For years, people involved in cryptocurrencies, whether in companies providing products and services or groups and individuals heavily promoting them, have waved away criticism. It was only a few bad actors. Things would prove themselves out. Those who didn’t jump in would be shown as losers.

Given the number of outrageous outcomes and events over the last few years, it’s time enough to question whether the whole idea of a completely decentralized digital form of exchange is sensible. It isn’t currency in the classical sense of the characteristics it needs. As an investment, it’s been wild speculation. And some of the people in charge of important mechanisms (taunting the claim of decentralization) have proven themselves untrustworthy.

Start with important characteristics of a currency:

- Store of value — currencies are supposed to hold value and have worth over time.

- Value stability — currencies need some degree of predictability in their value.

- Medium of exchange — a holder of currency is supposed to be able to pay for goods and services broadly with it.

- Liquidity — a currency needs to be easy to buy and sell.

- Portability — you have to be able to move currency around and exchange it for other currencies.

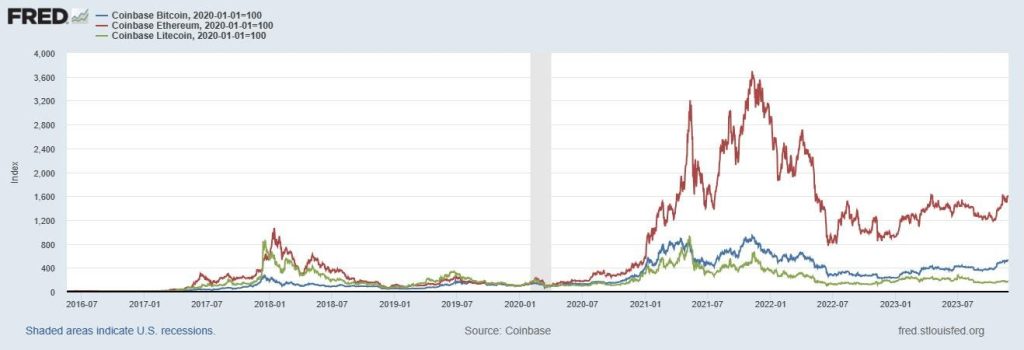

Proponents would claim that cryptocurrencies do this, but they don’t really. Even the most popular ones don’t have predictable values. Below is a graph of Bitcoin, Ethereum, and Litecoin

LTC

displayed in index form. The display isn’t of objective value, like dollar equivalents, but how their values have varied in comparison to where they stood on January 1, 2020.

Here is a similar graph of the U.S. dollar, using the Federal Reserve’s nominal broad U.S. dollar index. But the graph is deceiving because the scales are different. A huge jump is maybe a 10% to 12% increase in value. A plummet like that of July 2021 is about a 4% drop.

But with the cryptocurrencies, a big shift is anywhere from hundreds to thousands of percentage change. They lack the stability and arguably the basic store of value characteristic, if the worth of a cryptocurrency coin can rise and then fall in this way. Note that there are thousands of cryptocurrencies, and most are likely far more unstable.

Even the major cryptocurrencies aren’t widely useful to pay for things. When is the last time you were buying groceries or a hammer or stick of gum and Bitcoin

BTC

, say, was taken?

Even touting the digital capabilities of cryptocurrencies seems silly given that currencies and the larger concept of money are tracked and enabled digitally. Credit and debit cards are all digital transactions. Deposits in banks are entries in digital ledgers.

If cryptocurrencies fail as actual currencies, they must fall back on investments. But there is nothing behind them. Buy equities and you have a share of a company with assets, incomes, profits. Buy a bond and while your investment has risk, there is a company or government with resources and generally the ability to pay interest and then principal.

The risks are much higher with cryptocurrency. As MarketWatch reported at the end of last year, 2022 saw an estimated $3 billion lost to crypto hacks, up from $2 billion in 2021. That doesn’t count the many pump-and-dump scams.

Compounding the criminal theft is the amazing range of outrageous activities that the world has seen. Sam Bankman-Fried, late of the massive fraud that was FTX, is sitting in prison. Binance faces a $4.3 billion fine (it’s not clear that the firm has the money to pay) and CEO Changpeng Zhao had to step down after pleading guilty to money laundering.

In terms of importance in respective industries, this would be like seeing the NYSE and Nasdaq both taken apart in the wake of scandals.

Maybe there is some legitimate and useful role that cryptocurrencies will serve at some point. But now isn’t then.

Read the full article here