Artificial intelligence is having a 90s-like boom — and one analyst says Nvidia is leading the charge.

“This is a 1995 Moment as now the AI Revolution and $1 trillion of incremental spending over the next decade is hitting the software ecosystem and rest of tech sector,” Dan Ives, a tech analyst at Wedbush Securities, wrote in a recent analyst note.

Back in ’95, the internet became more commercially available — and changed the world in the process.

Ives thinks we could be at the same kind of inflection point with AI investments. Nvidia is taking advantage, he said, by making highly sought-after graphic processing units, or GPUs, that help companies power their AI models like OpenAI’s ChatGPT.

“Nvidia and the golden GPUs are the start of the spending wave..not the end,” Ives said in the note. “Now, the Street awaits as a myriad of uses cases get built out across the enterprise and consumer ecosystem.”

The analyst said the hunger for Nvidia’s AI chips from leading software providers like Salesforce, Adobe, and Oracle is a “transformational tech trend we have not seen since the start of the Internet in the mid 90’s.”

But that doesn’t mean major AI spending will lead to a stock market crash similar to the tech rout of the late 90s.

Ives noted that current tech stocks are “nowhere near the 1999/2000 period” when the dot-com bubble burst.

That era — which he said was fueled by speculative investments and the overvaluation of internet companies — occurred in a “totally different world back then compared to what we see today.”

“The AI Revolution starts with Nvidia and in our view, the AI party and popcorn is just getting started,” Ives said.

This trend, he said, was reflected in Nvidia’s fourth-quarter earnings that beat estimates. The company raked in $22.1 billion in revenue in the fourth quarter, proving the AI boom hasn’t run out of steam yet.

Ives and Nvidia didn’t immediately respond to Business Insider’s request for comment.

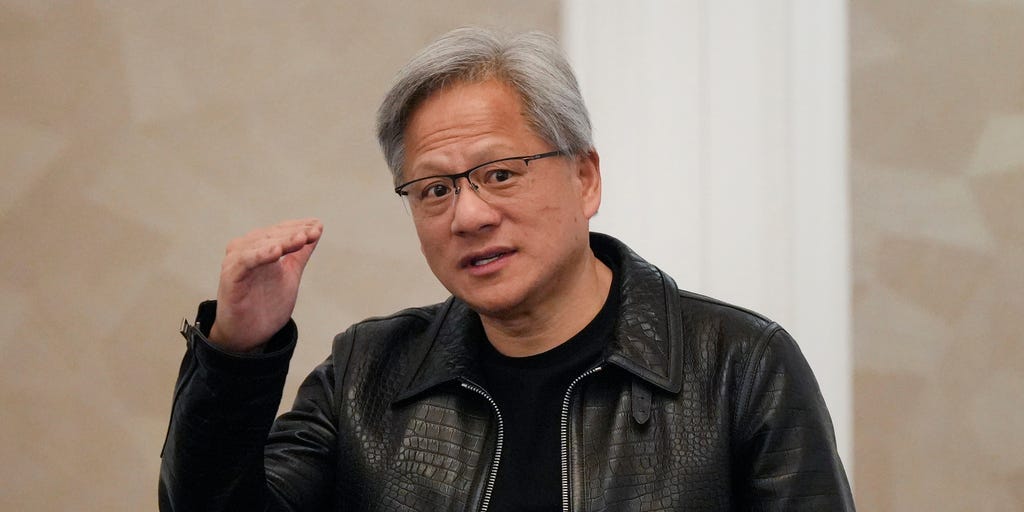

Jensen Huang — the CEO and co-founder of Nvidia who’s been nicknamed the “Godfather of AI” — told investors on the company’s latest earnings call that new AI data centers will “open up a whole new world of applications not possible today.”

“We started the AI journey with the hyperscale cloud providers and consumer internet companies,” Huang said. “Now, every industry is on board. From automotive, to healthcare, to financial services, to industrial to telecom, media, and entertainment.”

It may only be a matter of time before companies across the board bet big on AI. On the earnings call, Huang predicted that “every enterprise in the world” will one day run on Nvidia’s GPUs, which he expects will be “a very significant business over time.”

“We’re really just getting started,” Huang said.

Read the full article here