What Is Risk Management?

Risk management is the calculated approach to understand, evaluate, and tackle threats to your capital and future earnings. Whether it is evaluating investment opportunities or planning for retirement, risk management is pivotal in all spheres of personal finance.

It involves two primary components: risk assessment and risk mitigation.

The initial step is about pinpointing potential risks, either from current financial decisions or anticipated ones. It involves staying abreast of market changes, global events, or shifts in personal circumstances that might affect your financial health.

Once risks are identified, you formulate a game plan. This means deciding how much of that risk to accept, reject, or transfer and subsequently taking steps to mitigate its impact.

The Importance Of Risk Management In Personal Finance

Protecting Investments

Every penny you save, invest, or allocate towards a financial venture is a product of your hard work. Consider your investments as seeds planted for future growth.

Risk management functions as the fence that shields these seeds from external harm, ensuring that they have the opportunity to grow and thrive.

Minimizing Potential Losses

Every investment or financial decision comes with an inherent risk. Risk management is about navigating such risks smartly. It ensures that the risks do not spiral into debilitating losses.

Efficient risk management is akin to understanding the playing field and positioning your chess pieces so that even if you lose a few, you are still in a favorable position to win.

Ensuring Financial Stability And Security

The primary aim of personal finance is to achieve stability and security. It is about ensuring that in the face of job losses, medical emergencies, or unexpected global events, your financial foundation remains unshaken.

Risk management fortifies this foundation. By constantly evaluating potential threats and creating appropriate strategies, you create a buffer against the unexpected — ensuring that you and your loved ones remain secure, come what may.

Enhancing Long-Term Financial Growth

Growing your wealth is a marathon, not a sprint. Risk management ensures that your financial trajectory remains upward over the long haul, despite the inevitable dips and downturns.

Navigating risks intelligently opens doors to opportunities that others might overlook or avoid. For instance, instead of inducing panic, a market downturn can present you with lucrative investment opportunities.

These informed decisions compound, leading to substantial long-term growth.

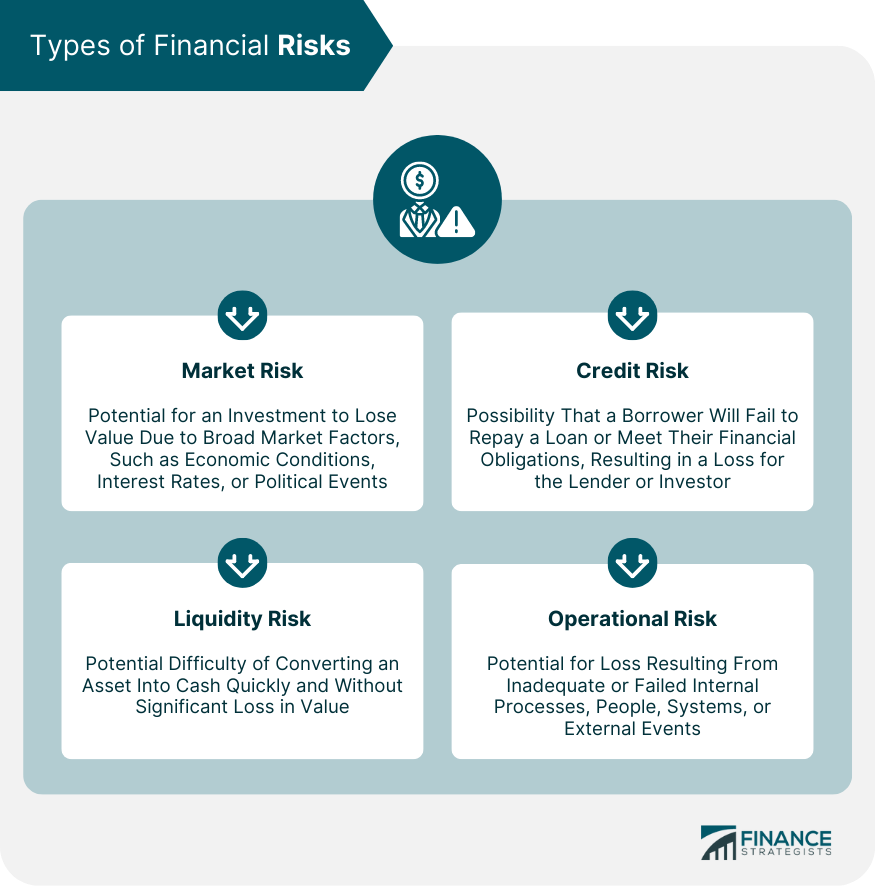

Types Of Financial Risks

Market Risk

Beyond the stock market fluctuations, market risk encompasses a broader range of financial instabilities. Interest rate changes, currency value, and other broad economic metrics can drive these.

As an individual investor, market risk can mean the difference between a comfortable retirement and financial strain.

Credit Risk

For those investing in bonds or loaning money, there is always the chance that the borrower might default. This risk is especially pertinent in peer-to-peer lending scenarios or investing heavily in corporate bonds.

Liquidity Risk

Liquidity risk is like being cash-strapped at the worst possible time. It is the inability to liquidate assets quickly without a considerable markdown in value.

Especially crucial in crisis scenarios, liquidity risk can hamstring your ability to address urgent financial needs.

Operational Risk

Ever had that moment where you realized you made a financial move based on poor advice or insufficient understanding? That is operational risk at play. It underscores the importance of continual learning and ensuring that all decisions are based on robust, accurate data.

Risk Assessment

Identification And Analysis

Risk assessment is an intricate blend of science and art, combining data-driven insights with instinctual knowledge of personal circumstances. Various techniques can be employed, such as historical analysis, scenario analysis, and risk profiling.

Historical analysis focuses on studying past market behaviors, identifying patterns, and drawing parallels to potential future events.

Scenario analysis requires constructing hypothetical adverse situations to gauge potential impacts. For example, how might your investments fare for a sudden 10% market drop?

Risk profiling determines your capacity, appetite, and tolerance for risk based on factors such as your liabilities, age, income, and short- and long-term financial goals.

Quantification

After identification, understanding the magnitude and implications of these risks is essential. This involves probability and impact analysis, where the likelihood of a risk occurring and its potential repercussions are gauged.

For a structured approach, risk scoring is employed. By assigning a numerical value based on combined likelihood and impact factors, risks can be compared, ranked, and addressed accordingly.

Tools like Risk Matrices can be handy, providing a visual representation of where each risk falls and guiding both strategic and immediate actions.

Risk Evaluation And Threshold

Once risks are quantified, they must be weighed against your personal risk tolerance. Defining a clear risk threshold — the level beyond which a risk becomes intolerable — aids in crafting an actionable response.

This might mean reallocating assets, diversifying investments, or seeking additional financial instruments to hedge against potential losses.

Risk Management Tools And Techniques

Diversification

Think of diversification as not putting all your eggs in one basket. It is a fundamental principle of risk management.

It is based on the rationale that a varied investment portfolio, spread across different asset classes and sectors, can help offset losses in one area with gains in another.

- Asset Diversification: It involves spreading your investments across various asset classes like stocks, bonds, real estate, and commodities. While stocks might offer high returns with high volatility, bonds can provide steadier, albeit potentially lower, returns.

- Geographical Diversification: Investing across global markets can shield your portfolio from regional economic downturns. For example, while the European market might face a recession, Asian or American markets might be booming.

- Sectoral Diversification: Different sectors, e.g. technology, healthcare, and energy, respond differently to market changes. Investing across multiple sectors can balance out specific downturns.

Hedging

Hedging involves offsetting potential losses from a primary investment by making a secondary investment. It is like a safety net, catching unforeseen downturns from the primary investment. Consider these examples:

- Options: These contracts give investors the right, but not the obligation, to buy or sell assets at specific prices before certain dates. They can be used to hedge against potential price drops or to capitalize on price increases.

- Futures: Similar to options, futures are contracts obligating the buyer to purchase and the seller to sell a specific number of assets at a predetermined price and date.

- Swaps: These are agreements between two parties to exchange financial instruments. Interest rate swaps, where parties exchange fixed and variable interest payments, are common examples.

- Collateralized Debt Obligations (CDOs): These pool various cash-flow-generating assets, creating layered securities with different risk levels.

Insurance

Insurance acts as a buffer against significant financial losses, allowing you peace of mind and the assurance of coverage when life throws a curveball. These products offer financial compensation against unforeseen adversities.

- Health Insurance: Medical emergencies can be both physically and financially taxing. Health insurance helps cover medical expenses, from routine check-ups to surgeries, ensuring that your health does not become a financial burden.

- Homeowners Insurance: Imagine a natural disaster damaging your home. Homeowners insurance can cover repair or replacement costs, protecting your investment against events like fires, floods, or theft.

- Auto Insurance: In the event of an accident, auto insurance can cover vehicle repairs, medical expenses, and even legal fees if someone sues you for damages.

- Life Insurance: It provides financial security for your loved ones in the event of your demise. Depending on the policy, beneficiaries might receive a lump-sum payout, ensuring they are taken care of in your absence.

- Disability Insurance: If an injury or illness prevents you from working, this insurance offers a percentage of your income, ensuring you can meet your daily expenses.

- Travel Insurance: Planning a vacation? Travel insurance can cover trip cancellations, lost luggage, or medical emergencies abroad, giving you peace of mind.

Risk Management Best Practices

Review And Update Regularly

A risk management plan is not a one-time blueprint but a living document that evolves with every phase of your financial journey. It should adapt to changes in income, lifestyle, financial goals, and global economic conditions.

Each review should thoroughly analyze your investments, evaluate their performance, and identify potential risks and opportunities.

To stay abreast of the dynamic financial landscape, consider scheduling bi-annual reviews. Utilize these moments to reassess your risk tolerance, which can change due to age, career progression, and family expansion.

Ensure that your investments align with your current financial objectives and risk appetite.

Build A Culture Of Risk Awareness

A proactive approach to risk awareness involves staying informed about global events, market trends, and economic indicators that can impact your investments.

Subscribe to reputable financial news outlets, join forums, and follow finance blogs and websites.

Being risk-aware also means educating yourself on the different financial instruments and investment strategies. Consider enrolling in financial workshops, online courses, or obtaining certifications to enhance your understanding.

This continuous learning culture empowers informed decision-making, helping to mitigate risks and capitalize on opportunities as they arise.

Maximize Technology

In today’s digital age, technology is pivotal in effective risk management. From AI-powered analytics tools offering predictive insights into market trends to mobile applications facilitating real-time portfolio tracking, leveraging technology can significantly enhance your risk management efforts.

Security is another crucial aspect. As transactions and investments increasingly move online, safeguarding sensitive financial information from cyber threats is paramount. Employ robust security protocols, stay updated on the latest cybersecurity, and consider cyber insurance to mitigate potential risks.

Seek Professional Advice And Guidance

Even the most seasoned investors recognize the value of professional advice. Financial advisors bring a wealth of experience, specialized knowledge, and an outside perspective that can refine your risk management strategies.

Consider seeking advisors who have the requisite qualifications and reputation that align with your financial goals and values. They can provide tailored recommendations, exploring avenues you might not have considered.

Moreover, their expertise in complex financial matters like tax planning and estate management can prove invaluable.

Conclusion

In personal finance, risk management is crucial in anticipating, understanding, and proactively addressing potential financial threats, ensuring that hard-earned capital remains secure.

By assessing, quantifying, and mitigating risks, individuals can shield their investments from unforeseen adversities, lay the foundation for long-term growth, and build a sturdy financial buffer against life’s uncertainties.

Leveraging technology, continual education, and seeking expert guidance are indispensable in this endeavor.

Ultimately, risk management is not just about avoiding pitfalls — it is about harnessing opportunities, adapting to changing circumstances, and strategically navigating the complex world of personal finance to achieve stability, security, and prosperity.

FAQs

1. Why is risk management important in personal finance?

Risk management ensures financial stability and safeguards against potential losses that can derail financial goals. By managing risks, individuals can build a robust financial foundation and achieve their long-term objectives with greater certainty.

2. Are there any risks in being overly conservative with my investments?

Yes. Being overly conservative, such as keeping all funds in a savings account or low-yield bonds, can result in inflation eroding the purchasing power of your money. It can also prevent you from achieving higher returns that could be available from more growth-oriented investments.

3. How do I determine my risk tolerance?

Risk tolerance is an individual’s comfort level with potential losses in pursuit of financial returns. It can be assessed by considering factors like age, financial goals, investment horizon, and personal feelings about market fluctuations. Many financial advisors offer questionnaires or tools to help determine this.

4. How often should I reassess my risk management strategies?

It is a good practice to review your risk management strategies annually or whenever there is a significant change in your financial situation, goals, or risk tolerance. Life events like marriage, having children, or nearing retirement can also necessitate a reassessment.

5. Are all risks avoidable?

No. While many risks can be mitigated, it is impossible to eliminate all risks entirely. The goal of risk management is not to avoid risks entirely but to understand and minimize them to ensure financial stability and achieve long-term objectives.

Read the full article here