Adam Neumann, 43, was born in Israel in 1979. His parents got divorced when he was 7, and he moved around a lot as a child with his mother — he reportedly lived in 13 different homes by the time he was 22.

Source: New York Magazine

Neumann is severely dyslexic, and couldn’t read or write until he was in third grade.

Source: Forbes

As is customary for Israeli citizens, Neumann served in the Israel Defense Forces after grade school. He served in the navy for five years, although only three years of service is required. “That’s where I got to know a lot of my best friends,” Neumann told Haaretz in 2017.

Source: Haaretz

After leaving the IDF, Neumann moved in 2001 to New York City, where he lived in a Tribeca apartment with his sister Adi. He spent his early days in New York going to clubs and “hitting on every girl in the city,” he said in a commencement speech in 2017.

Source: New York Magazine

Neumann enrolled at city school Baruch College in January 2002 and majored in business. He said he thought of the concept of WeLive, WeWork’s communal living business, for a school entrepreneurship competition. However, the idea was killed in the competition’s second round, because a professor didn’t think Neumann would be able to raise enough money “to change the way people live.”

Sources: New York Magazine, TechCrunch

Neumann dropped out from college just four credits shy of graduating. He ultimately finished his degree 15 years later, in 2017, after completing a four-month independent study, and delivered the commencement speech for Baruch College’s graduating class.

Sources: TechCrunch, Business Insider

While in college, Neumann met his now-wife, Rebekah Paltrow Neumann, who is a cousin of actress Gwyneth Paltrow. The pair got married in 2009, and now have five children together.

Source: Observer, Real Deal

On their first date, Paltrow Neumann called out the WeWork cofounder for being “full of s—.” Neumann credits his wife for getting him to stop smoking, and for telling him to pursue his passions instead of dreams to be rich.

Sources: Business Insider, Business Insider

While Neumann was at college, he worked on two business ventures: a failed idea for collapsible heeled shoe, and baby clothes with built-in knee-pads called Krawlers. He dropped out to pursue the second idea, and developed it into a baby-clothing company called Egg Baby in 2006.

Sources: Forbes, TechCrunch

Egg Baby is still around today as a luxury baby clothing company headed up by clothes designer Suzan Lazar. Neumann is no longer involved in the day-to-day operations of Egg Baby, whose children’s clothing is sold at department stores around the world.

Sources: Forbes, TechCrunch

Soon after launching Egg Baby, Neumann met WeWork cofounder Miguel McKelvey through a mutual friend. The two reportedly bonded over their backgrounds and competitive streaks, and McKelvey convinced Neumann to move Egg Baby offices to the same building he was working out of in Brooklyn.

Source: Forbes, New York Magazine

Soon after, the two developed the idea for WeWork after brainstorming an idea for renting out empty office space to other companies. In 2008, they convinced their building’s landlord to let them rent out a floor in a nearby Brooklyn building, and an earth-friendly co-working company called Green Desk was born.

Sources: Forbes, New York Magazine

However, McKelvey and Neumann decided to go off on their own. They sold off their share of Green Desk to their landlord for $3 million, and opened their first WeWork space in 2010 in New York’s Little Italy neighborhood.

Sources: Forbes, New York Magazine

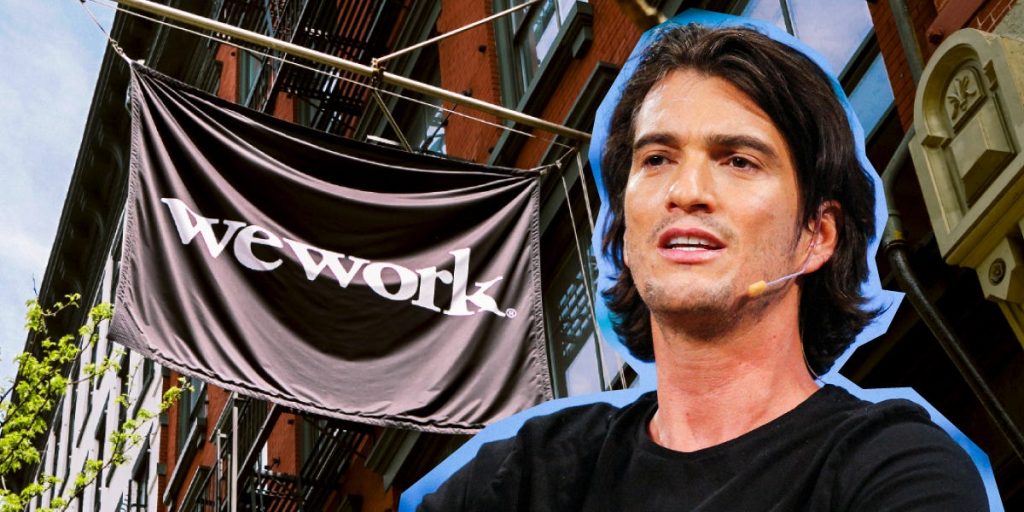

Under Neumann as CEO, WeWork expanded to provide co-working desk space in commercial buildings in more than 120 cities in nearly 40 countries. The company was valued at $47 billion.

Sources: Business Insider, Forbes

Paige Leskin contributed earlier reporting to this story.

One of WeWork’s biggest investors is the Japanese investment firm SoftBank, who has invested more than $10 billion in the company. Neumann has told Business Insider about his close relationship with SoftBank CEO Masayoshi Son, who he calls “Yoda.”

Source: Business Insider

Neumann also invested in a number of startups, both by himself and on behalf of WeWork. His niche-interest investments included a wave-pool maker, a medical marijuana provider, and a superfood startup, which sells things like “performance mushrooms,” powdered coconut water infused with beets and turmeric, and highly caffeinated coffee.

Source: Business Insider

Neumann was WeWork’s largest single shareholder. However, he cashed out some of his stake and took out loans. In total, Neumann’s sales and debt transactions reportedly totaled $700 million.

Source: Business Insider

The company publicly filed for an IPO on August 14, 2019. The IPO filing gave the public its best view yet at the company’s money-losing financials: notably, $1.6 billion in losses on $1.8 billion in revenue in 2018.

Business Insider’s Troy Wolverton and Shona Ghosh wrote in their coverage of WeWork’s S-1 that:

“The numbers show spiraling losses over the last three years:

- During the year December 31, 2016, WeWork lost $429 million on $436 million in revenue.

- The following year that loss increased to $890 million on $886 million in revenue.

- And for the full year 2018, WeWork lost $1.6 billion on $1.8 billion in revenue.

- For the first six months of 2019, the firm posted a loss of $690 million on $1.5 billion in revenue.

We Co. will be the most highly valued startup to go public since Uber in May.”

However, along with WeWork’s IPO paperwork came further scrutiny of its business. The filings showed that WeWork paid Neumann just shy of $6 million for the trademark rights for the “we” family trademarks for the company’s name change to the We Company in January 2019. After widespread criticism, Neumann paid the money back.

Source: Business Insider

The IPO paperwork also revealed a number of Neumann’s potential conflicts of interest regarding WeWork. Neumann was revealed to have personal financial ties to WeWork buildings, and his wife, Rebekah, was listed as one of three people who would decide the next CEO if Neumann could no longer run the company. WeWork limited her power by removing her ability to help choose the next CEO, and also banned her and any of Neumann’s family members from serving on the board.

Source: Business Insider

Shortly after the IPO was filed, a report revealed that WeWork had been bleeding human resources managers, and some pointed fingers at Neumann himself as the reason. Neumann reportedly criticized some employees as “B players” behind their backs.

Source: Business Insider

The IPO paperwork also showed that Neumann had special shares in WeWork that gave him a massive 20 votes per share, as well as majority control over the company. His power was limited in WeWork’s amended IPO filing in September 2019, in which the company slashed its valuation from $47 billion to below $20 billion.

Sources: Business Insider, Business Insider

In September 2019, a Wall Street Journal report detailed Neumann’s hard-partying ways, and drug and alcohol use. Two of the most startling revelations in the piece: Once after announcing layoffs, Neumann sent around tequila shots and organized a surprise Run-DMC concert. Also, his private jet was once recalled in Israel after marijuana was found hidden in an onboard cereal box.

Source: Wall Street Journal

Amidst the criticism, Neumann’s leadership of WeWork was thrown into question. WeWork’s board of directors met in September 2019 to discuss the possibility of removing Neumann as CEO — something reportedly backed by one of Neumann’s best assets, SoftBank head Masayoshi Son.

Source: Business Insider

On September 24, Neumann said he would be stepping down from his role as WeWork CEO. Neumann said in a statement that he had become a “significant distraction” in recent weeks, and it was in the company’s “best interest” to resign. Two WeWork executives — Sebastian Gunningham and Artie Minson — took his place as co-CEOs. The company then withdrew its S-1 filing, officially postponing its IPO.

Source: Business Insider

Neumann momentarily kept his role as chairman of WeWork’s board of directors, but he stepped down from the board in October 2019. SoftBank, WeWork’s largest investor, was given control of the company as part of a $9.5 billion bailout plan. As part of the buyout deal, SoftBank planned to provide Neumann with a $1.7 billion exit package.

Source: Wall Street Journal, Business Insider

Flow was valued at $1 billion in 2022, and Neumann spent over $1 billion last year purchasing 3,000 housing units for the startup.

A contributing factor in Neumann’s downfall from WeWork was leasing office properties he owned back to WeWork. Flow is operating in the properties owned by Neumann. The units are in Atlanta, Nashville, Tennessee, Fort Lauderdale, and Miami.

Source: Business Insider

At a conference arranged by A16z, Neumann said Flow tenants will want to plunge their own toilets because they’ll feel ownership over their apartment.

Neumann said at the conference in February 2023 that he wants Flow residents to “feel ownership” and that they’re “part of something” because he thinks people who feel ownership will live in the apartments longer, leading to more profit.

“If you’re in an apartment building and you’re a renter and your toilet gets clogged, you call the super,” Neumann said. “If you’re in your own apartment, and you bought it and you own it and your toilet gets clogged, you take the plunger.”

Source: Business Insider

After WeWork filed for bankruptcy on November 6, Neumann released a statement expressing his disappointment with the filing and the company’s failure to “take advantage of a product that is more relevant today than ever before.”

“As the co-founder of WeWork who spent a decade building the business with an amazing team of mission-driven people, the company’s anticipated bankruptcy filing is disappointing,” said Neumann in a statement on Monday.

“It has been challenging for me to watch from the sidelines since 2019 as WeWork has failed to take advantage of a product that is more relevant today than ever before. I believe that, with the right strategy and team, a reorganization will enable WeWork to emerge successfully,” he added.

Source: Business Insider

Read the full article here