This article is part of a series that provides an ongoing analysis of the changes made to Duquesne Family Office’s 13F stock portfolio on a quarterly basis. It is based on Stanley Druckenmiller’s regulatory 13F Form filed on 08/14/2024. The 13F portfolio value decreased from $4.39B to $2.92B this quarter. The holdings are concentrated, with recent 13F reports showing around 75 positions, many of which are very small. There are 30 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Coherent, Coupang, Vistra Corp, Natera, and Philip Morris. They add up to ~39% of the portfolio. Please visit our Tracking Stanley Druckenmiller’s Duquesne Portfolio series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q1 2024.

Stanley Druckenmiller started the family office in Q4 2011 after closing his hedge fund Duquesne Capital in 2010. Prior to that, he managed George Soros’s Quantum Fund between 1988 and 2000. He follows a trend-following trading style that is similar to George Soros. To know more about Druckenmiller’s trading style, check out Trend Following: Learn to Make Millions in Up or Down Markets.

Note: – Druckenmiller said he invested in the top-five Argentine ADRs and has increased the position significantly since after hearing Milei’s Davos 2024 speech. The top Argentine ADRs include YPF SA (YPF), Cresud (CRESY), IRSA (IRS), Grupo Financiero Galicia (GGAL), and Edenor (EDN).

New Stakes:

Philip Morris (PM) & Calls: PM is a top five 6.43% of the portfolio position purchased this quarter at prices between ~$88 and ~$103 and the stock currently trades well above that range at ~$123.

Mid-American Apt. (MAA): MAA is a 3.15% of the portfolio stake established this quarter at prices between ~$123 and ~$142, and it is now well above that at $161.

Camden Property (CPT): The 2.16% CPT stake was purchased this quarter at prices between ~$94 and ~$110, and it now goes for ~$124.

Flutter Ent. (FLUT): FLUT is a 2.10% of the portfolio position established this quarter at prices between ~$178 and ~$212. The stock currently trades at ~$210.

Mercadolibre (MELI): The ~2% MELI stake was purchased this quarter at prices between ~$1356 and ~$1788, and it is now at $2,016.

GE Vernova (GEV): GEV is a spinoff from GE. Shares started trading at ~$137 and currently goes for ~$191. Duquesne had a position in GE. Shareholders received 1 share of GEV for every 4 shares of GE held.

Springworks Therapeutics (SWTX): The 1.32% SWTX stake was established this quarter at prices between $36.06 and $47.62 and the stock currently trades at $40.93.

Adobe Inc. (ADBE): ADBE is a very small 0.70% of the portfolio position purchased this quarter at prices between ~$439 and ~$556, and it is now at ~$570.

Stake Disposals:

iShares Russell 2K (IWM) Calls: IWM Calls were the largest net long position at 15.14% of the portfolio as of last quarter. The position was established during the quarter as IWM traded at prices between ~$189 and ~$210. The entire stake was eliminated this quarter as IWM traded at prices between ~$192 and ~$209. The stock currently trades at ~$219.

Vertiv Holdings (VRT): VRT was a 1.86% of the portfolio stake established during H2 2022 at prices between ~$8.25 and ~$15. The two quarters through Q2 2023 saw a ~80% reduction at prices between ~$12 and ~$25 while the next quarter saw a ~53% stake increase at prices between ~$24 and ~$40. Q4 2023 saw a ~23% further increase at prices between ~$35 and ~$49. The stake was decreased by 57% during the last quarter at prices between $45.55 and $82.67. The disposal this quarter was at prices between ~$75 and ~$106. The stock is now at ~$80.

General Electric (GE): GE was a 3.41% of the portfolio position purchased during Q2 2023 at prices between ~$94 and ~$110. The position was increased by 16% during the last quarter at prices between ~$99 and ~$144. The stake was sold this quarter at prices between ~$136 and ~$169. The stock currently trades at ~$174.

Eli Lilly (LLY): A fairly large position in LLY was first purchased during Q2 2022 at prices between ~$279 and ~$327. There was a ~150% stake increase during H2 2022 at prices between ~$296 and ~$375. The two quarters through Q2 2023 saw a ~27% reduction at prices between ~$311 and ~$469. That was followed by a ~15% selling in the next quarter at prices between ~$433 and ~$598. Q4 2023 also saw a ~11% trimming. The stake was decreased by 85% during the last quarter at prices between ~$590 and ~$791. The disposal this quarter was at prices between ~$723 and ~$908. The stock currently trades at ~$940.

Cameco (CCJ), Citigroup (C), KBR Inc. (KBR), Keycorp (KEY), Marvell Technology (MRVL), and Meta Platforms (META): These small (less than ~1.5% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

Coherent Corp (COHR): The 8.92% COHR stake is currently the largest individual stock position at ~9% of the portfolio. It was established during the last quarter at prices between $40.60 and $66.89. This quarter saw a ~42% stake increase at prices between $49.26 and $73.98. The stock is now at $77.72.

Natera Inc. (NTRA): The top five 7.33% NTRA stake was established over the three quarters through Q1 2023 at prices between ~$32 and ~$58 and it is now at ~$116. The position was increased by 116% during the last quarter at prices between ~$59 and ~$93. There was a minor ~2% increase this quarter.

Seagate Tech. (STX): STX is a fairly large 6.21% stake purchased during Q3 2023 at prices between ~$57 and ~$73. The next quarter saw a ~130% stake increase at prices between ~$63 and ~$87. The position was decreased by 32% in the last quarter at prices between $79.46 and $97.83. This quarter saw a ~22% stake increase at prices between ~$82 and ~$105. The stock currently trades at ~$98.

Kinder Morgan (KMI): The 4.60% KMI position was established during the last quarter at prices between $16.31 and $18.06, and it is now at $21.42. This quarter saw a ~75% stake increase at prices between $17.19 and $19.84.

Option Care Health (OPCH): OPCH is a 1.78% of the portfolio position established during Q4 2022 at prices between ~$28 and ~$35. There was a ~50% reduction in the next quarter at prices between ~$28 and ~$33 while Q2 2023 saw the position rebuilt at prices between ~$27 and ~$33. The next quarter saw a ~72% selling at prices between ~$31 and ~$36. There was a ~20% stake increase during Q4 2023. The stake was decreased by 53% during the last quarter at prices between $31.09 and $34.31. This quarter saw a whopping 175% stake increase at prices between $27.70 and $32.79. The stock currently trades at $31.65.

Daktronics (DAKT): The 1.19% DAKT stake was established last quarter at prices between $7.25 and $10. It was increased by ~20% this quarter at prices between $8.91 and $13.95. The stock currently trades at $14.61.

Note: they have a 5.2% ownership stake in the business.

Barclays plc (BCS), and Madison Square Garden Ent. (MSGE): These very small (less than ~1% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Coupang Inc. (CPNG): CPNG had an IPO in March 2021. Shares started trading at ~$49 and currently go for $22.03. Druckenmiller had a 10.5M share stake that went back to funding rounds prior to the IPO. There was a ~50% stake increase in Q3 2021 at prices between ~$28 and ~$44.50. The next quarter saw another ~15% stake increase at prices between ~$26 and ~$31. There was a ~50% reduction this quarter at prices between $18.20 and $23.65. It is currently their second-largest stake at 7.88% of the portfolio.

Microsoft Corp (MSFT): MSFT is a 6.14% of the portfolio position established during Q1 2023 at prices between ~$222 and ~$288. There was a ~14% stake increase during Q2 2023 and that was followed by a ~23% increase in the next quarter at prices between ~$312 and ~$358. Q4 2023 saw a ~7% increase, and that was followed by a minor ~2% increase in the next quarter. There was a ~64% reduction this quarter at prices between ~$388 and ~$452. The stock currently trades at ~$413.

Teck Resources (TECK): TECK is a 2.39% of the portfolio stake purchased in Q1 2022 at prices between ~$29 and ~$42. The next quarter saw a ~55% reduction at prices between ~$26 and ~$46. There was a ~200% stake increase in the three quarters through Q1 2023 at prices between ~$26 and ~$44. That was followed by a two-thirds further increase over the next three quarters. The stake was decreased by 18% in the last quarter at prices between $36.85 and $45.78. This quarter saw a two-thirds reduction at prices between $45.35 and $54.67. The stock currently trades at $47.37.

Note: TECK has seen a previous recent roundtrip. It was a 2.47% of the portfolio position built in Q4 2020 at prices between ~$12.25 and ~$18.85. The bulk of it was sold in Q3 2021 at prices between ~$19.50 and ~$26.80.

Flex Ltd. (FLEX): The 1.46% FLEX position was increased by 241% in the last quarter at prices between $22.13 and $30.64. There was a ~62% reduction this quarter at prices between $26.34 and $33.78. The stock is now at $32.34.

News Corp (NWS): The 1.27% NWS stake was purchased during Q1 2023 at prices between ~$16 and ~$22. There was a ~55% stake increase in the next quarter at prices between ~$17 and ~$20. Q3 2023 also saw a ~9% further increase, while in the next quarter there was ~12% trimming. The last quarter also saw similar trimming. There was a ~70% reduction this quarter at prices between $24.54 and $28.72. The stock is now at $28.94.

Nvidia Corp (NVDA): NVDA is currently at 0.91% of the portfolio. It was established during Q4 2022 at prices between ~$11 and ~$18. There was a ~35% stake increase during Q1 2023 at prices between ~$14 and ~$28. That was followed by a ~20% further increase next quarter at prices between ~$26 and ~$44. The last quarter saw another ~27% increase at prices between ~$40 and ~$50. It was by far the largest position as of Q4 2023. The stake was decreased by 84% in the last quarter at prices between ~$48 and ~$95. This quarter saw another similar selling at prices between ~$76 and ~$136. The stock currently trades at ~$118.

Discover Financial Services (DFS): DFS is a small 0.75% of the portfolio purchased during the last quarter at prices between $96.45 and $131.09. There was a ~75% reduction this quarter at prices between ~$119 and ~$131. The stock currently trades at ~$138.

Arista Networks (ANET): ANET is a 0.63% of the portfolio position that was increased by 83% in the last quarter at prices between ~$229 and ~$306. There was a ~88% reduction this quarter at prices between ~$246 and ~$351. The stock currently trades at ~$347.

Freeport-McMoRan (FCX), Palo Alto Networks (PANW), and Wabtec (WAB): These small (less than ~2% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

Vistra Corp (VST): The 7.74% VST position was purchased during Q3 2023 at prices between ~$26 and ~$34. The next quarter saw a ~20% stake increase and that was followed with a ~10% increase in the last quarter. The stock currently trades at $84.67.

Woodward Inc. (WWD): The 5.70% WWD position was increased by 136% in the last quarter at prices between ~$132 and ~$155. The stock is now at ~$167.

Palantir Technologies (PLTR): PLTR is a very small 0.67% of the portfolio stake that was kept steady this quarter.

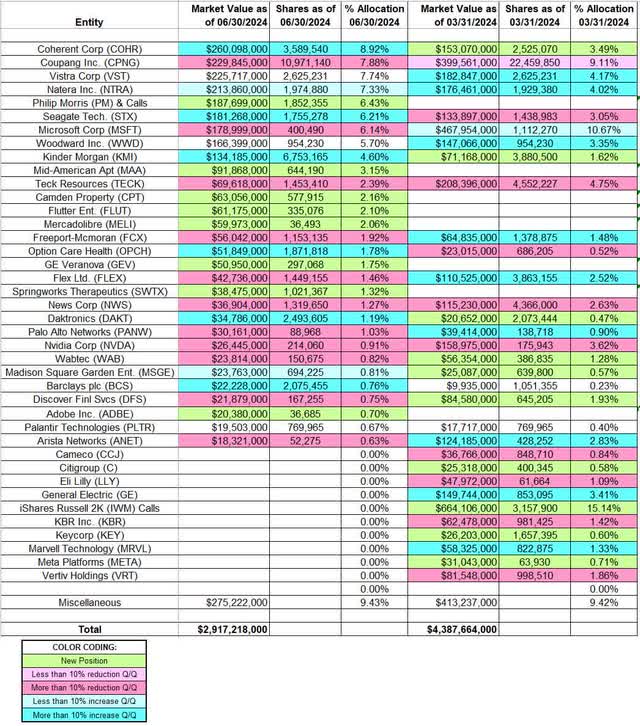

Below is a spreadsheet that highlights the changes to Stanley Druckenmiller’s Duquesne Family Office 13F stock portfolio as of Q2 2024:

Stanley Druckenmiller – Duquesne Family Office Portfolio – Q2 2024 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Duquesne’s 13F filings for Q1 2024 and Q2 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here