Hollywood dealmakers finally appear poised to say “lights, camera, action” to a renewed cycle of mergers and acquisitions following months of paralysis during the historic writers’ and actors’ strikes.

Big-time media dealmaking doesn’t necessarily hinge on an active production environment, but months of uncertainty about when Hollywood will start rolling again have had a chilling effect, entertainment-industry insiders say. “Nobody felt that they could think about anything else in relation to this business other than the strikes,” Jonathan Handel, a media-industry attorney and columnist for Puck News, told Insider.

Other experts on media dealmaking echoed that sentiment: Bankers, lawyers, and investors said that along with the work stoppages, many of the themes driving the strikes — from fears around artificial intelligence to disruptions in the development process — unleashed anxiety in the industry and depressed M&A activity this summer.

“The unknown is hard to transact in,” Sam Powers, the global head of technology, media, and telecommunications for Bank of America, told Insider. He pointed to the “impact of AI” and “structural questions around linear and streaming” as fundamental sources of uncertainty, which makes it “harder for people to do, certainly, transformative M&A — but, even on the smaller side, harder to do M&A that gets impacted by those things.”

Now, insiders say the engine of transacting may soon start firing again, with everyone from private-equity investors to big conglomerates keen to get a piece of the action. PE firms, for their part, are armed with record capital: Last year, they counted more than $200 billion in assets under management in the telecommunications and media sector, according to the data firm Preqin.

Of course, the industry isn’t out of the woods yet. Hollywood has yet to put its other big hurdle — the actors’ strike — behind it. Last week, talks between the actors’ union SAG-AFTRA and the AMPTP (which negotiates on behalf of the Hollywood giants) broke down, dimming hopes for a quick resolution to a labor stoppage that’s raged for more than three months. But members of the Writers Guild of America, which reached an accord with the AMPTP last month, have ratified that deal, and scribes are back at work on fresh film and TV content.

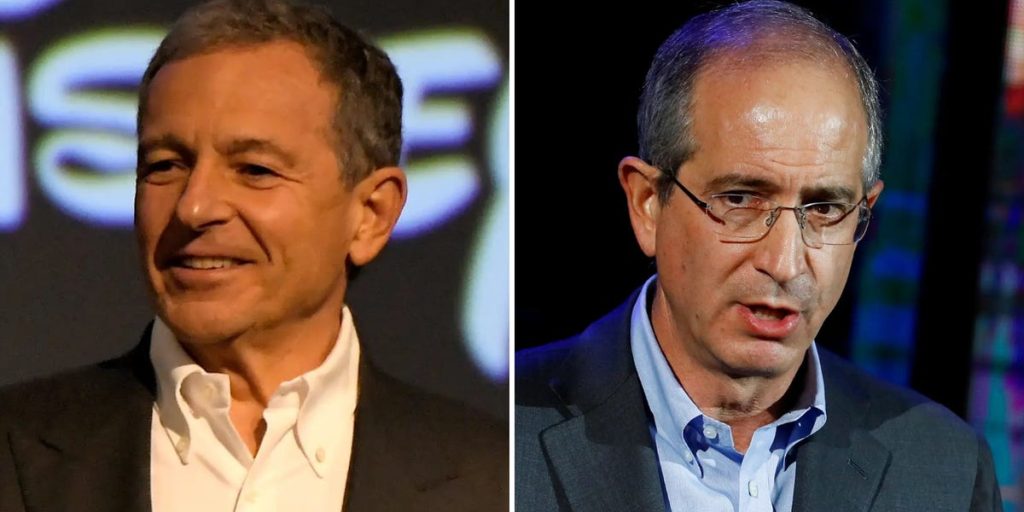

Meanwhile, under-the-radar deal talk stirred after Disney CEO Bob Iger put some of the company’s assets in play, including ESPN and other linear and cable TV channels. Reports of offers and partnership talks have swirled, and a transaction could kick off reactions by other companies. Microsoft’s $69 billion acquisition of Activision, which was completed Thursday, has also put media and tech M&A back in the spotlight.

“In certain ways, the best time to invest is when there’s a disruption,” said one bullish investor at a midsize asset manager specializing in media. This person — who spoke under the condition of anonymity to freely discuss the M&A landscape — conceded that investors had been gun shy during the strike, but expressed optimism for where the industry’s deals machine is headed.

Here’s a look at the predictions from 10 industry sources who spoke to Insider about what they expect.

Big entertainment companies are looking to sell assets

Legacy media companies are searching for workable business models to please Wall Street shareholders, stem subscriber losses, and reach profitability. But they’re losing ground in the streaming wars to cash-rich tech giants and racing to cut costs with budget trims and layoffs.

Collectively, Hollywood has shrunk to the tune of 45,000 jobs since May, according to data from the Bureau of Labor Statistics, which cited the disruptive impact of the strikes. Iger slashed 7,000 jobs at Disney alone in a bid to save $5.5 billion in expenses.

While Disney is deep in negotiations now to acquire Comcast’s share of Hulu, Iger has also signaled the company would consider offloading assets that are creating a drag on cash flow. This summer, the CEO suggested he would evaluate options like selling components of Disney’s legacy, linear TV business — which includes networks from ABC to Freeform — that “may not be core to Disney,” he said.

Disney’s reevaluation of its portfolio could kick off similar processes at other conglomerates, according to banker, investor, and analyst sources. “When Disney is putting out there that it’s looking for investors, you have to think that is going to force all the other players to start thinking about what all their options are,” a media company exec said. “It’s going to kick off a lot of activity and energy.”

On the other hand, there aren’t a lot of buyers for linear TV networks — especially buyers who will pay what Disney wants. Nexstar Media Group was reported to be in talks to buy ABC, and Byron Allen — whose Allen Media Group owns 36 network affiliate TV stations as well as the Weather Channel — put his hat in the ring, making an offer to buy the ABC network as well as some of Disney’s cable channels for $10 billion, which he said he’d finance by turning to banks and private-equity firms. Allen said at a media conference Thursday that Iger told him Disney isn’t ready to sell. (Disney has said it’s not made any decisions about selling any properties.)

Some other big players are already working to unload linear assets, like Lionsgate, which is in the process of spinning off cable network and streamer Starz from its studio business; and Paramount, which has tried to sell BET. Legacy companies could also offload assets like real estate — physical studio spaces have attracted a rash of private-equity interest in recent years — or video game businesses, in the case of WBD, experts said.

Other experts counter that interest rates are too high right now for the studio lots to be attractive to a buyer, and that while WBD needs to slash its debt, gaming is too core to the company to offload. The company on its last earnings call has underscored that it sees big potential in its gaming business — pointing to the success of “Hogwarts Legacy” — and is investing accordingly, while a source familiar with Warner Bros. Games told Insider it’s not for sale.

The big studios also boast smaller assets that could be attractive to a more focused owner (and private-equity investors may be eager to pick up some of these spoils): NBCUniversal has Sports Engine and GolfNow, a tee-time marketplace. Disney has Disney Digital Network, formerly called Maker Studios.

Perpetually looming over the industry, too, is the possibility — some would say the inevitability — of further consolidation. Observers are still watching to see if Comcast could combine with Paramount Global or Warner Bros. Discovery as a way to improve its overall business profile and boost its streaming effort. A tie-up with WBD couldn’t happen until 2024, however, under the terms of the merger that created WBD.

Tech companies certainly have the money to make a major acquisition of a film or TV studio or an entire entertainment conglomerate. But they haven’t shown themselves to be big acquirers of such properties. Amazon is still working to integrate its purchase of the MGM film studio, Microsoft is focused on gaming, and Netflix continues to assert that it’s more builder than buyer.

As more streamers lean into live sports, however, Disney’s ESPN could be the exception, and some insiders believe Apple could eventually acquire it to solidify its foothold in live sports.”People have been holding their breath in nervous anticipation” about the idea of tech buying big media, one investor told Insider. “They can,” this person added. “But it’s not a foregone conclusion that they will.”

Private-equity bets on media and Hollywood have seen mixed results

Private-equity firms may have the cash to finance major media acquisitions, but they’re reckoning with market volatility.

Some media valuations have tumbled as a result of this year’s economic headwinds, but interest rates remain high — which could make the prospect of taking on a big debt loan to finance a leveraged buyout feel especially onerous. At the same time, borrowers including movie studios and production-services companies have been turning to these firms’ private-credit arms for financing.

PE investors are known to heavily diligence acquisition targets to model their profit and loss projections — a task made more complex while the strikes have been on, according to Handel.

It’s hard to model business’ growth forecasts when revenue has been down and commercial interactions have been upended. “Logistically, you’ve got executives whose attention is focused elsewhere,” he added. “When a lion is pacing outside the door, you don’t talk about redoing the roof.”

“There’s not just risk issues,” Handel continued. “The issue is noise in the data,” since much of it would be “stale” and taken from before the strikes went into effect, he explained.

In the two years ahead of the strikes, private-equity firms went big on media acquisitions to capitalize on the rise in streaming and live entertainment — from Blackstone-backed Candle Media’s rollup of kids programmer Moonbug, Reese Witherspoon’s Hello Sunshine production company, and more; to RedBird Capital Partners, which has poured millions into sports and media, including Jeff Zucker-led RedBird IMI, a partnership with Abu Dhabi.

Private asset managers appear well capitalized to make deals, with their stockpile of so-called “dry powder” (undeployed capital) never higher. A report from SP&G Global Market Intelligence found that global private-equity dry powder had ballooned to nearly $2.5 trillion by mid-2023.

To be sure, there are other forces that could deter PE firms from making purchases.

A recent report from Bloomberg indicated that this year’s earnings at Candle Media — which was founded with more than $1 billion in capital from Blackstone — are about 50% behind forecasts from the companies they’d acquired.

The company’s co-CEOs, Tom Staggs and Kevin Mayer, told Bloomberg that an “unprecedented” array of challenges — ranging from the strikes to reduced industry spending to the soft advertising market — had contributed to the tepid results. That’s contrasted against wins by some other PE firms in the media space — such as Apollo Global Management‘s successful $5 billion bet on Yahoo in 2021, which has led to significant growth for the decades-old digital media stalwart.

Investors previously told Insider they were energized by startups cropping up at the intersection of artificial intelligence and media — a market that’s expected to balloon in value to nearly $100 billion by 2030.

The enthusiastic investor at the media-focused asset manager also pointed to fresh opportunities in data analysis that could come to the aid of creatives — like showrunners and writers — who are seeking information about the performance of their IP on major streamers. A crucial issue during the strikes has been streamers’ lack of transparency when it comes to audience data, with writers winning some concessions over streaming metrics-sharing in their new deal.

Are you a Hollywood insider? Get in touch with these reporters. Lucia Moses can be reached at [email protected], and Reed Alexander can be reached at [email protected].

Read the full article here