Dear readers/followers,

Ericsson (NASDAQ:ERIC) is one of those companies I get a lot of requests about, but I choose to write relatively few articles on the company. My last one was over half a year ago, and despite being bullish at the time, I made it clear that I do not own significant amounts of Ericsson directly, and would not consider doing so at the time.

The upside for Ericsson is there – because the company is a worldwide giant with a portfolio of assets and patents that give it a significant upside – but we also have to consider the risk for this business, which is significant, even after a 20% decline from my last article.

Updating on Ericsson – Things are not looking much better

On paper, Ericsson looks like a great investment. It’s a decades-old telco business with roots and operations in many parts of the world. Its technologies are used on every continent, even if in places, like the USA, is underrepresented due to the dominance of legacy operations like Bell, Kellogg, and Automatic Electric. Ericsson was a legacy telephone major that saw much of its appeal decline with the advent and rise of mobile communications, which left it mostly with its technology appeal.

The major reason why Ericsson saw a decline in mobile is in part due to its pushing for the WCDMA standard above the Qualcomm (QCOM) standard CDMA2000 which already had CDMA tailwinds in the USA. While this wasn’t the only reason for the company’s fall, it was nonetheless the start during the 1999 lawsuit where both parties agreed to essentially pay one another for royalties for the use of their technologies.

The company issued its first profit warning in early 2001 (I remember this because the news was very prominent in Sweden – a legacy like Ericsson essentially in trouble). No one believed any downturn for this company to be long-term – and keep in mind, this was after the dot-com crash, and Ericsson was still considered strong. It falling was much like General Electric (GE) or Berkshire falling. The mobile telephone segment/JV became a financial burden, showing a loss of 24B in 2000, not much better in 2001. Then came a factory fire, and delivery stops that crippled Scandinavian companies including Nokia (NOK), and Ericsson spun its phones off into a Sony (SONY) JV.

This leaves us with Ericsson as it is today – a data communication and backend hardware manufacturer, with a dozen-billion global market, with Ericsson near a market-leading position.

This company is in a position that many would describe as being “significantly undervalued”. You’ll see why I am positive about the company later on in my valuation section – but I hope that I can explain the risks to you as well – because many do exist and bear consideration.

However, what makes a good company?

A good company has better margins and profitability than other companies in the same segment. It’s fundamentally sound, it generates consistent profit, and it pays those profits to shareholders in one form or another. Valuation is something that comes into the equation later, but if the company isn’t a leader or at least better than average, I typically am not very interested in the business.

Ericsson is a market leader. Its gross margins, operating and net margins, and ROE/ROIC numbers are in the 60-80th percentile in the hardware/telco backend industry (Source: GuruFocus data). I would not compare this company necessarily to other telco businesses, because Ericsson isn’t a traditional telco as such. Rather, it enables traditional telcos.

Ericsson should be viewed as nothing more or nothing less than an infrastructure hardware and software provider. That is what they know and can do.

Its fundamentals are average – not great compared to the rest of the sector, but not worse either. Where Ericsson shines is a combination of valuation and profitability. The yield, given the low valuation, has also gone to a very high level and now stands at over 4%. This is not common for Ericsson, and the payout ratio for that dividend is only 44% – meaning I would consider it safe.

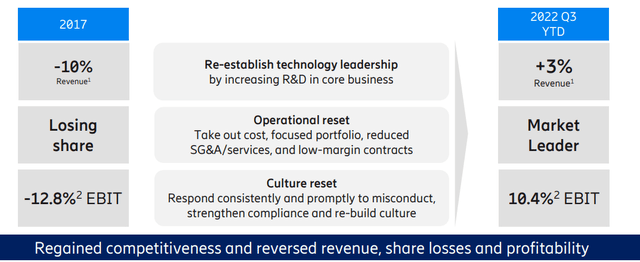

The latest set of results more or less cement the views I have on this company. Ericsson is still in the middle of a fundamental shift in order to guarantee long-term profitability. For much of this, the strategy has actually worked out well.

Eric IR (Eric IR)

Many Swedish investors, especially pensioners whom I know personally, have held onto this “loser” for decades at this point and are wondering when they might see a fundamental shift or turnaround. Well, I believe that time is coming, or might already be here. Ericsson now has leadership in key segments, including things like:

- 39% RAN revenue share, which is up 6% from 2017.

- 16 out of 20 CSPs use Ericsson’s 5GC

- It’s #1 on 3GPP standards

- 50% of all 5G traffic is carried over Ericsson’s radio networks – and that’s global, not national or regional

Ericsson is present in 137 out of 228 live 5G networks, and it presents technology leadership as part of its argument. It’s too early to say that we’re seeing a turnaround – things are still a bit “slumpy”.

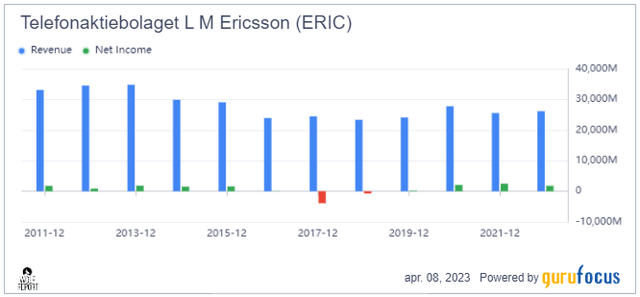

ERIC Revenue/net (GuruFocus)

But we’re seeing the worst of the trends, which came in in 2017, no longer being present. The company’s cash flows look healthy, and the company, despite increased interest costs, manages to get good and positive returns on its investments. In layman’s terms, it makes money on the ventures and projects it acts on, and it makes more money than the cost of the capital to the company. The company still isn’t in the green in terms of all fundamental measurements, and you can notice assets growing faster than revenues (which can be a red flag, depending), but I no longer see a near-term risk that the company is in serious actual trouble.

Because of legacy infrastructure Ericsson is good and operates with China essentially being closed in many nations in terms of telco infrastructure, in a global duopoly. The only non-Chinese company doing what Ericsson does to any sort of scale is Nokia. Any other peer you care to mention here is really non-trivial on a global scale and does not do what Ericsson, Nokia or the Chinese closer peers like ZTE does.

Being burned by Ericsson as an investor is easy. In fact, it has been easy for almost 20 years to be burned by Ericsson – the company has been on a volatile trajectory, but one of decline, for going on 20 years at this point, since they lost market leadership in legacy. While there are investments at certain times you could have made that would have resulted in a profit, these would have been at high risk-reward ratios that would not have seen favorable comps on the market as a whole (meaning there would have been companies at significantly better risk/reward).

I have always known what sort of circumstances need to present themselves for me to seriously abandon my “Investor AB only”-position, and really crack the company open to buy the common share.

Remember, Ericsson remains at BBB-, and a 4% yield isn’t great in the telco business (if we compare it to that), where yields are often currently closer to 6%, with a potentially better upside.

Since the 20% drop though since September, something has changed. And I believe this warrants a thesis update.

Valuation for Ericsson – It’s actually looking compelling here

Somewhere, I knew that Ericsson eventually might become a compelling investment. While the company is still in no shortage of scandals with potential litigious outcomes, there comes a point in a company where it must be considered part of normal business operations. Such is the case for 3M (MMM) and Johnson & Johnson (JNJ) as well, both of which I own.

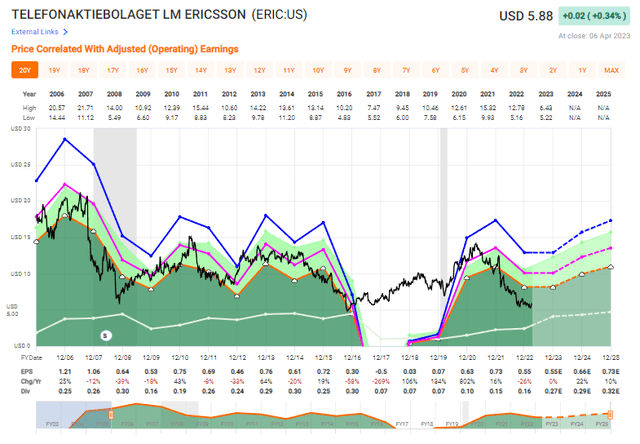

Since I last wrote about it, Ericsson’s valuation and share price have done this.

ERIC valuation (F.A.S.T graphs)

What’s interesting to me here is how far the company’s valuation has declined, relative to its actual earnings potential. In terms of share price, we’re now at a level we last saw when the company did not actually have any adjusted earnings – but that is not the case at this time.

The market is disregarding or at the very least devaluing that the company does have positive earnings, and while they may be forecasted flat for this year, I believe growth to be in the company’s future. We’re now at a position where even forecasting only at a P/E of 15x, we can see RoR in the triple digits until 2025E.

Or, if you like, the company could drop to 7.5x from 10.8x P/E today, and still make 7% RoR in 2025E. Your potential at this time, of losing money given normal business operations and forecasts being met, seems to be now be quite limited.

Using DCF for Ericsson given its volatility comes with problems – but a quick look at a 20-year model with a 3-5% growth estimate, which I believe is fair, still gives us an implied FV of $6.5-$7 – compared to the current stock price of less than $6, which is a double-digit margin of safety.

Comps do exist, as I mentioned. Nokia is actually larger in terms of market cap and also has an upside, but Ericsson performs better in certain areas than Nokia does – I’m talking Return indicators like ROCE, while also having a significantly lower yield. When taking dividends into account and looking at ERIC as a comparison, I would characterize Nokia as being no more than “Fairly valued” at best. Other peers remain extremely difficult. I would tend to regard something like ZTE with a bit of conservativism given the history of China and accounting. Consensus comes to a P/E of around 14.9X on average, with an EV/EBITDA of 8.5X, a 2.3X book value multiple, and a low 1.75% average yields, owing to Nokia and ZTE’s low yield. Again, it’s only two real peers worth mentioning.

As I said in my previous article – Ericsson is undervalued. It’s still, and more undervalued here. And we’ve now reached a point in time where I believe this undervaluation is significant enough to warrant a real change in my approach to the stock.

I previously gave the company a 115 SEK/share target. I’m not shifting from this target, because I don’t see that any of the negatives or headwinds we’ve been seeing really impacts the fundamental potential of the company.

However, at this valuation, I’m making a change in how I invest in Ericsson. Previously, I said:

However – I personally invest not in ERIC but in the investment company Investor AB. By doing so, I get exposure to Ericsson, but also to a whole other host of great businesses, and in doing so I diversify my holdings and my risk. Investor AB is currently at a discount to NAV, so makes for a good investment, all things considered.

(Source: Ericsson Article)

Investor AB is still at a discount to its NAV – but at this time, I believe that the valuation for Ericsson itself is compelling enough to warrant a common share investment, if you’re in it for the long haul.

Based on this, I am not shifting my stance, which was already at “BUY”, but I am shifting my approach. I am now open to buying the common share in the company.

Thesis

- Ericsson remains one of the premiere backbone communication hardware companies in the world, with impressive software capabilities. The company is technically sound, but has a bit of a 20-year troubled past, leading it to trade in a volatile manner. However, I believe that the company and the market is showing signs that these negative trends are changing.

- The valuation has dropped to “too low” levels, and I believe it is time to look at buying/investing more in Ericsson. I now also believe it is time to invest in ERIC directly, instead of the proxy investment into Investor AB.

- I view Ericsson as a “BUY” with a 115 SEK, or $9.50 price target.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Ericsson fulfills all of my criteria at this point, and I view it as a “BUY”.

Read the full article here