The Biden administration has just released new details on an upcoming student loan forgiveness plan currently in development.

The new initiative is designed to replace the student debt relief program that the Supreme Court struck down in June. Immediately following that decision, President Biden announced the development of a “Plan B” for student loan forgiveness. However, unlike the first plan, this new program would take months to develop.

Here’s the latest.

Biden Had Announced Creation Of New Student Loan Forgiveness Plan

Biden’s initial student loan forgiveness plan would have cancelled $10,000 in federal student loan debt for millions of borrowers, and up to $20,000 for those who had received Pell Grants. The administration had enacted the plan under the HEROES Act of 2003, which allowed the Education Department to bypass the normal regulatory process required for the creation of most programs, and quickly established the plan after it was first announced.

However, Republican-led legal challenges derailed the initiative before anyone received student loan forgiveness under the plan. The Biden administration appealed to the Supreme Court, which agreed to take up two of the cases. But in a 6-3 ruling in June, the Court’s conservative majority struck down the program, concluding that Congress did not contemplate or authorize such sweeping student loan relief when it passed the HEROES Act, notwithstanding the statute’s broad language allowing the Education Department to “waive” or “modify” nearly any provision of federal student loan regulations in response to a national emergency.

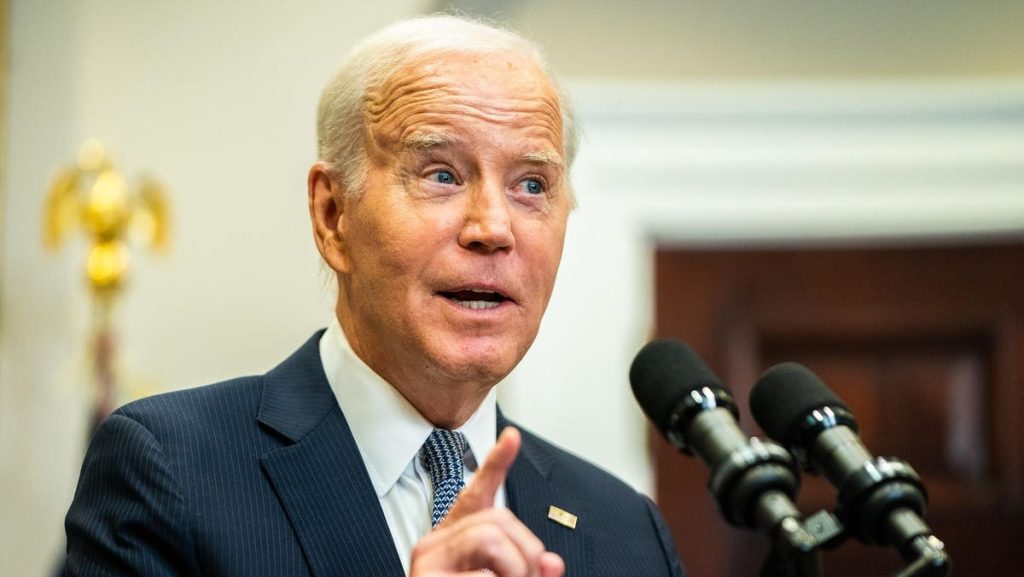

The Biden administration quickly pivoted in response to the ruling, announcing that officials would begin establishing a new student loan forgiveness plan under a different statute, the Higher Education Act. “The Court closed one path today, but we’re working on another,” said Biden at the time.

The HEA contains a provision allowing the Education Department to “compromise” or “waive” federal student loan obligations. One of the benefits of relying on the HEA’s so-called compromise and settlement authority to establish a new student loan forgiveness plan is that it has already been used by the Education Department in a variety of circumstances, albeit not on the scale of Biden’s original student debt cancellation plan.

The downside, however, is that new programs and regulations under the HEA must go through a long development process called negotiated rulemaking, involving the establishment of a committee of stakeholders who must hold a series of hearings and consider public input before establishing the new program. The process takes many months.

Biden Administration Announces New Details And Next Steps For Student Loan Forgiveness Plan Development

On Friday, the Biden administration announced significant next steps to create the new student loan forgiveness plan under the HEA.

“The Biden-Harris Administration has taken unprecedented action to fix the broken student loan system and deliver record amounts of student debt relief. Now, we are diligently moving through the regulatory process to advance debt relief for even more borrowers,” said Secretary of Education Miguel Cardona in a statement. “We’re committed to standing up for borrowers and making sure that student debt does not stop anyone from climbing the economic ladder and pursuing the American dream.”

The Education Department released an issue paper outlining the administration’s initial vision for the new student loan forgiveness plan. This paper provides the most detailed information yet on the proposed new program.

The paper suggests that, given the statutory language that focuses the HEA’s compromise and settlement authority on loans that are unlikely to be repaid within a reasonable amount of time, a new student loan forgiveness plan would be tailored to be within that framework.

The paper outlines possible circumstances that could be covered by the new student loan forgiveness program. These include situations where student loan borrowers have experienced substantial balance growth over time due to interest accrual; borrowers who attended educational programs that did not provide enough financial value to make student loan repayment affordable; borrowers with very old student loans; and those whose continue to experience financial hardships such that they would not be able to repay their student loans within a reasonable timeframe, even given current federal student loan relief programs.

Next Steps For Biden’s New Student Loan Forgiveness Plan

The Education Department’s new details are not a final outline of Biden’s new student loan forgiveness plan. Rather, it provides an initial foundation for deliberation as the department begins the negotiated rulemaking process.

The department also formalized the creation of the negotiated rulemaking committee, which it is calling the Student Loan Relief Committee. That Committee will discuss the possible criteria for the new student loan forgiveness plan, including the possible target areas identified in the department’s issue paper, at its first public hearing that will be held virtually on October 10 and 11. The Committee will hold subsequent virtual public hearings in November and December.

“Members of the public will also have an opportunity to provide comments at the end of each day,” says the department. “Through this process, the Department will continue to develop regulatory text for consideration… Updates on the student debt relief rulemaking process will be posted here. Members of the public who wish to view the sessions or provide public testimony can also find a link on that page closer to the committee’s meetings where they can register to do so.”

After the initial public hearings have concluded, the department will release draft regulations for the new student loan forgiveness plan sometime in 2024. “The public will have an opportunity to submit written comments on the draft rules when they are published next year,” said the department.

Further Student Loan Forgiveness Reading

8 Ways To Lower Your Student Loan Payments As Billing Resumes

Biden Administration Announces $72 Million In Student Loan Forgiveness

Student Loan Forgiveness Update: ‘Targeted’ Initiatives Continue, But Threats Loom

There’s Still Time To Qualify For Student Loan Forgiveness Under Adjustment

Read the full article here