could remain elevated.

While structurally higher inflation could reduce sovereign bonds’ diversification benefit over the long run, tactically speaking, duration exposure could benefit multi-asset portfolios now.

As always, investors should carefully weigh government bonds alongside other portfolio diversifiers, such as alternatives, real assets, and factor strategies like growth or low-volatility equities. Investors should also stay dynamic and flexible in adjusting their strategy mix to adapt to a changing environment.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here