One of my favorite duties as the leader of our Seeking Alpha Investing Group is answering questions from members and providing analysis of their prospective trades or tickers. Recently, one of the members inquired about X4 Pharmaceuticals, Inc. (NASDAQ:XFOR) and why the ticker was selling off following they publicized mixed interim data from mavorixafor’s Phase II study for chronic neutropenia (CN). The data revealed that 3 out of 23 patients on Mavorixafor discontinued due to non-serious adverse events, which resulted in the share price being nearly cut in half and has failed to show any signs of a recovery.

Although the discontinuation rate is a concern, we note that mavorixafor (Xolremdi) was recently approved for WHIM syndrome, and the CN interim efficacy data showed that mavorixafor increased neutrophil counts for subjects who remained on the therapy. To me, the market’s reaction is a bit overblown considering the company is moving forward with a pivotal trial, and the company has already launched Xolremdi for WHIM syndrome. As a result, I am looking to catch the falling knife in the immediate term.

I intend to provide a brief background on X4 Pharmaceuticals and will review mavorixafor’s recent data readout. Then, I will discuss why I am looking to catch the falling knife, as well as some of the accepted risks involved. Finally, I take a look at the charts to see if I can formulate a game plan for XFOR.

Background on X4 Pharmaceuticals

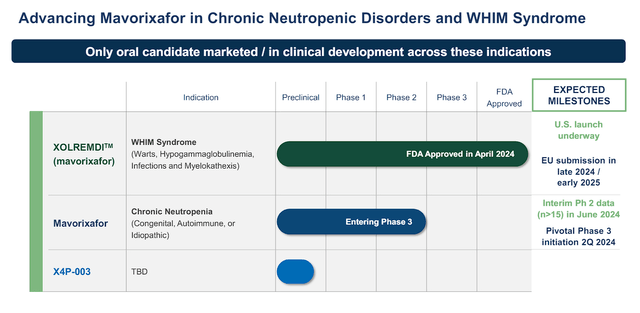

X4 Pharmaceuticals is an intriguing healthcare company that is tackling rare diseases. X4’s flagship pipeline drug is mavorixafor, an oral CXCR4 antagonist that is taking on WHIM Syndrome (Warts, Hypogammaglobulinemia, Infections, Myelokathexis), and is expected to combat chronic neutropenia, as well as other immunodeficiency disorders.

X4 Pharmaceuticals Pipeline and Milestones (X4 Pharmaceuticals)

X4 is using mavorixafor to take on rare diseases, which has encouraged the FDA to grant a few of their special designations for the regulatory path and commercialization. The FDA and EMA granted mavorixafor their Orphan Drug Designation (ODD) for the treatment of WHIM Syndrome, which provides it a number of benefits including market exclusivity, tax credits, and aid with engineering a clinical trial. In addition, the FDA awarded mavorixafor their Breakthrough Therapy Designation (BTD) for WHIM Syndrome, which expedites the development path and their review process. Mavorixafor also has the FDA’s Priority Review option, which potentially truncates the review timeline and accelerates the drug’s availability.

The company’s first target was WHIM Syndrome, an immunodeficiency disorder caused by CXCR4 dysfunction that typically emerges in childhood. This disease is associated with a lower life expectancy due to continuous threats of sepsis, organ damage, persistent pneumonia, and cancers. Unlike mavorixafor, contemporary treatments are not going after the underlying cause of the disease.

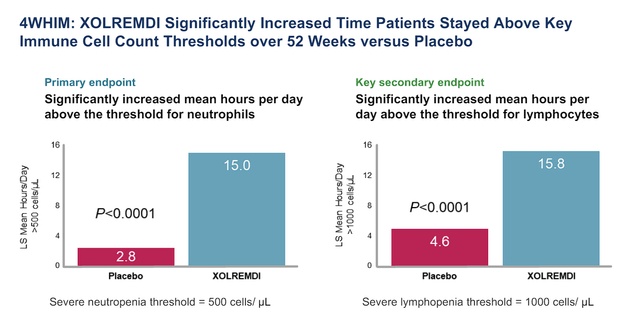

X4 the primary endpoint for their Phase III clinical trial for WHIM Syndrome was the improvement in ANC, with secondary endpoints including improvements in absolute lymphocyte count (ALC), infection score, and wart change score.

X4 Pharmaceuticals Xolremdi Phase III Primary and Secondary Endpoints (X4 Pharmaceuticals)

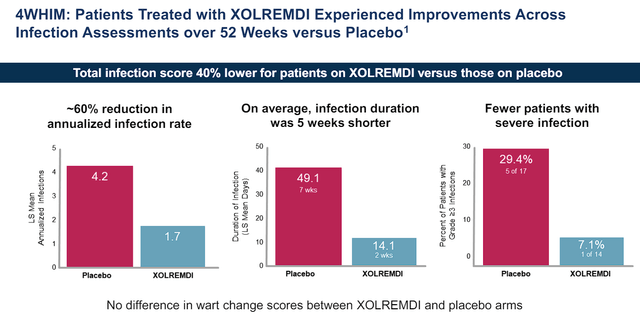

In addition to boosting neutrophil counts, Xolremdi also improved infection rates, infection duration, and infection severity compared to the placebo.

X4 Pharmaceuticals Xolremdi Phase III Infection Score vs Placebo (X4 Pharmaceuticals)

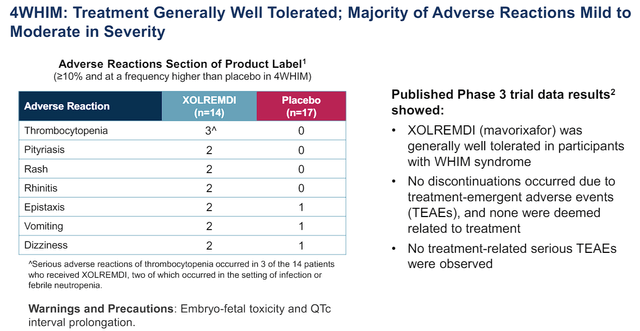

In terms of safety, Xolremdi was by and large well tolerated with “no discontinuations occurring due to treatment-emergent adverse events, none were deemed related to treatment.”

X4 Pharmaceuticals Xolremdi Phase III Infection Score vs Placebo (X4 Pharmaceuticals)

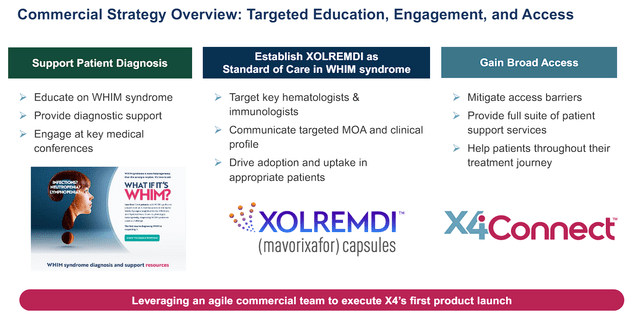

As a result, the FDA approved Xolremdi “For use in patients 12 years of age and older with WHIM syndrome to increase the number of circulating mature neutrophils and lymphocytes.” The company’s commercial strategy is centered on educating 3,500 providers about WHIM Syndrome and providing those offices with diagnostic support. The primary targets will be prominent hematologists and immunologists to help with initial adoption and bolster uptake. The company has priced Xolremdi’s annual costs for patients over 50 kg at $496,400 and for those 50 kg or under at $372,300.

X4 Pharmaceuticals Xolremdi Commercial Strategy for WHIM Syndrome (X4 Pharmaceuticals)

X4’s goal is to grow Xolremdi’s sales and validate it as the standard of care for WHIM Syndrome.

In addition to WHIM Syndrome, X4 is aiming mavorixafor at chronic neutropenia, which has been an underserved patient population. The company’s Phase II CN trial assessed the safety and durability of absolute neutrophil count (ANC) levels over a six-month period, both as a monotherapy and in combination with G-CSF.

The trial demonstrated that once-daily oral mavorixafor increased ANC counts in all evaluable participants. Importantly, mavorixafor showcased durable ANC levels above the lower limit of normal for CN. On the safety and tolerability side, mavorixafor posted no drug-related serious adverse events at the cut-off date, which the company believes is superior to contemporary injectable treatments.

As a result, X4 initiated their 4WARD Phase III pivotal trial to test mavorixafor in a broader patient population. The primary endpoint is the annualized infection rate and ANC response, while secondary endpoints cover the severity and duration of infections, antibiotic use, fatigue, quality of life, and safety.

Looking To Catch The Knife

Typically, I avoid “falling knife” tickers… especially from healthcare companies that have reported undecided data that could have less-than-ideal prospects for a rapid recovery. A “falling knife” is a name for a stock that is in a free fall state, with the share price plummeting with no sign of stopping. Traders attempting to catch, or buy, a falling knife stock are risking getting cut by the knife as it moves lower, leading to substantial losses. It is often advised to wait for the ticker to show some signs of stability or a strong reversal setup before committing their hard-earned money to a high-risk move. However, those who take the chance at grabbing the falling knife could seize a huge opportunity if the market is overreacting and the share price quickly rebounds as the market corrects the hyperbolic move.

I am willing to take a chance on XFOR during this falling knife scenario because of mavorixafor’s market potential. Currently, there is a lack of effective therapies for WHIM Syndrome, thus, positioning mavorixafor as a potentially high-value treatment option. Although CN is a broader patient population than WHIM Syndrome, it is also lacking operative therapies. Although both of these indications lack gigantic patient populations, the potential market for mavorixafor is still substantial, considering it is potentially a first-in-class therapy targeting the underlying causes of these diseases. Essentially, mavorixafor is walking into unclaimed territory.

How Big of an Opportunity? What is mavorixafor’s total addressable market?

Both WHIM Syndrome and CN are rare conditions, so we will use the conservative figures to derive a rough estimate. For WHIM Syndrome, we will say the population will be 1,000 patients priced at an annual cost of $496,400 for patients over 50 kg and $372,300 for those 50 kg or under. So, let’s go with an average annual cost of $450K per patient, which gives us a $450M total addressable market, or TAM, for WHIM Syndrome.

Mavorixafor’s market for CN could encompass several forms, including idiopathic, cyclic, and severe congenital neutropenia, which can be estimated to be around 5K to 10K patients in the U.S. alone. However, there are some estimates having 1M-2M worldwide. For this analysis, we will use 7.5K patients. If we assume the same average annual cost of $450K per patient, mavorixafor’s total addressable market for CN could be $3.375B. Therefore, mavorixafor’s total addressable market for both WHIM Syndrome and CN is roughly $3.825B.

Into the bargain, mavorixafor’s development is not limited to WHIM Syndrome and chronic neutropenia. The drug’s mechanism of action with CXCR4 antagonism could unlock its ability to be operative in other rare immunodeficiencies. By antagonizing CXCR4, mavorixafor increases the migration of cells from the bone marrow, raising circulating levels of neutrophils and lymphocytes, thus, offsetting neutropenia and lymphopenia. Some other rare diseases that involve neutropenia and lymphopenia include:

- Cartilage-Hair Hypoplasia

- Shwachman-Diamond Syndrome

- Chediak-Higashi Syndrome

- Reticular Dysgenesis

- Griscelli Syndrome Type 2

- Chronic Granulomatous Disease (CGD)

- Myelodysplastic Syndromes (MDS).

I don’t know if mavorixafor would be effective in all these diseases, but the list illustrates the need for a drug that has the prospects to improve both neutrophils and lymphocyte levels. Plus, adding more indications to mavorixafor’s label would bolster the company’s long-term outlook.

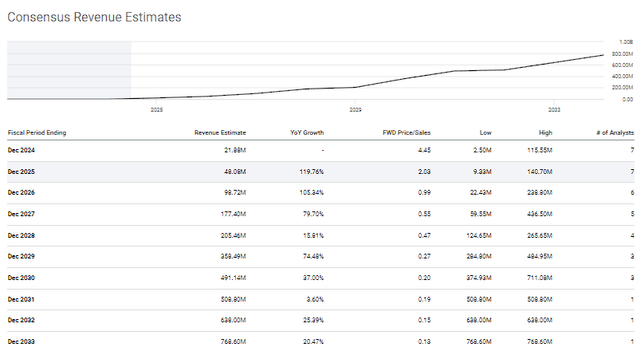

The Street has extreme outlooks on X4’s performance in the coming years, with some Street analysts expecting a very slow launch, while others expect the company to be hot right out of the gates.

X4 Pharmaceuticals Annual Revenue Estimates (Seeking Alpha)

Regardless of which growth trajectory you believe in, the projected revenues would have a dramatic impact on the company’s financials and valuation. The Street’s low revenue estimate for 2026 has X4 pulling in $22.43M, which is far from being a blockbuster drug. However, one must consider the XFOR’s market cap is just under $100M, so the company won’t have to bring in a billion dollars to move the needle. In fact, the industry’s average price-to-sales is about 4x to 5x, so $22.43M in 2026 would justify a valuation between ~$80M and ~$112M. So, we could argue that XFOR is trading at a fair price for its projected revenue in 2026… but, the company should see additional growth in the coming years as Xolremdi continues to establish the WHIM Syndrome market and possibly get the CN label expansion. It is possible that the company could be reporting over $500M before the end of the decade, which would be around 0.25x forward price-to-sales, and would substantiate a $2B to $2.5B valuation, or about $12 to ~$15 per share. Considering the ticker is trading around $0.60 per share, I would say there is significant upside for investors.

Another point to add is the possibility that the successful launch and optimization of Xolremdi could establish X4 Pharmaceuticals as a leader in rare diseases with a valuable product that could entice a potential acquisition.

So, I think there is enough there to justify my ploy to catch the “falling knife.”

Risks To Consider

One has to admit there is significant upside potential for XFOR, however, maximizing this opportunity requires X4 getting mavorixafor through the FDA CN and the rest of the globe for both indications. In addition, we have to consider market penetration, which is heavily reliant on provider education on these diseases, adoption, patient adherence, and the threat of competition from other treatments. X4 might have a fantastic product, but their commercial efforts will fall short.

Another major concern is X4’s ability to work on reimbursement negotiations with payers to support mavorixafor. Thankfully, orphan drugs often get decent reimbursement due to the lack of alternatives, but it is still something to keep an eye on in upcoming earnings conference calls. A lackluster launch does not bode well for a drug, and the ticker would almost certainly take a beating.

Finances are almost always a concern for pre-commercial healthcare companies, and X4 is not an outlier. At the end of Q1, the company had $82M in cash and equivalents. In addition, X4 now has $105M from the sale of their Priority Review Voucher in May, as well as $20M from their loan facility with Hercules Capital.

X4 Pharmaceuticals Balance Sheet Summary (X4 Pharmaceuticals)

Together, X4 should have around $207M going into the second half of 2024, which they believe will last into “late 2025.” X4’s average quarterly cash burn rate is around $21.76M, which would allow that cash position to last for a cash runway of about 9.5 quarters, or until the second half of 2026. Therefore, it looks as if the company expects their OpEx to rise as they fund their commercial launch and move mavorixafor into the Phase III CN trial. This acceleration in cash burn will put added stress on the early phase of the commercial launch as investors attempt to determine when the company could go from “cash burn to cash earn.” A weak launch could move that runway estimate closer, increasing the fear of eminent dilution, or taking on more debt to fund the company.

Another small note to make is that XFOR’s share price is currently trading under $1.00 per share, which is below NASDAQ’s listing requirement. Tickers that trade below the NASDAQ requirement can regain compliance by closing at or above $1.00 per share for no less than 10 consecutive trading days within 180 calendar days. If a company/ticker fails, it may face delisting from the NASDAQ. However, the company can perform a reverse stock split to boost its share price and regain compliance.

Thankfully, XFOR has not been trading below the $1.00 threshold for a long time, so this is not an immediate concern, however, this could become a problem as we get closer towards the end of 2024. I don’t expect the company to choose delisting over a simple reverse split… but investors need to accept the ticker is going to remain volatile as long as it trades under $1 per share.

All of these risks can help fuel the selling pressure and XFOR will continue to trade like a “falling knife,” cutting through levels of support. As a result, I am giving XFOR a conviction level of 2 out of 5, and will be on the “Bio Boom” speculative watch list.

Timing The Knife

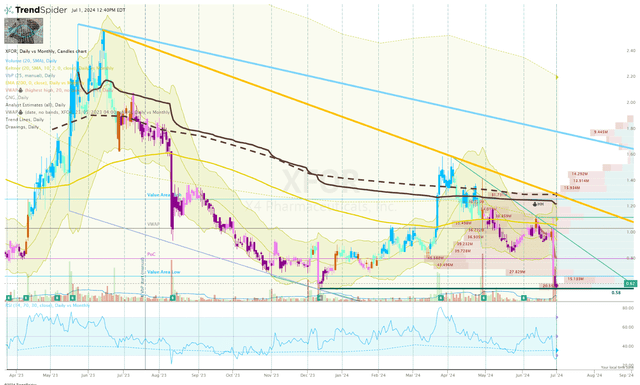

The XFOR Daily Chart shows the ticker has been in a clear downtrend since April 2023 and is currently trading below the 200-day EMA, indicating a bearish trend. The Keltner Channel tests show the share price frequently touching or moving outside the channels, indicating strong momentum moves to the downside. However, the RSI is below 30, indicating an “oversold” condition and setting up the possibility for a bounce. Key support is around $0.58, which in combination with an oversold RSI might be enough to fuel a potential reversal that could move to the resistance levels around $1.00 and $1.40 per share.

XFOR Daily Chart (Trendspider)

So, I am looking for a strong bounce off $0.58, which will encourage me to locate a potential entry point on a lower timeframe. Typically, I would start with a miniature position when there is a falling knife scenario in play, but I am looking to book some profit right under $1.00 per share and quickly move my position to a “house money” status. If that occurs, I will wait for additional data or commercial updates before adding to that position. On the other hand, if the ticker moves lower, I will move my attention to the Monthly and Quarterly Charts to formulate a longer-term game plan for XFOR.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here