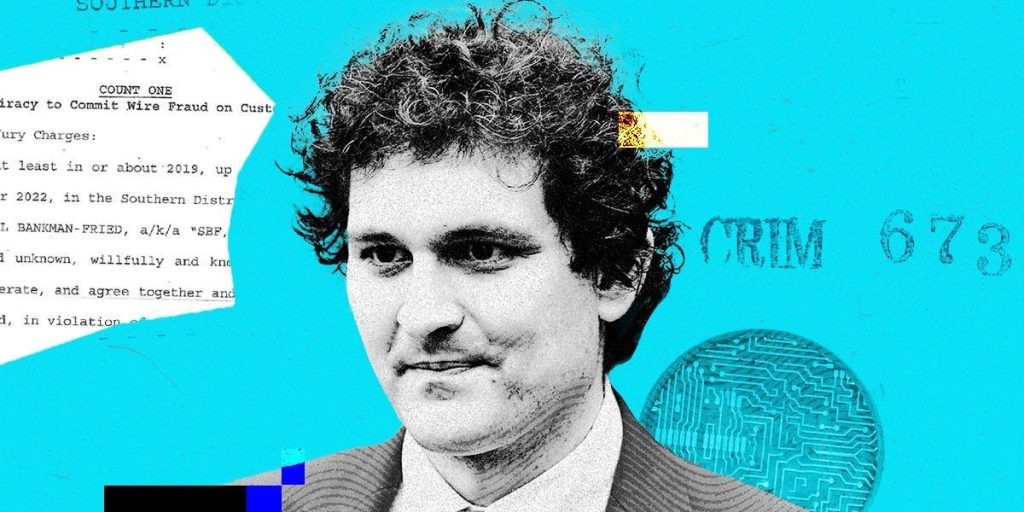

- A top attorney for FTX testified Thursday in the trial of Sam Bankman-Fried.

- Can Sun said he was “shocked” by a $7 billion hole in FTX, while Sam Bankman-Fried was unsurprised.

- SBF asked for possible “legal justifications” for using customer money, but Sun said there were none.

FTX’s corporate attorney testified in court against his former boss, Sam Bankman-Fried, in Manhattan federal court on Thursday, sharing details about the company’s bankruptcy in November 2022.

Can Sun said he was appalled to learn that Alameda Research, FTX’s hedge fund sister company, had special privileges over all other customers on the crypto exchange and that the companies, both owned by Bankman-Fried, had co-mingled funds taken from customers without their consent.

“I was shocked,” testified Sun, who traveled from Japan to take the stand. “I consistently told our investors that FTX and Alameda are two fully independent and separate companies.”

Prosecutors have charged Bankman-Fried with seven financial crimes related to defrauding investors and customers. Several former members of his executive team have pleaded guilty to financial crimes and testified against Bankman-Fried at his trial.

Sun said on November 7, 2022 – four days before FTX declared bankruptcy – Bankman-Fried had a call with a potential investor who raised questions about FTX’s finances, and Bankman-Fried asked Sun to “come up with legal justifications” for FTX using customer funds.

Prior to Bankman-Fried’s call with the investor, he pulled Sun aside to go for a walk, Sun said. Sun told the jury he explained there were no justifications for FTX using customer funds without their expressed consent, only theoretical arguments that weren’t supported by facts.

“Yep, yep” Bankman-Fried replied, according to Sun’s testimony. “Got it.”

“I was actually expecting a bigger response, but it was very muted,” Sun added of his former boss. “He was not surprised at all.”

Shortly before his walk with Bankman-Fried, Sun also observed a panicky Nishad Singh in the Bahamas office. Singh, FTX’s former engineering director, pleaded guilty to financial crimes earlier this year and testified last week that the bankruptcy left him “suicidal.”

“Nishad was sitting there. His entire face was pale and gray,” Sun testified. “It looked like his soul had been plucked from him.”

Singh asked Sun about his “personal exposure” regarding loans he received from Alameda, admitting that he learned of the hole in FTX’s finances months earlier. Sun testified that Singh told him Bankman-Fried was unfazed when he confronted the CEO about the hole.

Bankman-Fried told Singh something to the effect of: “It is what it is. There’s nothing to do but grow the company and fill the hole,” Sun testified.

Read the full article here